Whoever begins studies on Bitcoin and the cryptocurrency market is faced with a fascinating world full of news.

Technology, network theory, economics, sociology are among the branches of knowledge that pass before those who seek a better understanding of the proposal, the fundamentals and the value of Bitcoin It is also common to be excited to know and experience something so innovative, which inevitably makes us “evangelize” friends and family so that they also know about the existence of this new world.

With that, it is to be expected that we are faced with contrary arguments and doubts of the most varied types, which requires us to be prepared to seek to resolve them, generating deeper reflections.

"Too volatile to be considered a store of value", "does not work as a means of payment", "is an environmental waste", among others, are some of the most famous questions that need to be analyzed further to better understand some concepts.

In this report, we bring you some insights inspired by an article by Fidelity Digital Assets, which presents six of the most common criticisms and misconceptions related to Bitcoin and the answers that can be used.

BITCOIN IS TOO VOLATILE TO BE A VALUE RESERVE

Volatility is a measure of how much the price of a financial asset varies over time.

When it comes to Bitcoin and the crypto market as a whole, we are talking about a still small market capitalization compared to older and consolidated markets.

This makes it more volatile, as few participants with larger amounts can move the price without much difficulty.

Furthermore, this market is free of interventions and has no mechanisms that limit price fluctuation, occurs in the stock market, where there are fluctuation limits and artificial reduction of volatility preventing investors from moving

your money.

Bitcoin showed strong volatility in the period as well, but it continued to function normally, allowing users to make the best decision.

As Bitcoin becomes more widespread and gains more liquidity, through the spot and derivatives market, which has been breaking records in recent months, its volatility is expected to decrease and the price to stabilize more and more.

However, until it reaches greater scope, volatility still tends to appear, but in smaller proportions and intensity than in the past.

The maturity trajectory of an asset is not linear and, at the moment, Bitcoin is an emerging reserve of value and is in the process of consolidating as a de facto reserve of value.

HOW IT IS POSSIBLE TO CHECK IF THE BITCOIN'S VOLATILITY IS DECREASING IN THE TIME OF TIME.

BITCOIN FAILED AS A MEANS OF PAYMENT

In order to reach the most reliable and secure cryptographic level, Bitcoin had to give up better scalability to preserve the characteristics that made this security possible.

Although use as a medium of exchange may be one of Bitcoin's functions, it is neither the only nor the main function. Therefore, for recurring day-to-day transactions, such as paying for coffee, today it really may not be the most conducive use for Bitcoin, as in that sense it does not compete with major payment companies such as Visa, Mastercard and PayPal.

However, this is compensated by its efficiency in carrying out transactions with large amounts and globally, with agility and low cost, something extremely limited in the traditional financial system, in which to make an international transaction, authorizations are necessary, which can take days and cost quite expensive due to the high fees and taxes charged.

Increasingly, frequent billion-dollar transactions are made and entrusted to the Bitcoin network, costing very little.

In addition, there are second-tier solutions, such as the Lightning Network, that can meet the demand for lower value transactions in the not-too-distant future.

This 92,857 Bitcoin transaction, the equivalent of $1,700,000,000 million dollars in current values, at the time cost 0.00033699 BTC (less than $6.00), as you can see in the image. According to the World Bank, the average global shipping cost of $200 in remittances is 6.8%.

A BLOCKCHAIN GENERALLY NEEDS TO OPEN HAND OF ONE OF THESE REQUIREMENTS TO WORK WELL

In the case of Bitcoin, decentralization and safety are the priorities.

BITCOIN IS A WASTE

Bitcoin mining depends on proof of work to maintain the safety and functioning of the network, which is composed and powered by computers with high processing capacity, which obviously use a lot of electricity. As adoption increases, more computers join the network, causing consumption to rise as well.

