While I had some COTI proving some earnings on Binance, I have decided to make a move on it by going long with COTI by staking all of it into the Treasury. As things are growing and more development is done there are exciting times ahead with the announced MultiDAG 2.0 layer which will enable to launch of multiple tokens such as a governance token for COTI’s treasury, the first enterprise token, a payment token on top of the Trustchain and more. These will teleport COTI from a single coin network to a Layer 1 blockchain with multiple tokens on top of it, used by consumers and merchants around the world. So moving my COTI tokens to the treasury ahead of these developments, might also ensure my participation in future airdrops.

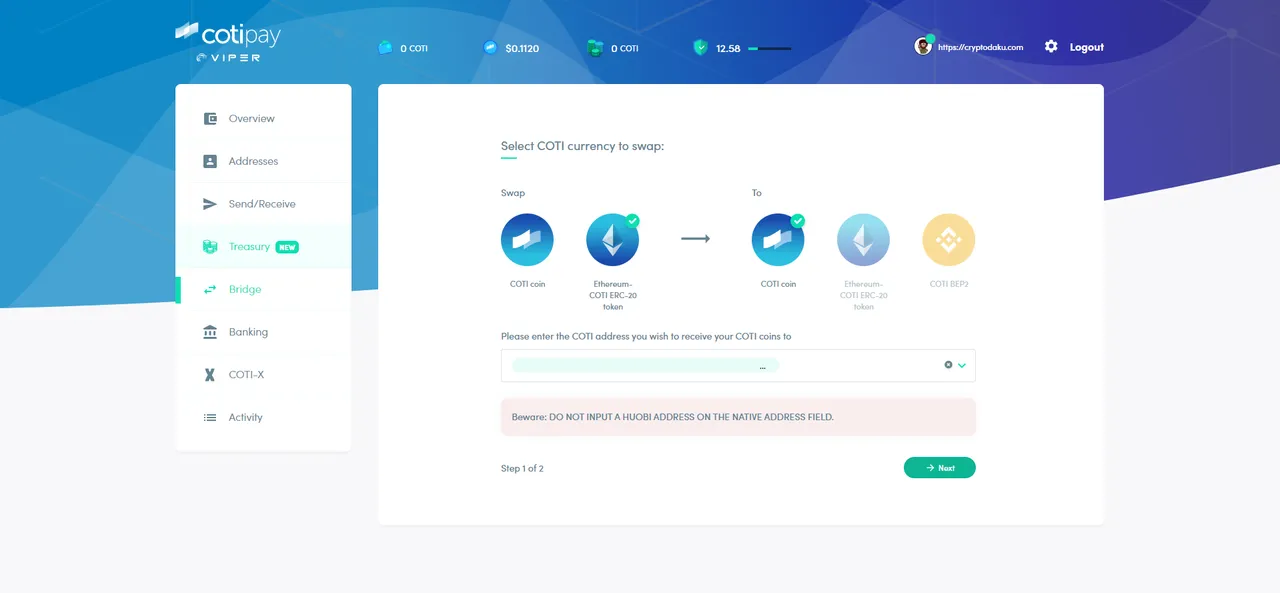

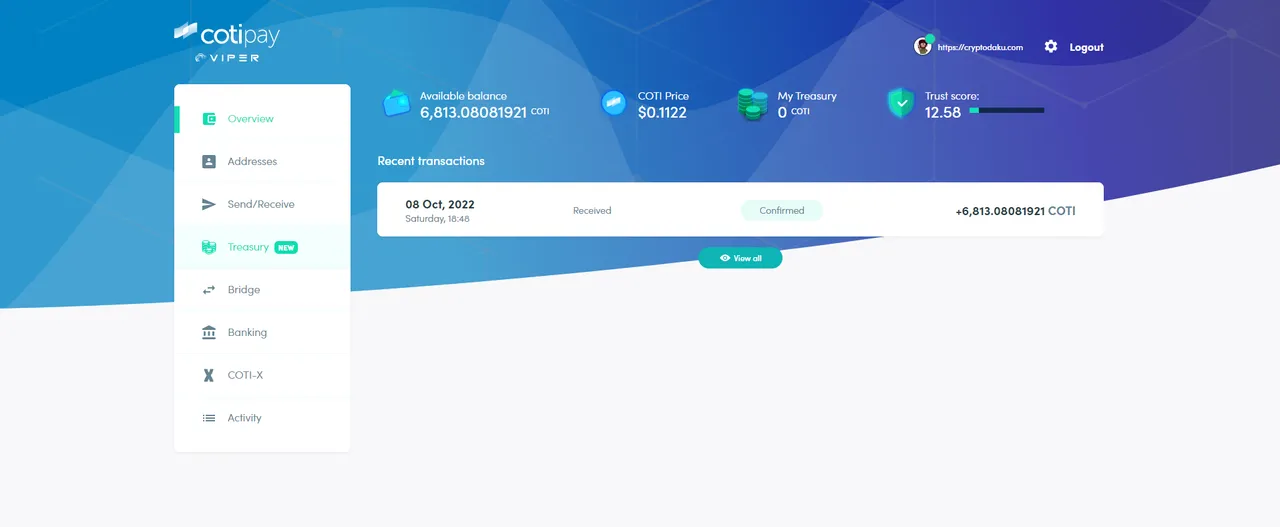

