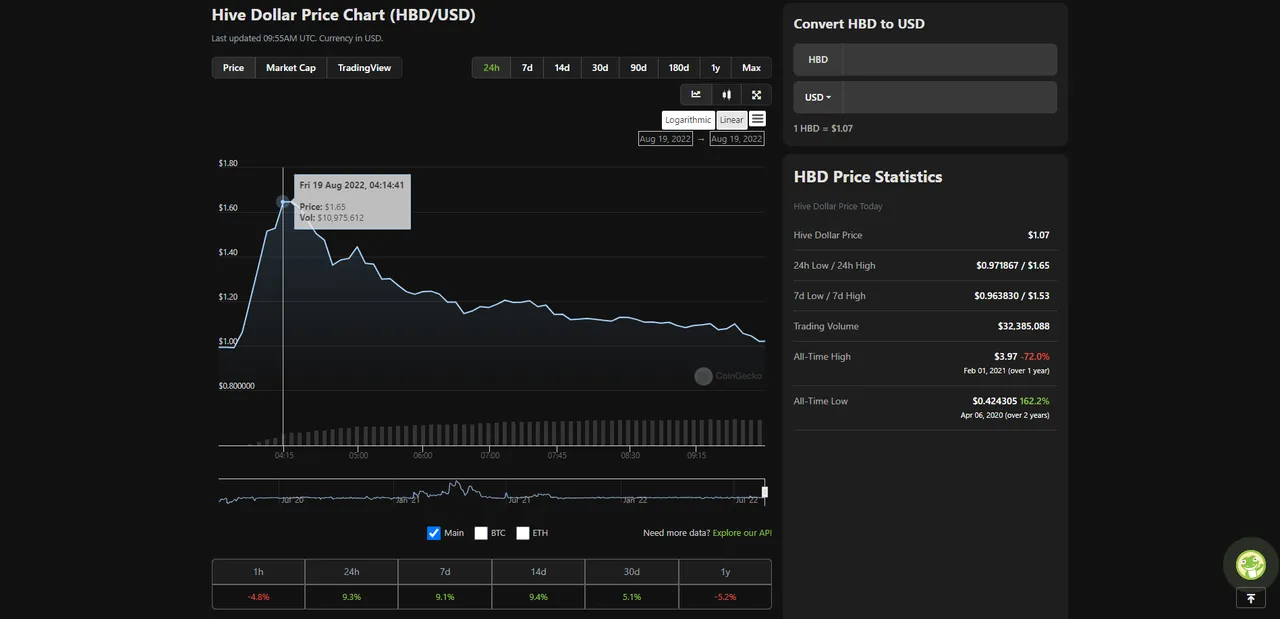

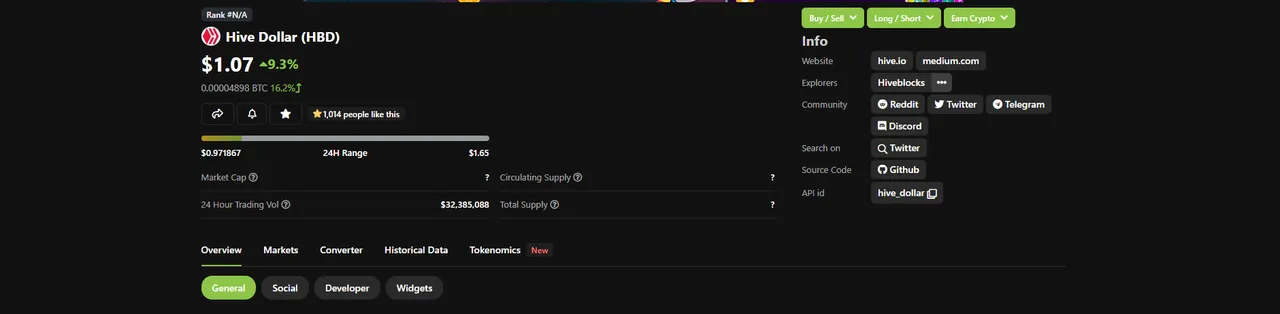

Hive Backed Dollar (HBD), the Hive algo, spiked again reaching as high as $1.65 with some serious volume behind it. At this price, more than $10M was traded, but much more even before and after the price deflating.

The entire market hype took around 5 hours and at the end of it the price ended at around $1.07, which is still above the pegged price of $1 worth of Hive.

With such big movements on the market repeating regularly I wonder if it is better to hold liquid HBD instead of locking it into HBD Savings, even if the APR is standing at a juicy 20%. You just need to catch one such spike, convert HBD into a different stablecoin, and after that back to HBD when the price gets back again to $1. This will provide better returns, only that you need to be more proactive in taking gains by placing orders on one exchange or the other.

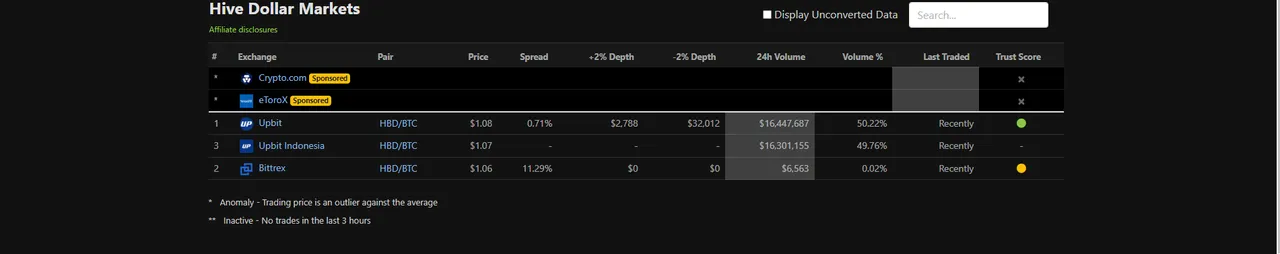

UpBit looks like is the only centralized exchange supporting HBD, but we have also the option on PolyCUB as a decentralized exchange where we can take advantage of the price. If only this would extend to other exchanges with big volumes like Binance and it would be easier to take advantage of such movements.