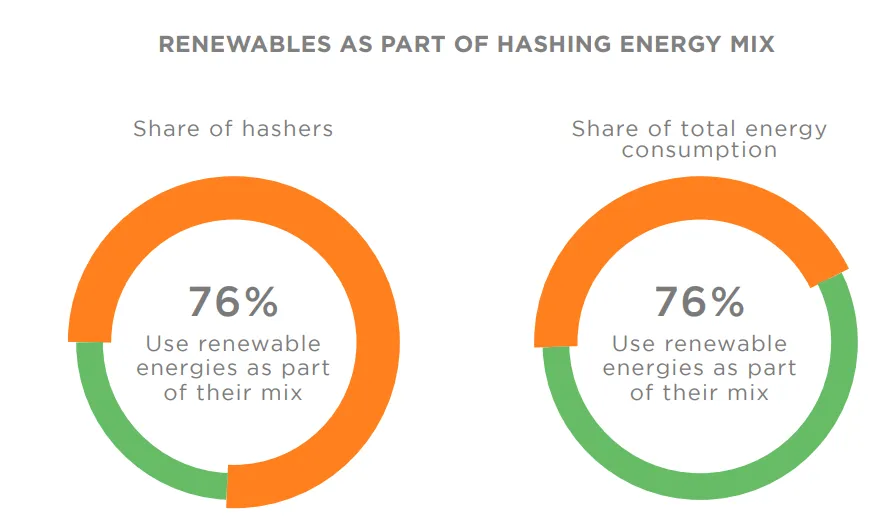

However, studies by CoinShares estimate that a considerable part of mining operations (reaching 76% in December 2019), is driven by renewable energies, from natural sources (hydropower, wind, solar) or energy that would otherwise would be wasted.

Energy consumption and the impact on the environment are legitimate concerns (it is undeniable that Bitcoin mining consumes energy), but analyzing more deeply, this energy is not wasted, but is used to protect and keep the network that works. allows one of the greatest inventions of recent times.

A decentralized asset, demonstrably scarce, resistant to apprehension or censorship, transparent, without borders, immutable and secure. Do you believe that the energy that is expended to sustain something with so many qualities is a waste?

The use of energy spent for Bitcoin sustains a true monetary revolution and gives rise to real money (sound money) for human freedom and evolution.

The Cambridge Center for Alternative Finance (CCAF) Global Cryptoasset Benchmarking report estimates that 76% of miners use renewable energy, especially hydropower, as part of their energy matrix.

The study found that more than 39% of the total energy consumed by PoW cryptocurrencies, including Bitcoin, Ether (ETH), Bitcoin Cash (BCH) and others, comes from renewable energy sources.

