Microstrategy has been a stagnant company for years with respect to revenue, profits and market capitalization. That suddenly changed when Michael Saylor started to use his company's immense cash reserves to dive into Bitcoin. This continued with further debt offerings and stock sales with the express intent of using it to acquire even more Bitcoin.

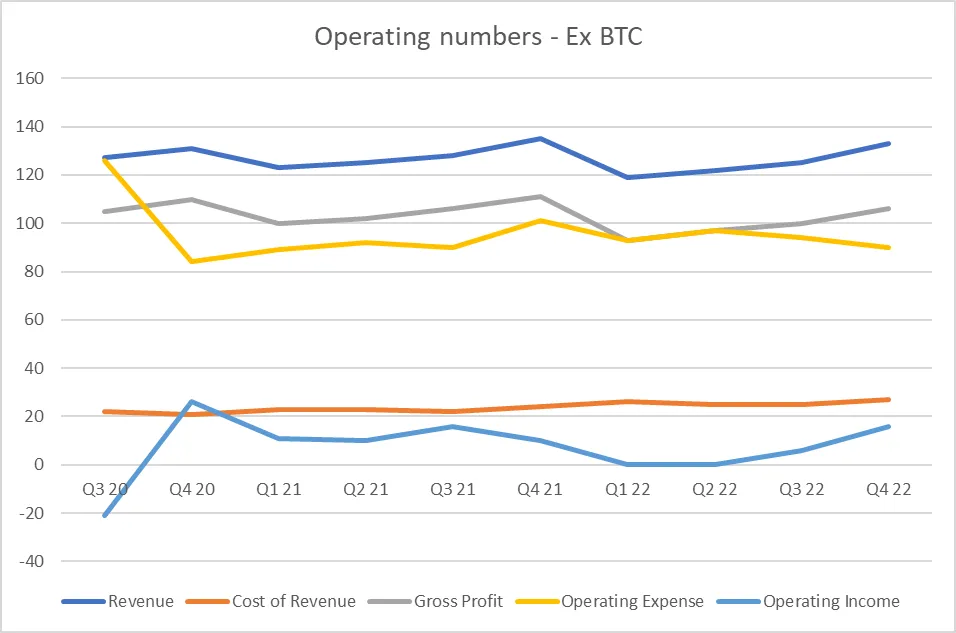

Business financials without adjustments for Bitcoin related corrections:

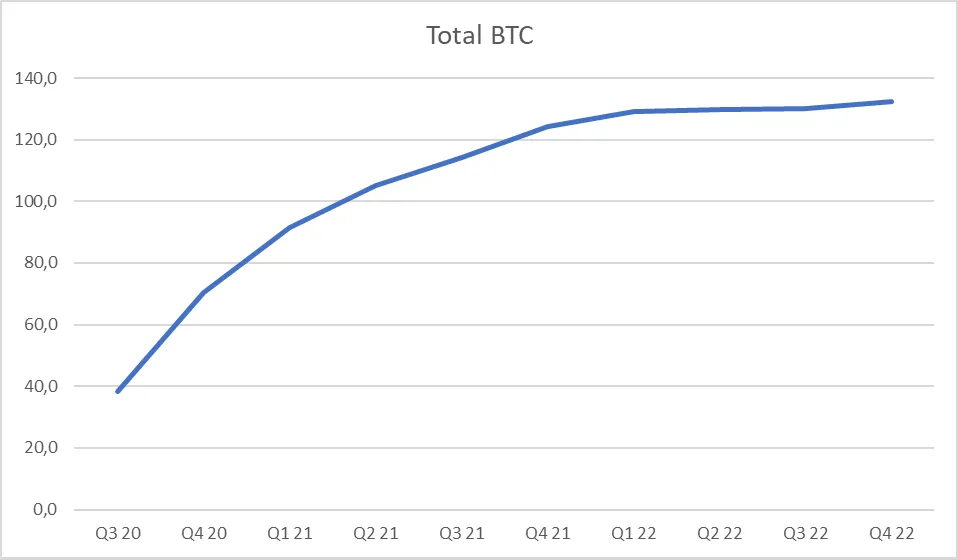

Starting August 2020, Microstrategy has bought in aggregate 132,5 BTC at a total cost of $4 billion for an average price of $30’137 (Source: Q4 22 Financial Results).

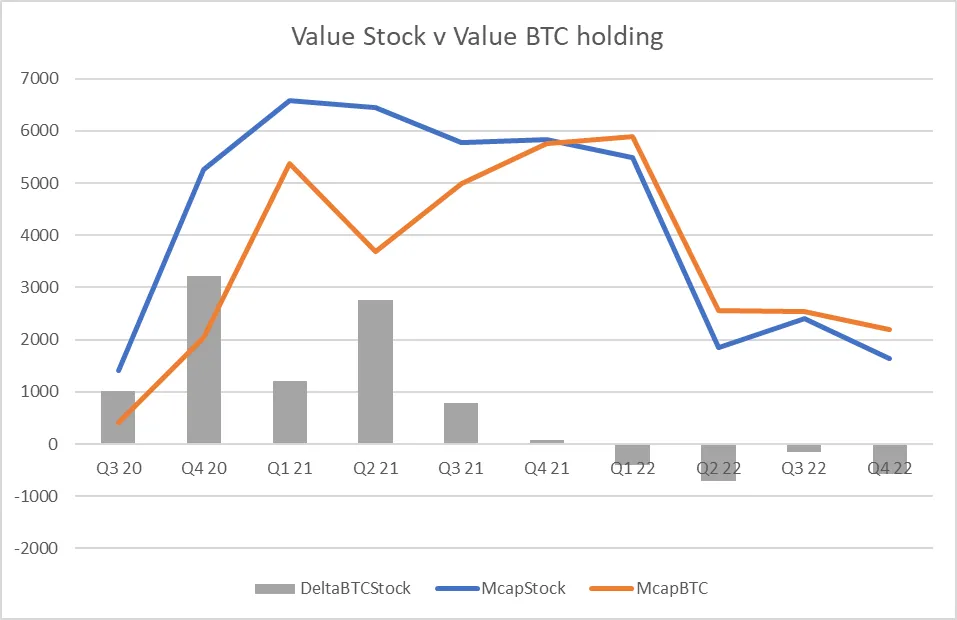

This growing stake of BTC has influenced the valuation of the companies’ stock market valuation significantly. The differential between the market cap of the stock and the market value of the digital asset has changed significantly. In the beginning, the stock was overvalued with respect to the BTC stake. During this crypto winter, it has been slightly undervalued.

The highest overvaluation occurred in the 4th quarter of 2020, with a positive delta of $ 3,2 billion.

The most severe undervaluation so far occurred in the 2nd quarter of 2022, with a delta of negative $ 713 million.

Data is aggregate numbers per quarter as disclosed by the company.

Sources:

Source Microstrategy financials:

Microstrategy investor relations page for 10-K and 10-Q reports.Source Microstrategy stock market data: finance.yahoo.com

Source shares outstanding:

ycharts.comSource BTC price:

coingecko.com

Vote for my witness: @blue-witness