The effects of money creation and the distortions resulting from the increase in the monetary base are known as the Cantillon Effect, in honor of the Franco-Irish economist Richard Cantillon, who was the one who first described the consequences of inflation under the paper system. coin in the early 18th century.

Due to his great economic knowledge, Cantillon accumulated great wealth during episodes like the South Sea Bubble and the Mississippi Bubble caused by strong monetary expansion.

The theory proposed by Richard Cantillon explains that when a state issues a large amount of money without backing, those who will really benefit are those who are better positioned in the institutional structure.

This means, those who can access the money right from the start, that is, large companies, banks, etc.

Cantillon explained that the first to receive the newly created money have their income increased and, as that money migrates to the other classes, it loses its value.

Thus, the last to receive the currency see their purchasing power deteriorating as consumer price inflation occurs.

When the money supply increases, prices do not follow immediately. Instead, they slowly increase as markets react to the new total money supply.

The result is a redistribution from the poor to the rich. If the poorest were the first to receive the newly created money, they would not be as impacted.

However, what happens today is that the newly created money comes first to some companies and to the big commercial banks, which are also the ones who issue and grant credit.

Together, central banks and large financial institutions have a monopoly on money issuance and credit granting and that is why this distortion occurs.

Richard Cantillon highlighted the details of this phenomenon in his book “An Essay on Economic Theory”, which is more current than ever, at a time when we seem to be heading towards high monetary inflation.

A by-product of these extraordinary QE operations is the creation of a disconnect between the stock markets and the real economy, generating asset inflation. Often, such resources are not invested in the economy, generating employment and productivity.

Its holders use it to repurchase their own shares in their companies, which generates discrepancies between the financial market and the real economy, causing the price of these assets to be artificially inflated and move away from their fundamentals, generating speculative bubbles.

It is not by chance that periods of monetary expansion tend to coincide with periods of strong increases in the stock indexes.

Behind these distortions, the Cantillon Effect is reproduced to its full extent.

Since the Fed decided to expand the Quantitative Easing program, the S&P 500 Index has recovered from its March drop, breaking historical highs, anchored in these monetary stimuli.

HOW DOES BITCOIN SOLVE THIS PROBLEM?

Solutions to these and other economic phenomena have been thought of for a long time and, fortunately, since 2008 we have an alternative to the vicious circle arising from all forms of currency manipulation.

Bitcoin is the only peaceful solution to financial system fraud and phenomena like the Cantillon Effect. It belongs to all its users, its monetary policy is already clearly defined in its code and no centralized decision can inflate it.

Distribution is done more fairly and in line with the policy, with the new units being granted only to those who work guaranteeing network security.

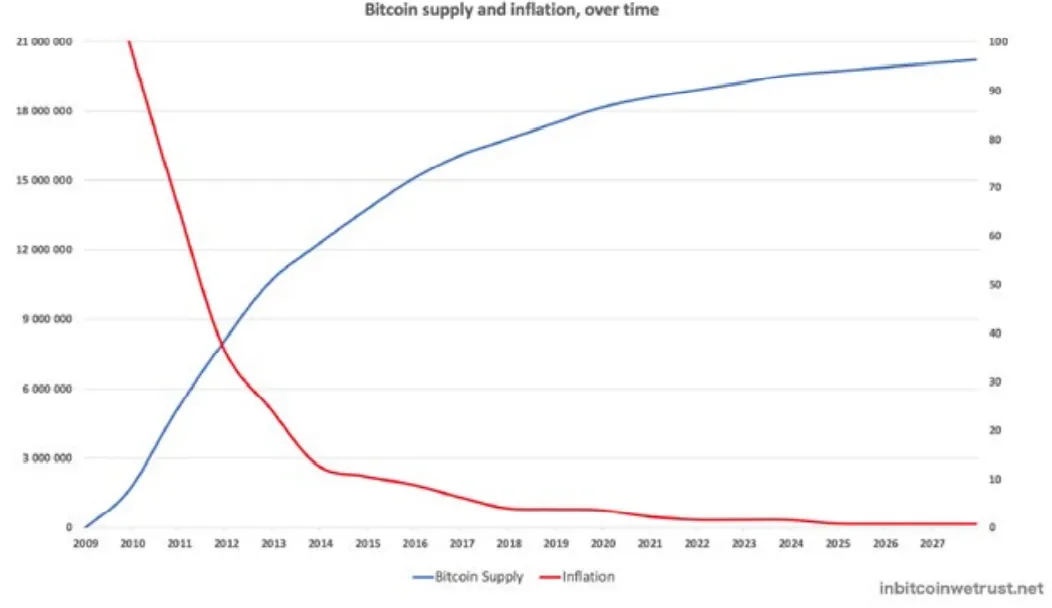

The schedule for issuing new Bitcoins is known in advance until all Bitcoins are issued by 2140.

1 Bitcoin purchased in 2020 will represent 1 21 million Bitcoin in 2050.

While the traditional monetary system has a quantitative easing policy, Bitcoin has a quantitative hardening monetary policy, which protects what you own. Better yet, the value of Bitcoin increases over time, requiring its holder to simply acquire it and save it.

The process for inflation to be absorbed and interest to return to normal levels can take time, and until then, anyone who is not concerned with protecting their assets may suffer from the devaluation of fiat currency.

In short, all the money that humanity has used has been unsecured in one way or another. This insecurity was manifested in a wide variety of ways. From counterfeiting to theft. But the most pernicious of which was probably inflation.

BY NICK SZABO

Bitcoin is deflationary and corrects distortions in the current system, paying only those who guarantee the protocol. And as we know, that amount is limited to 21 million.

Gold can also act as a store of value and protection against the Cantillon Effect, but it is not accessible to most people. Therefore, here Bitcoin confirms its status as digital gold, because in addition to all the similarity with the precious metal, it still has advantages such as portability and divisibility.

Bitcoin is therefore the best alternative and the antidote against the Cantillon Effect and several other economic distortions.

Of course, the Cantillon Effect is not the only problem, but it is a phenomenon that reflects the reality of how the economy is conducted.

Together, all the distortions of the economy increasingly strengthen the reasons that drove the creation of decentralized monetary solutions represented by Bitcoin.

And in the month that Bitcoin reaches historic price levels, we should reflect further on its importance, as it is becoming increasingly necessary in the current monetary system, which is a true machine to generate inequality and poverty.

The bigger Bitcoin becomes, the more exposed the corrupt reality of the current system becomes. It is up to us to spread this message.