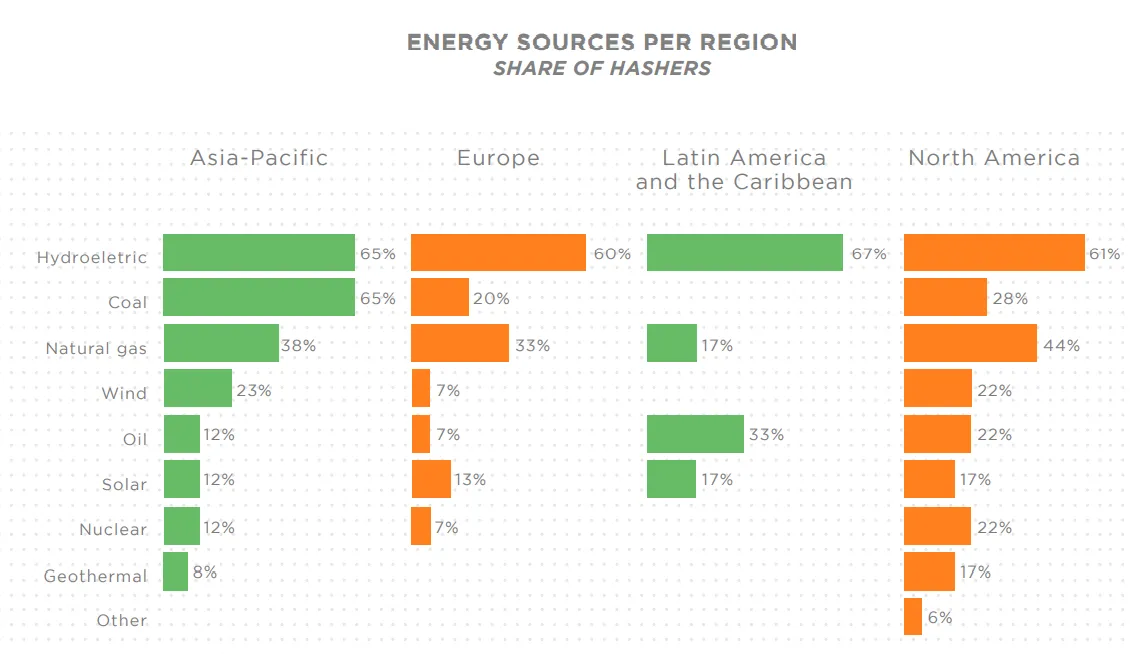

Almost 62% of miners use energy from hydroelectric plants. The sources of coal and natural gas occupy the second and third places with 38% and 36%, respectively.

Wind, oil and solar energy are the three other common sources of energy for crypto mining.

Bitcoin mining equipment is mobile and therefore can be placed close to any cheaper energy source, to arbitrate it and give a purpose to this idle energy production.

Almost 62% of miners use energy from hydroelectric plants. The sources of coal and natural gas occupy the second and third places with 38% and 36%, respectively.

Wind, oil and solar energy are the three other common sources of energy for crypto mining.

Bitcoin mining equipment is mobile and therefore can be placed close to any cheaper energy source, to arbitrate it and give a purpose to this idle energy production.

In other words, a simple gold coin carries a large amount of energy spent for its design and that is one of the reasons for its value.

BITCOIN WILL BE REPLACED BY A COMPETITOR

Many cryptocurrencies have already emerged with the aim of proposing improvements to Bitcoin's shortcomings. However, none to date have been successful and have achieved the network effects that Bitcoin has.

Bitcoin is the first cryptocurrency created and continues to dominate in terms of market capitalization.

It is the crypto that attracts more investors, users, miners and interest from institutional investors. It also has the strongest and most consolidated foundations and infrastructure.

Even if better-performing cryptography emerges, it will be very difficult to overcome the adoption and confidence that Bitcoin has.

Bitcoin is the King of this market!

GOVERNMENTS WILL BANNER BITCOIN

This is also a legitimate concern. From 1933 to 1975, Americans were banned from possessing large amounts of gold, in a clear demonstration of the level that state authoritarianism can reach even in one of the freest nations in the world.

However, unlike gold, Bitcoin uses cryptography and therefore cannot be confiscated, except by some court order. However, governments can prohibit the operation of exchanges and make them illegal, which would withdraw institutional money and put Bitcoin on the black market.

But that seems far from happening, as large companies and investment funds have started to acquire BTC. Companies, Grayscale, MicroStrategy, Square and investors, Paul Tudor Jones and Stanley Druckenmiller are among the influential names who own bitcoin and believe in it as a protection against inflation. Not to mention companies that offer custody services, such as Fidelity and Paypal.

All of this makes it extremely difficult and unpopular for a government to ban Bitcoin at this time and with increasing market capitalization it will become increasingly complicated.

However, it is necessary to monitor this risk closely, always managing the exposure cautiously and intelligently.

Although the list does not cover all doubts and criticisms, the answers can be supplemented to address other misconceptions not scored here.

Bitcoin is an exclusive digital asset that requires a deeper study for its better understanding, so it is in our hands to pass the message on, spread knowledge and thus contribute to the increasingly healthy adoption of crypto and against misinformation.