The First step was to move my funds from Binance to Coti Treasury and as this involved different blockchains, I had to use a bridge in order to transform my tokens to native COTI. It didn't come cheap as I had to pay 27 COTI in fees, but it was a move that I needed to do anyhow. Using the COTI Bridge I could translate my ERC-20 address to a COTI native address and do the transfer. While I don't like bridges, the transfer was seamless and I got my tokens pretty fast in the Treasury wallet.

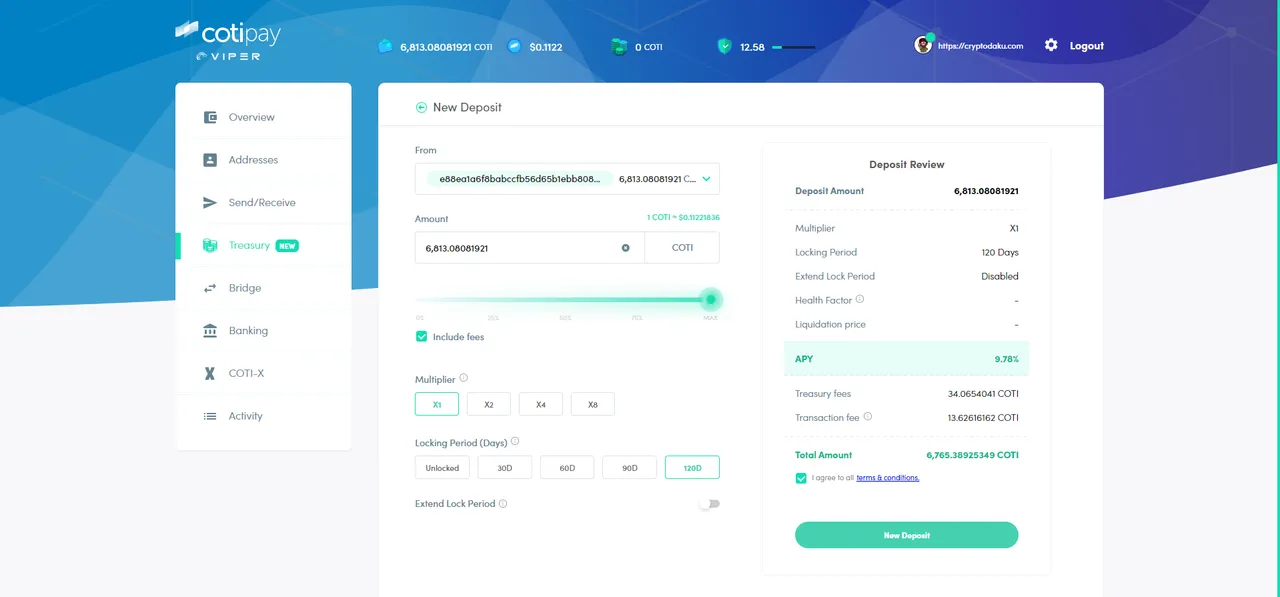

The second step as I had my native COTI in the Treasury wallet was to move them in a Deposit. I have chosen a 120 Day deposit with x1 Multiplier to minimize the risk, which got me a 9.78 APR%. This came with some other fees like Treasury fees of 34 COTI and Transaction fees of 13 COTI. Not cheap, but from the APR I should cover all the fees and get some on top of that.

