I have a dream, but unfortunately it will be in vain. You see I wish to see #GOLD traded as crypto 1:1 but how could that ever happen without a middle man. Of course ledger technology needs no middle-men, but when it comes to physical possession there is much more to cryptography alone.

Human beings are fickle. There is good and there is bad. Because of the bad actors we need witnesses even when it comes to the digital reality meeting physical reality. We can pretend we can function in a digital life; a digital cache of fortune. However when it comes to owning things and feeding our bodies we are currently the manifestation of reality.

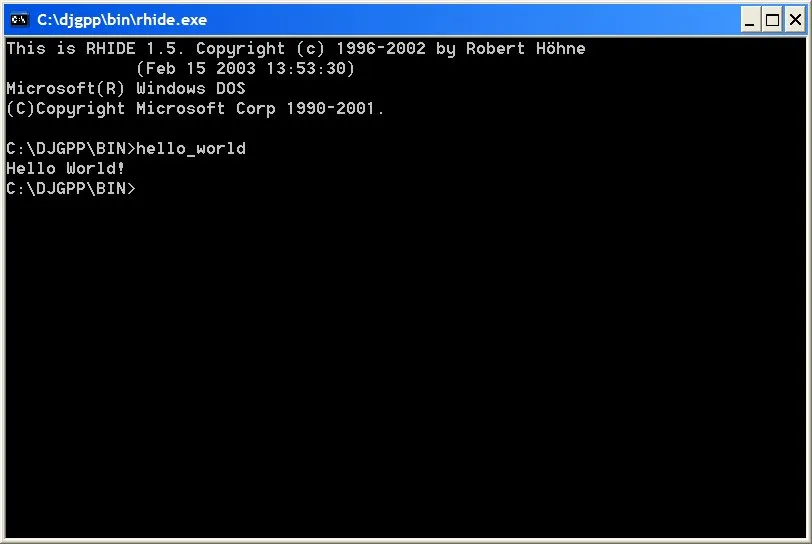

Like DOS-SHELL the outside reality is much more dependent on 'things' to function.

https://en.wikipedia.org/wiki/DOS_Shell

"DOS Shell was incapable of full multitasking. It supported rudimentary task switching; it could switch between programs running in memory, at the cost of performance hit. However, all the running programs had to fit into conventional memory area, as there was no support for swapping to disk."

A little too technical so basically I want to make the analogy of a virtual environment within a virtual environment.

#BTC may be a scarce digital asset, but we must never forget we aren't plugged into a Matrix world where our digital avatars can feed on zero's and one's. Our physical bodies require what perhaps are much more advanced models of binary language. Although our conscious minds might try to forget we are in a physical world, our bodies and its needs will not.

If you were to make a digital accounting of physical gold you would need auditors. Eyes to see and hands to touch. This is why I always say there is no perfect solution when dodging a central bank that prints digital notes, but cannot print physical energy.

Sorry for the click bate header. This has nothing to do with discrimination or foolish woke ideas. Here I'm going to talk about fundamentals and ultimately where I would like to see where things are headed.

