INTRODUCTION

Decentralized finance is an integral part of the Web 3 ecosystem, providing people worldwide with transparent financial services by leveraging blockchain technology and cryptocurrency. This technology is changing not only the economic landscape of the world but also governance and how people interact with one another.

In today’s post, we will take a deep dive into DeFi protocol, Mantra. This post will cover the core features of Mantra, its history and its impact on DeFi. At the end of this post, the reader should understand how Mantra works and the various ways to utilize its protocol.

HISTORY

Mantra DAO...

On August 16, 2020, Mantra (previously known as Mantra DAO) was founded by John Patrick Mullin, an entrepreneur and blockchain enthusiast. Mantra aimed to leverage the knowledge and wisdom of the crowd to create a community that was transparent and decentralised to give control back to the people.

In July 2020 Hex Trust was appointed to be the custodian for the Mantra fundraising campaign. LD Capital (a leading blockchain fund manager in Asia) and PLUTUD.VC are some of the initial institutional investors in Mantra.

On August 3, 2020, Mantra worked with Consensus Labs to develop the Defi ecosystem in China. In that month mantra became a validator on the Kusama network, a Polkadot’s experiment “canary” network created to help blockchain companies understand how DeFi protocols work.

On August 1, 2020, Mantra performed its Initial Membership offering of its OM Token with over 1,300 individuals signed up for the whitelist. It was able to raise $5.9 million from this event. The token had a supply of 888,888,888 which was to be distributed in 7 stages.

Firstly, Mantra had a public distribution which included the pre-IMO and IMO rounds. This consisted of 8.5% of its supply standing at 75,555,555 OM. The second was the private distribution which consisted of 95% of the total OM supply. 17.5% went to the Team and Advisors; 30% to staking rewards; 10% to reserves; 12.5% to grants, and another 12.5% to referrals.

OM TOKEN

OM is the base token of Mantra DAO. It is generated when users stake or lend their crypto on the Mantra platform. Holders of the OM token can stake it to earn more Om Token. It can also serve as collateral for loans on the Mantra platform

OM also serves as a governance token. It is used to vote on proposals pertaining to the DAO's level of inflation, ecosystems grant allocations, interest rates, etc. It also serves as a reputation indicator on the karma protocols and those with high reputation scores can be rewarded for their contribution to the DAO.

There are various ways to purchase the OM token. It can be traded on popular centralized exchanges like Binance, OKX, KuCoin, etc with other crypto or stablecoins. In addition, the Mantra base token can also be found on decentralized exchanges like UniSwap.

KARMA PROTOCOL

This is the reputation mechanism of the Mantra DAO. As earlier stated, the reputation system is geared toward rewarding active participants in the Mantra ecosystem. Users can increase their karma by staking, submitting and voting on proposals; receiving grants, etc. The more Karma an individual has the higher their staking reward. Also, they get to enjoy low-interest rates, loyalty rewards, etc

MANTRA REBRAND

On August 18, 2022, Mantra DAO rebranded to Mantra which is referred to as the OMiverse. The OMiverse comprises four stacks which encompass the products and services Mantra offers to its customers and community. These four stacks include Mantra Nodes, chain, finance and DAO.

