Now that centralized systems are waning and digital transactions define global commerce, blockchain technology emerges as a revolutionary force that offers unparalleled security, transparency, and efficiency. Yet, despite its transformative potential, widespread adoption remains elusive, hindered by complexity and skepticism. Innovative use cases, like Block Inc.'s resolve to integrate Bitcoin payments into Square’s platform, demonstrate blockchain’s power to redefine everyday transactions. This is a call for businesses and consumers to embrace this decentralized future for a more resilient and inclusive financial ecosystem.

Bitcoin payments on square will stir blockchain tehcnology adoption in commerce...

On May 28, Block Inc. (NYSE: SQ), the fintech giant behind Square and Cash App, announced plans to integrate Bitcoin payments into its Square platform, with a rollout slated for the second half of 2025 and full availability targeted for 2026, pending regulatory approvals. This initiative, leveraging the Bitcoin Lightning Network, is a practical way of making Bitcoin an everyday payment method for merchants worldwide. This is a compelling use case for blockchain technology in mainstream commerce.

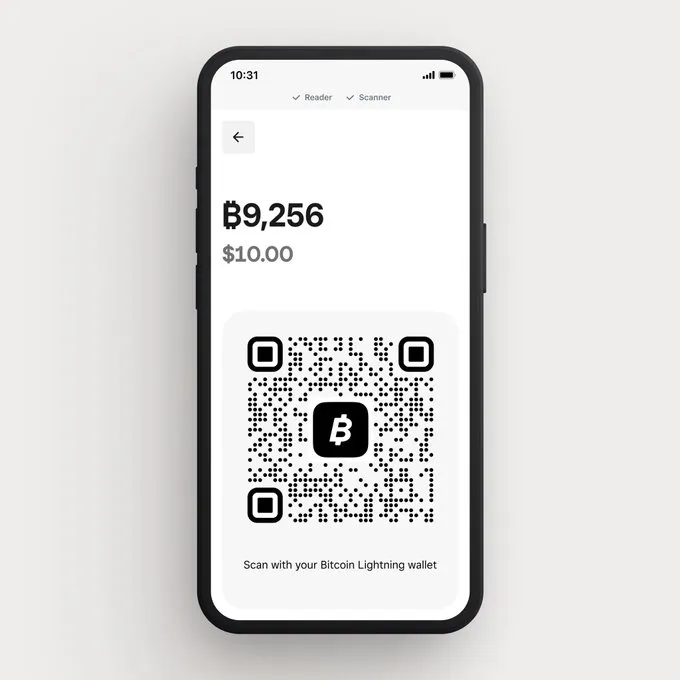

Block’s latest venture builds on its existing Bitcoin-focused innovations, such as Cash App’s Bitcoin trading and the Bitcoin Conversions feature launched in 2024, which allows merchants to convert a portion of their sales into Bitcoin automatically. With the integration of Bitcoin payments directly into Square’s Point of Sale app, merchants will be able to accept near-instantaneous, low-cost Bitcoin transactions using their existing Square hardware. This seamless integration eliminates the technical barriers that have historically hindered cryptocurrency adoption in retail settings, offering a user-friendly bridge between traditional finance and decentralized digital currencies.

The announcement comes with a real-world showcase at Bitcoin 2025, a major industry conference in Las Vegas from May 27–29, 2025, where attendees can experience the feature firsthand at the BTC Inc. merchandise store. Leveraging the Lightning Network (a layer-2 scaling solution for Bitcoin), Square wants to ensure fast, cost-effective transactions. This, in turn, will address common pain points like high fees and slow confirmation times. This use case highlights blockchain’s potential to enhance payment systems, offering merchants and consumers alike a secure, decentralized alternative to traditional financial rails.

Block’s ecosystem, including its self-custody Bitcoin wallet Bitkey, its Bitcoin mining hardware Proto, and open-source development arm Spiral, expressing its its commitment to advancing cryptocurrency’s utility. The company already holds over 8,500 Bitcoin on its balance sheet, signaling strong confidence in the asset’s long-term value. By enabling merchants to accept Bitcoin directly, Block is not only encouraging adoption but also empowering businesses to tap into a global, borderless financial system.

Block Inc. is not alone on this matter. There is a growing institutional interest in Bitcoin, as evidenced by projections from Bitwise, which forecasts $420 billion in Bitcoin inflows by 2026 from corporations, ETFs, and even nation-states. Block’s initiative could stir further adoption, positioning Bitcoin as a viable medium of exchange rather than just a speculative asset. For blockchain enthusiasts, this is a prime example of how innovative applications of decentralized technology can reshape commerce, bringing financial sovereignty to businesses and consumers alike.

Meanwhile, the UK is planning stricter crypto oversight by 2026 and U.S. policies that are potentially softening under new leadership. Block’s timing is strategic. Embedding Bitcoin into Square’s widely used platform will help the company to pave the way for blockchain to become a cornerstone of everyday transactions. This will inspire other industries to explore decentralized solutions. For merchants, this means access to a global customer base; for blockchain advocates, it’s a milestone in proving the technology’s real-world utility.

Image created on peakd AI

Here is Jack Dorsey's call forusers to spend bitcoin at Square terminals. he says that merchants can choose to hold the bitcoin or auto-convert it to fiat in real-time.

A post says they are already accepting bitcoin payments at #TheBitcoinConf and promises that soon, merchants can accept bitcoin payments wherever they are.

BTW: Looks like there is a Hive dapp can perform similar action. Which?

Stay tuned as Block’s Bitcoin payment integration unfolds, offering a glimpse into a future where blockchain-powered commerce is the norm, not the exception. I am your Blockchain and Technology Journalist.