Even before this bull run which I hope is not over or near that, I took a moderate approach on my crypto investments. Instead of going all in on volatile crypto assets, even if trusted and already validated by the market, I have decided to set aside part of my finances and put them at work through stablecoins. And one that I opted on was HBD right here in the Hive blockchain ecosystem and already validated that it can weather the challenges in time. With that I've put all my HBD into the Savings account for an appealing 15% APR which is even more considering the compounding effect. And as a well known saying by now in the crypto world - "It might not be much, but at least it's honest work".

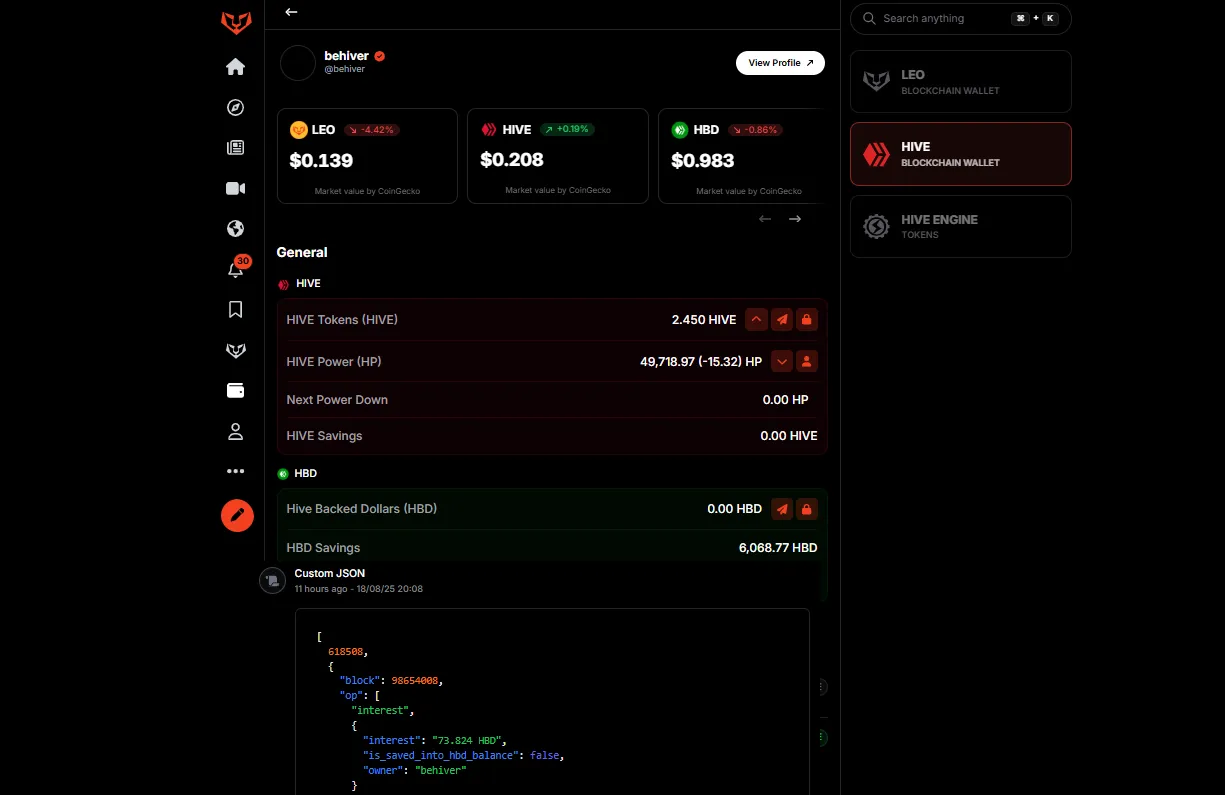

I have just claimed my HBD Interest in the amount of $73.824. While having already $5,994.946 HBD in Savings account, I've ended up with $6,068.77, thus surpassing the $6k threshold which was somehow a goal for me. There were times when I was doing in the past even well above $100 HBD/month in interest, but along the way I diversified some of those. Some good choices, some other not so good and this only confirmed that having a strategy where you hold part your investments in stables is a good thing. Now as I grow my HBD stash, I have new dilemmas thrown at me: continue to accumulate HBD as Interest from the Savings account once per month, or withdraw some of the funds and invest in SURGE which offers few percentages over the HBD APR% and pays on a weekly basis.

Growing my HBD stake in Savings

Growing my HBD stake in Savings is the easiest option that can be on the Hive blockchain. HBD Interest keeps on growing with each block transaction, it is paid on a month basis and if you want to withdraw any or all of your savings it is just taking 3 days. No complications, no drama, no variables upon one thing or the other, just either deposit or withdraw and see your fund accumulating in time.

Investing in SURGE is quite appealing

SURGE provides better yield than storing HBD in Savings and it also pays the interest on a weekly basis. Thus the compounding effect is stronger if received HBD would be put back in SURGE. But I think it is a little bit more work on this and if you want to sell all your SURGE tokens you need to put them on the market where you would need to sell at a discount if really needing the funds. But on a long term, SURGE seems to rise above HBD in Savings.

While I am torn between these options, I will simply take a breath until I make a decision on this. With HBD in Savings I know the INs and OUTs and it is just an easy and lazy option, while SURGE is quite new on the market and even if it looks very trusting, it has some variables around it. It is a matter if I want to grab a few points more with SURGE compared to HBD. Probably if the APR for SURGE would have been around 20%, that would have make my choice easier, but in the same time I don't know how sustainable that would be for the team offering this token. Decisions, decisions, decisions... we cannot escape them, we need to do our due diligence and swim with it. Which way will I go? Still undecided for now, I will see if I will go one way or the other or maybe a balanced investment in between the two.