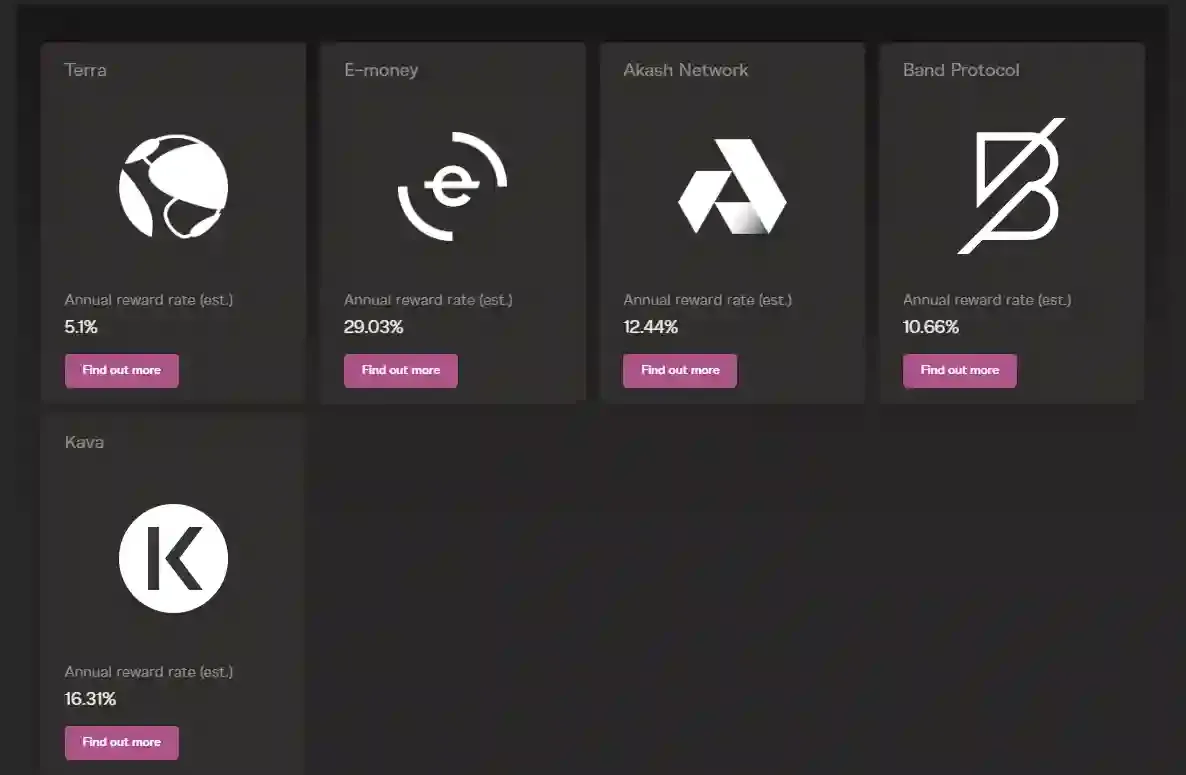

MANTRA NODES

These are a group of validators in the Mantra ecosystem. Their primary function is to generate revenue by providing yield opportunities across different blockchains. By taking advantage of emerging blockchain-providing network infrastructure, these validators help grow Mantra’s presence in the Web 3 space. Mantra provides a range of node services, namely: retail staking, institutional nodes, cloud/white-label node development and deployment. Below is a list of active Nodes on Mantra.

MANTRA CHAIN

Mantra chain is built on the COsmos SDK which allows the chain to other with other Cosmos blockchains with the IBC Module. This facilitates development on the chain by providing developers with the necessary tools to create web decentralised applications i.e games, and non-fungible tokens which work in tandem with decentralised exchanges. Mantra is also compatible with Ethereum Virtual Machine (EVM) which opens it up to the Ethereum ecosystem

The Mantra chain has an Identity system known as Decentralised I.D (DID). This is a KYC feature that verifies the user’s identity on the Mantra chain allowing them to make use of dapps in the Mantra ecosystem. The user is provided with a digital passport which gives them an added layer of security mitigating the risk of fraud or illicit activities on the chain.

Also, Mantra plans to launch a native token for their Web 3 chain called $AUM. This token will be airdropped to OM holders and stakers. Not much is known about the tokens as of the time of this post. However, to keep up with the latest developments on the token’s functionality and tokenomics, kindly follow Mantra’s official Twitter handle: MANTRA_Chain

MANTRA FINANCE

Mantra Finance is a multi-asset platform that provides financial services to institutional and individual investors. They achieve this by linking traditional finance and decentralised finance by working with regulators across the globe to develop financial products that adhere to regulations across different jurisdictions.

Mantra Finance solves two major problems. The first is providing institutional investors with investment opportunities that align with government policies which provides a stable and safe space for institutional investors to invest. Secondly, through its decentralised Identification system, Mantra is able to mitigate fraudulent activities by bad actors which engender customers' confidence.