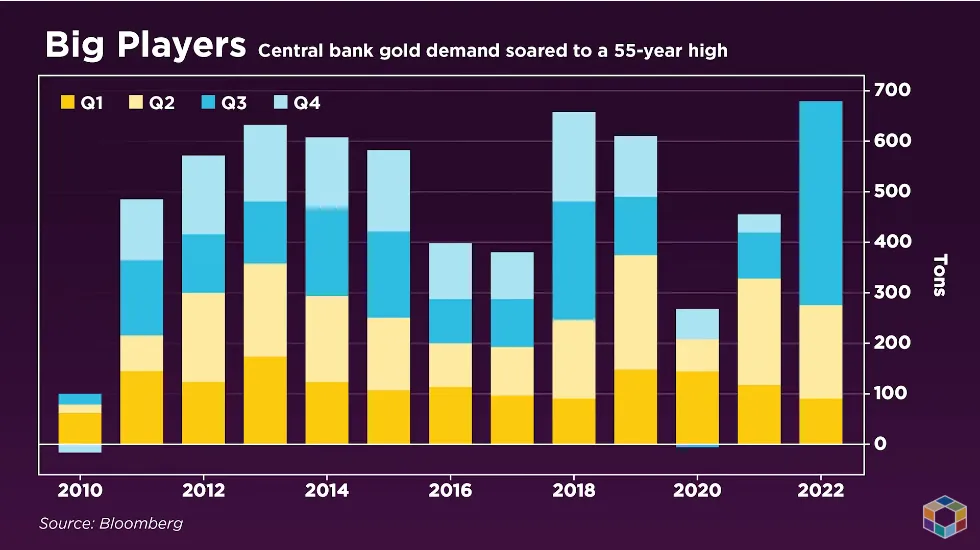

"Central banks around the world are nervous," about the U.S. dollars they have in central bank reserves, says Randy Smallwood, president and CEO of Wheaton Precious Metals. "Gold is the constant store of value, it's always provided that for society and it will always provide that for society," he tells our Daniela Cambone. "A healthy apolitical alternative is gold," and cannot be weaponized by future governments as we may be seeing today with the U.S. dollar, Smallwood continues. The ultimate goal for gold is to improve the "accessibility, transparency and trust behind it," through digital means, he concludes.

Although I disagree at the moment with Mr. Smallwood (sorry about the last name). US cash reserves are the current #GOLD for international trade.

The biggest buyers to date? Turkey, Pakistan, and Qatar. To be honest none of those countries particularly interest me. I know that's terrible to say, but when it comes to Elite's and world power they seem nothing like second rate platers.

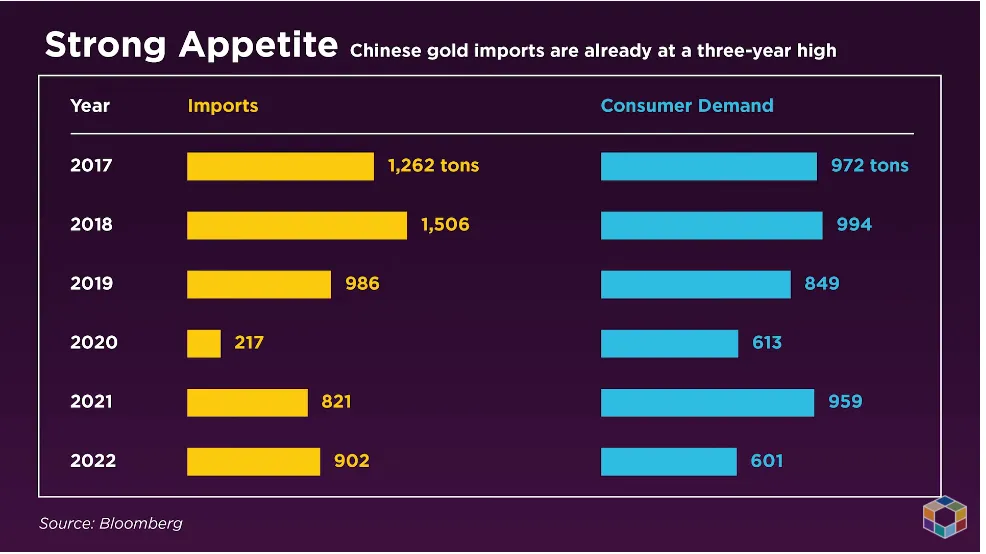

We do know that China and Russia have been buying and hoarding Gold but as you can see there is disclosure. The advantage of not disclosing is in fact why it is a strategic asset. On Discord I talk to all sorts of maximalists and I try to explain why Gold is even better than crypto. Alright to be fair both have their place. Gold has no counter party risk, Crypto is much more nimble but controlled by the internet.

maximalist -măk′sə-mə-lĭst-

A. One who advocates extremist views or radical action to secure a social or political goal.

B. A person with maximalist beliefs or tendencies; someone who prefers redundancy or excess

Anyways it's a little longer of a blog post than usual. I do try to bring new ideas or at least expose that which we already know. Mid-term elections are soon in the United States. Paper prices might get a nice pump. It's not physical, and it's not crypto. It is what the majority view as the price point. When you put something into your hand you have it. It's value can go to zero on paper, but it will still exist in physical reality.