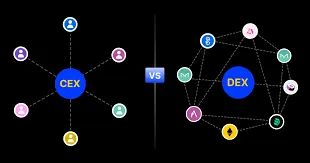

The cryptocurrency trading landscape is at a crossroads, with decentralized exchanges (DEXs) and centralized exchanges (CEXs) fighting for dominance. Each represents a distinct vision for the future of finance: CEXs offer familiarity and efficiency and basicallyis just a extention of what we have in banking today, while DEXs champion the promise of decentralization and that anyone can be its own bank.

The discussion between CEX and DEX is about who controlls the capital and liquidity.

Can anyone participate or will people be left out just like with banks today.

The future of money is at stake.

As technological advancements accelerate and regulatory pressures mount, the competition between DEXs and CEXs will define how crypto trading evolves. Will DEXs lead us in a new era of financial sovereignty, or will CEXs maintain their grip on the market? The answer lies in their ability to adapt to user needs and navigate a rapidly changing environment.

Centralized exchanges like Binance, Coinbase, and Bybit have long been the gateway to crypto trading. By acting as intermediaries, CEXs provide intuitive platforms, high liquidity, and features like spot trading, derivatives, and fiat on-ramps. In 2025, CEXs still handle the lion’s share of global trading volume, with platforms like Binance reporting daily volumes exceeding $20 billion, according to recent market analytics. Their centralized infrastructure ensures fast transactions and robust customer support, making them the go-to choice for institutional investors and retail traders. Additionally, CEXs have invested heavily in compliance, integrating KYC and AML protocols to align with global regulations. Again, because they just wanna operate as a normal banking service and be welcomed in that world.

However, the centralized model has vulnerabilities. Users must surrender control of their funds, exposing them to risks like hacks, latest proved by the $600 million Binance hack in 2022 or mismanagement, as seen in the FTX collapse, which no one in crypto has forgotten.

Regulatory scrutiny is another challenge; governments increasingly demand transparency, which clashes with the privacy preferences of many crypto users. We see more growing frustration with CEXs’ KYC requirements, with some traders seeking alternatives that prioritize anonymity.

Decentralized exchanges, such as LeoDex, Thorchain, Uniswap, Curve, and Balancer, offer a compelling counterpoint. Built on blockchain protocols, DEXs enable peer-to-peer trading via smart contracts, allowing users to retain custody of their assets. This aligns with the crypto ethos of decentralization and self-sovereignty. In 2025, DEXs have surged in popularity. Innovations like automated market makers (AMMs) and liquidity pools have made DEXs viable alternatives, while layer-2 solutions like Arbitrum and Optimism have slashed transaction fees, addressing a key barrier to adoption.

DEXs also excel in accessibility, listing tokens that CEXs often overlook, such as emerging DeFi or NFT-related assets. Cross-chain bridges enable trading across blockchains like Ethereum, Solana, and Polkadot, enhancing flexibility. Yet, DEXs struggle with user experience. Navigating wallet integrations and understanding gas fees can overwhelm newcomers, and liquidity remains lower than on major CEXs. Security risks, like smart contract exploits, such as the $90 million Nomad bridge hack in 2022, though audits and formal verification are improving and making the DEXs safer.

Regulation will play a pivotal role in this battle. CEXs, with their established compliance frameworks, are better positioned to navigate tightening global rules, such as the EU’s MiCA framework or U.S. SEC guidelines. DEXs, however, face uncertainty. While their decentralized nature makes them harder to regulate, authorities could target developers or front-end interfaces, as seen in past actions against Tornado Cash. Conversely, innovations like decentralized identity and zero-knowledge proofs could allow DEXs to offer privacy while meeting regulatory demands, potentially leveling the playing field.

Looking ahead, the future may favor coexistence over domination. CEXs are adopting decentralized features, like non-custodial wallets, while DEXs are streamlining interfaces to rival CEX usability. Technological advancements, such as Ethereum’s sharding or Solana’s high-throughput chains, will further boost DEX scalability. By 2030, some analysts predict DEXs could capture 40% of trading volume, driven by DeFi growth and user demand for control.

The battle between DEXs and CEXs is less about one defeating the other and more about how each evolves to meet user expectations. CEXs offer reliability for those seeking convenience, while DEXs empower those prioritizing freedom. As technology and regulation reshape the crypto landscape, traders will benefit from a diverse ecosystem where both models thrive, each pushing the other to innovate.

I hope to see LeoDex being a frontier champion of DEX in the future! Facilitating many different protocols and letting its users choose what to use.