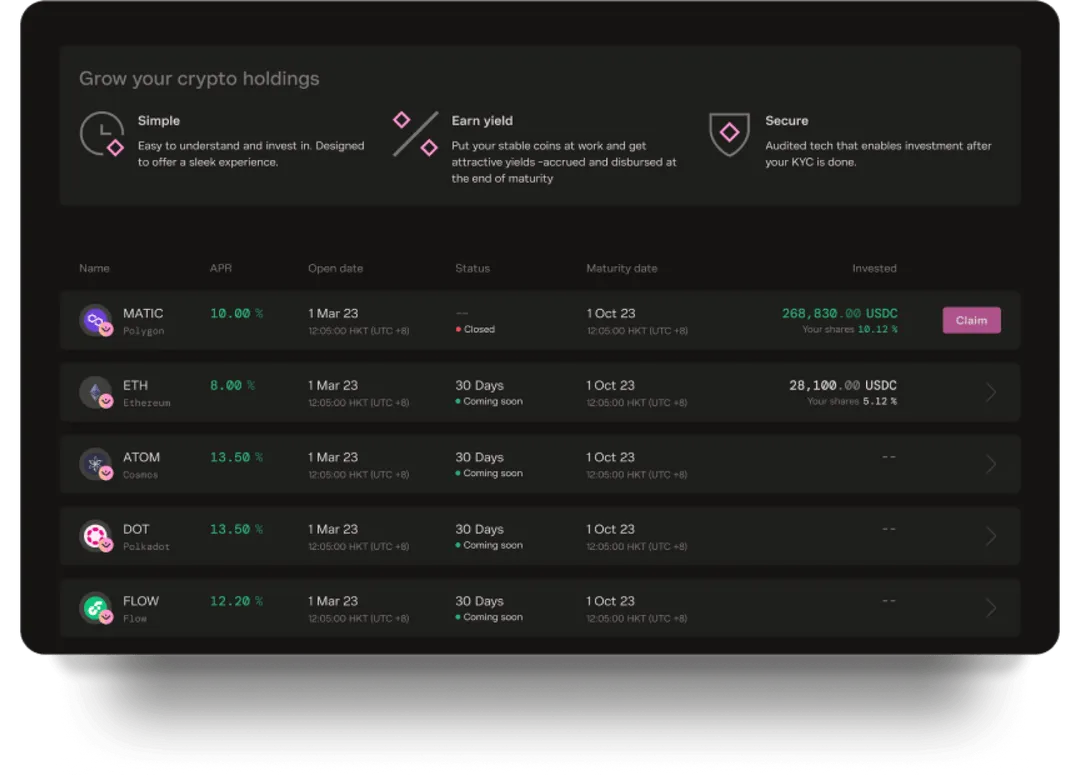

There are two major financial services Mantra plans to offer, namely: single-asset vault and multi-asset vault.

SINGLE-ASSET VAULT

This vault will allow users to lock Proof of Stake (Pos) cryptocurrencies like Ethereum to generate yield. At launch, this vault will support only a selected number of ERC-20 tokens. This list will increase as the project moves from its initial phase.