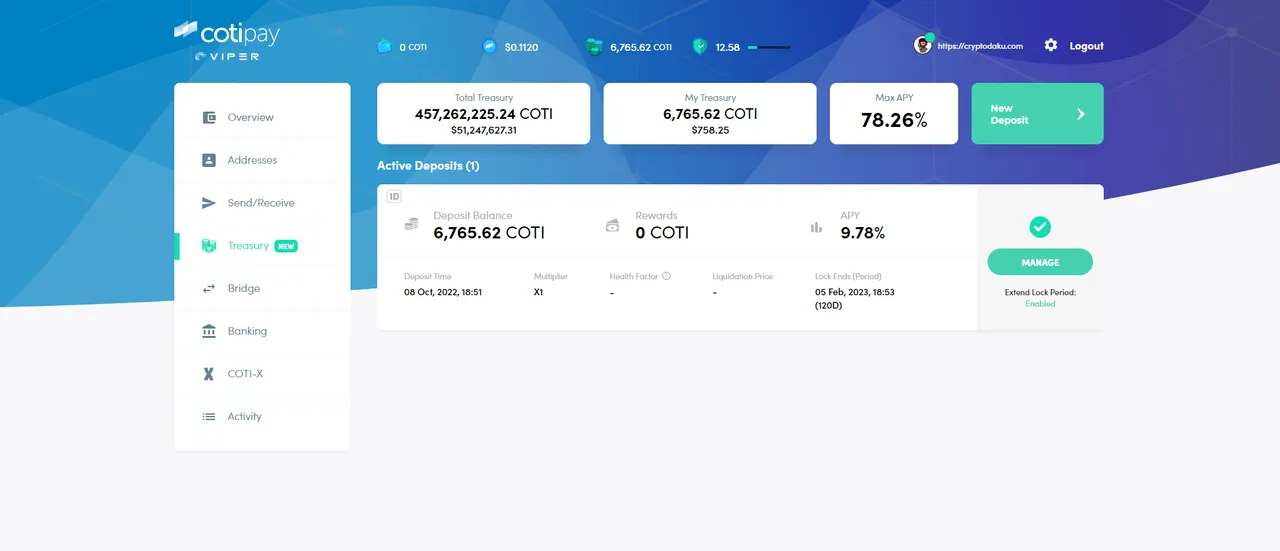

After I've submitted the deposit the smart contract created a record of it and performed the confirmations on the blockchains. I could see these details on the Treasury Management page.

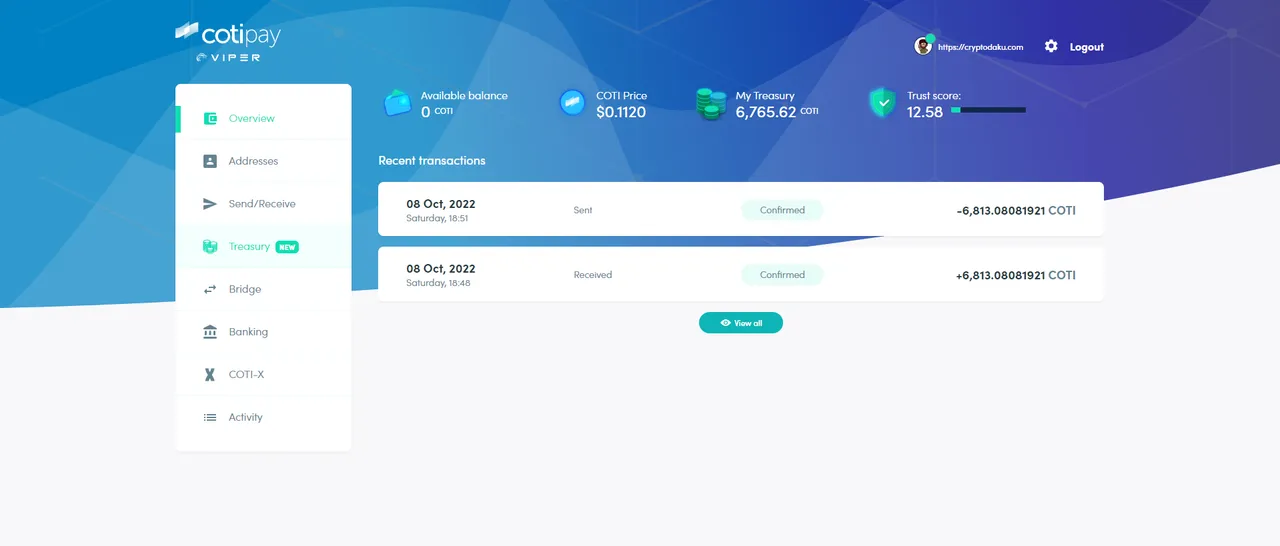

As well I could track the transactions performed, including the one for the deposit in the Treasury. Transparency and a clear view of what operations I have done.

This concluded the flow of moving the COTI assets from Binance where it was an ERC-20 cryptocurrency to COTI Treasury using the Bridge which translated those into Native COTI. From there on I've added a deposit into the Treasury for 120 days with a decent 9.78% APR. Overall I have paid in fees 74 COTI, while from the deposit I am expecting a return of 220 COTI. The net return would be at 146 COTI which represents 2.15% APR for a 4 months period or 6.45% APR per year. Not too much, not too low, but above all there might be new perks coming my way through future expected airdrops. And besides that, I am thinking of buying more COTI and adding to the Treasury considering that the current price is somewhere around $0.11, while it had an ATH of $0.66, thus more than enough space to grow.