It's that day already ! Time for a #SaturdaySavers update 😀

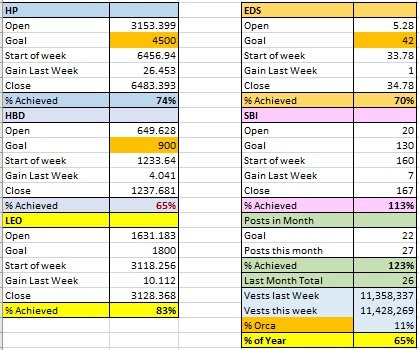

Here's my weekly progress spreadsheet;

Overview of the Week

Overall it's been a productive week, and I've managed to (somehow !) keep up with posting every day.

I'm still hitting most of my goals; the only one that has slipped under is HBD. I'm not too worried about it (yet...) because next week should be when the interest goes in. I deliberately haven't converted HIVE to HBD, because with the price of HIVE continuing to drop it makes no sense. But I'm wondering if I was getting a bit too excited when I increased my goal from 650 to 900 additional HBD for the year !

My Thoughts on the HBD Interest Rate Discussions

If you've been watching LeoFinance, I'm sure you'll have seen the discussions around the HBD interest rate. Some of the Hive Witnesses are signalling that they would like to drop it back to 12%.

I've got a few thoughts about this. First, 12% is still better than I currently get from a bank savings account. It's probably slightly higher than I'd get in a medium to high risk stock, bond or REIT focused on dividend yields.

However, crypto is definitely higher risk than many traditional investments, the fees associated with the multi-step process of extracting HBD back to fiat have to be factored in, and also the fact that it is pegged to the US Dollar. I expect the dollar to drop in value over a period of time as the newly expanded BRICS works hard to de-dollarise their trade and the level of US debt continues to rocket.

I haven't seen a convincing data-driven reason for the proposal to drop the interest. While I appreciate that the drop in the price of HIVE has worsened the HBD/HIVE debt ratio, it doesn't appear to be at crisis level yet, and I haven't seen any of the witnesses giving a convincing argument that the current rate is unsustainable in the short to medium term.

The issue I really have is that an 8% drop feels like a knee-jerk reaction to market sentiment and the falling price of HIVE. I totally get that the rate isn't fixed forever, but would far rather see slower incremental changes that can be monitored for effectiveness. I could live with 18% interest, and then a move to either 16% or back to 20% once the impact was known.

What I haven't seen a consistent explanation for what the witnesses calling for 12% are aiming to achieve.

- Is it to improve the debt ratio ? I don't see the current state needing that drastic a reaction.

- Is it to reduce the amount of HBD in savings and see the liquid HBD turned into Hive Power to push up the price of HIVE ? That won't happen; people will take their HBD, turn it into HIVE and then sell it off, dropping the price of HIVE further.

- Is it a way to dump the price of HIVE in order to buy massive amounts before pumping it up again ? Well, that's the only one I can think of that makes sense so far, and it's a dick move if true !

- Is it to help mass adoption of Hive ? If so, I don't understand how, and no-one has explained it.

Overall, this is a useful lesson to me. While I love Hive as a social platform and a way to earn some crypto, it proves it's not as stable as I had thought. It's made me step back and evaluate my overall investing strategy, and I've realised that I've been pushing too much into crypto, and HIVE in particular. At least for a while I need to rebalance my investments into other fields entirely. I'll stop putting more fiat into Hive and focus on earning within the ecosystem. I've got enough liquid HIVE to get me through a few months of HPUD's.

If the 12% interest is implemented, I can see it crashing the price of HIVE, so that's the day I'd pull all my HBD and liquid HIVE out and convert it to BTC or USDT and probably start powering down most of my HP. I'd still use Hive, but purely as a publishing/social platform and forget about the earnings. I've already reviewed which witnesses I support - personally, I feel Hive governance as a whole could probably be improved.

The metric I'll be using going forward is fairly simple. Because I've been buying HIVE steadily over the last year or so as the price has slowly declined, the amount I have invested is quite a bit more than the current value of my HIVE, HBD and Tribe tokens. When I've earned enough, or if the price increases enough, that the portfolio becomes worth more than I've invested, I'll start putting money in again. That way, even if I'm buying at a slightly worse price, I'll be buying on an upward trend rather than chasing a downtrend.

I'd love to hear what others think about this ! Is my approach sensible, or am I finally giving into FUD ?