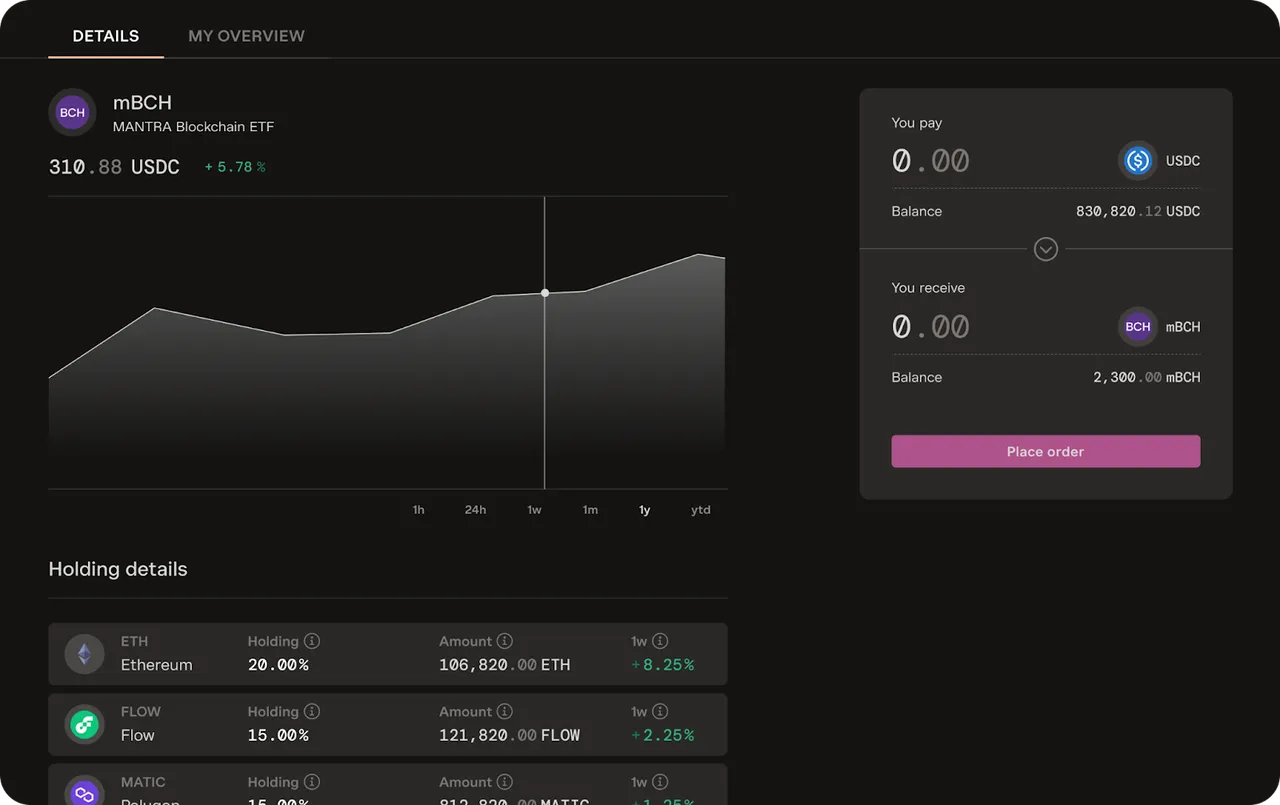

MULTI-ASSET VAULT

The multi-asset will allow users to lock different cryptocurrencies within a single pool of USDC. This will give users more exposure to a number of PoS coins. This is quite similar to the concept of an Exchange-Traded Fund (ETF).

Decentralized Exchanges

In addition to its vaults products, Mantra is also planning on launching a DEX that offers a variety of features, namely:

Automated Market Maker (AMM): this will provide a fair market for traditional financial products (i.e ETFs) and real-life assets (i.e real estate)

Liquidity provision/farming

Central limit order books

Cross-chain compatibility: interoperability is key to the success of a DEX and Mantra will ensure that its chain is connected to as many other chains as possible to allow for the seamless transfer of assets.

High speed and low latency

Easy-to-use interface: this will allow for seamless interaction with the platform

Staking rewards: participants in the Mantra's staking protocol will be able to earn rewards

Dynamic fees: this will ensure that the cost of trades aligns with market requirements which will provide a sustainable ecosystem for liquidity providers.

MANTRA DAO

Mantra DAO consists of OM token holders who participate in its governance. This entails voting and submitting proposals relating to the Mantra ecosystem. This ensures that members engage in every stage of the community decision-making process, allowing for transparency.

In order to submit a proposal and vote on the Mantra DAO, a member needs to hold and stake the OM token with each stake representing one vote. To submit a proposal a member needs $100 worth of OM as collateral.

Mandtra DAO has a council of 5-9 members who serve for two years. They supervise the voting and submission of proposals to the Mantra DAO. This said council can also create a sub-council to oversee other activities in the Mantra ecosystem.

CONCLUSION

Mantra has come a long way in the last two years from a DAO and now launching its chain. Mantra has taken on a very audacious project to integrate Traditional finance and Decentralised finance

From a developer's point of view, the Mantra Chain is a decent space to develop projects and products. It has an active community and a blockchain that is compatible with the Ethereum ecosystem. This allows for projects to move across chains seamlessly

In terms of investment opportunities, Mantra offers some decent products, from its robust DeFi protocol to its versatile Web 3 chain for the building of decentralised applications. This provides (institutional and individual) investors with an array of investment options.

Mantra also has a long history of carrying its community along in every single step they make. This fosters transparency and trust, which are an integral part of the success of any project.

In general, Mantra has a solid plan and a good use case that will bring value to its stakeholders (community members, validators, stakeholders, etc). Over the course of the next few years as Mantra roll out their various product, they will be faced with the huge task of gaining traction in the Web 3 and bringing into fruition all their plans. I look forward to seeing how this pans out in the long run.

Below is a list of Mantra’s social media accounts:

Social Links:

● Twitter: https://twitter.com/MANTRAOMniverse

● Facebook: https://www.facebook.com/MANTRAOMniverse

● LinkedIn: https://www.linkedin.com/company/mantraomniverse/

● Instagram: https://www.instagram.com/mantra_omniverse/

● Medium: https://mantraomniverse.medium.com/

● Telegram: https://t.me/MANTRA_OMniverse

References:

[ALL IMAGES WHERE SOURCED FROM MANTRA'S OFFICIAL WEBSITE]