A new week ahead, and as always, a lot of stuff is happening in the crypto space. ETH is slowly approaching the $4000 milestone, which is a psychologically important level. Meanwhile, my focus is still on the large caps, $SOL, $SUI and $HYPE, which have also done very well recently.

Besides these, I'm thinking it's about time to stretch the risk curve a bit and start allocating some funds into riskier, smaller-cap assets. This is because when the altcoin season starts, it might happen very suddenly and surprisingly.

In this post, I'm sharing 3 of my beta plays, or a bit riskier assets that I believe will do quite well when/if alts start pumping. Note that this isn't financial advice, and you should always do your own research. That being said, let's take a look at what I'm investing in!

$JUP

Excluding the King, Hyperliquid, I can honestly say that my favourite DEX is without a doubt, Jupiter, on the Solana network.

I've been using this for about 2 years now, and it just keeps on getting better and better. Jupiter has very low fees, and swaps are really smooth and fast. That alone would make me stay a loyal user, but Jupiter just keeps on innovating and adding new features.

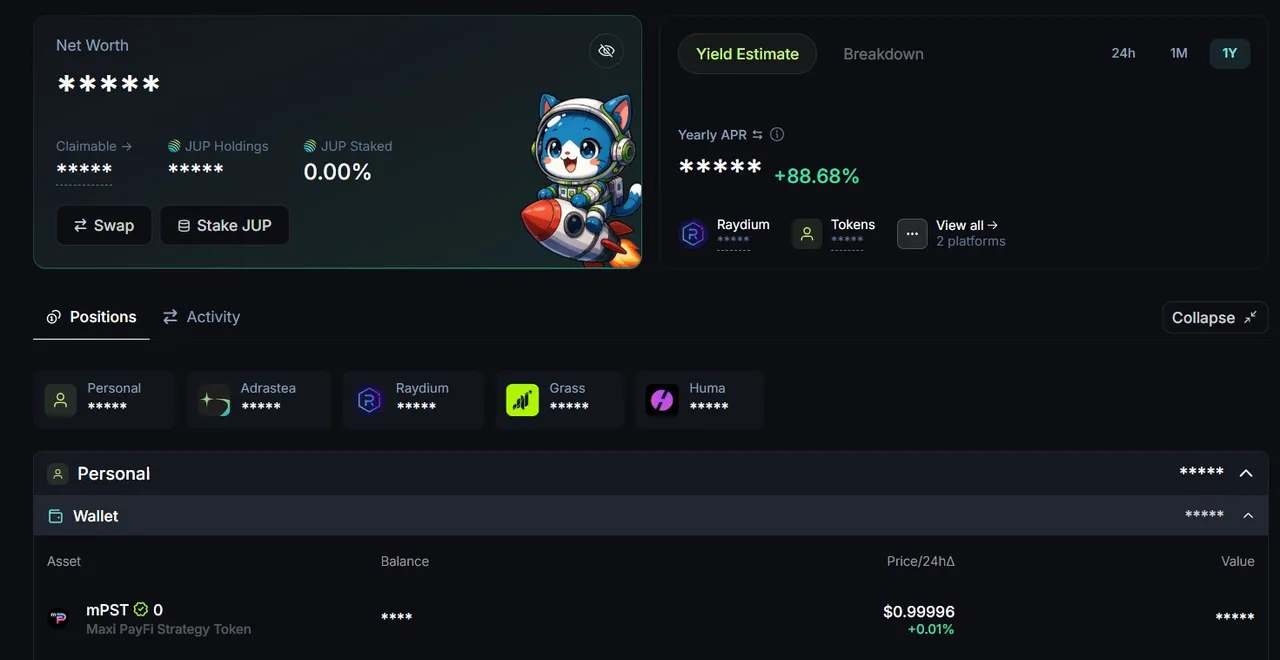

One of their recent additions, Portfolio, tracks your wallet activities & holdings across the whole Solana, displaying defi positions, rewards, APRs, everything in a slick interface.

The latest Jupiter feature launch, Jup Studio, is also gaining a lot of attention, and it seems to have flipped Pump in a competition of Solana launchpads.

On a weekly chart, $JUP looks like it has bottomed already and is now on its way to test the descending trendline. Breaking this and a successful retest would be a good entry point here, in my opinion.

$JUP usually performs very well when $SOL is surging, so it's a decent Solana beta play if we want to be a bit more risk-on. The exit plan would be rotating back to SOL or USDC.

$ENA

This is something I bought out of whim, and unfortunately, close to the top. Since then, I've watched $ENA fall lower and lower, but I didn't sell because it was a rather small amount in question. Just recently, I've become more attentive to it. Here's why:

Ethena's partnership with Anchorage Digital to launch USDtb, the first GENIUS-Act compliant stablecoin, has boosted confidence in the project’s regulatory alignment and institutional appeal.

Support from BlackRock through its BUIDL product for tokenizing $45 million in reserves, alongside potential collaboration with ArbitrumDAO, further enhances investor trust.

Ethena’s USDe synthetic dollar and “Internet Bond” offer a crypto-native alternative to traditional banking, appealing to DeFi investors. The protocol’s $290 million in revenue and a burn mechanism strengthen its fundamentals

$ENA is clearly one of the assets benefiting from the new US regulations, and while the surge has already been impressive, I think there might be a lot more room for the upside as institutional interest seems to be increasing.

Here's an $ENA chart I shared some time ago with the range I drew that has now been broken and retested. Buying any decent dips from here on wouldn't be such a bad idea, as $ENA is in a clear uptrend.

$KTA

This one is one of the newer additions to my portfolio. The native token of the upcoming Keeta L1 chain, $KTA, is already tradable on Base and has been performing very well since its launch in March.

Some time ago, Keeta raised some eyebrows by demonstrating 10 million transactions per second (TPS) with settlement times as low as 400 milliseconds under a testnet environment. Backed by the former Google CEO, Eric Schmidt, Keeta aims to challenge such L1 giants as Solana and Sui.

The amount of $KTA tokens already in circulation is 405,531,368 (out of 1,000,000,000 total supply), which sets the market cap/FDV ratio to $KTA at 0.41, better than Sui's current 0.35. Also, no unlocks until 2026.

$KTA has just broken a resistance level, and we are soon to find out if it will now hold as support. If the level is retested and holding, $KTA could soon be going for ATH levels near $1.70. Pretty good entry point here if the overall crypto trend remains bullish.

Conclusion

During the previous bull runs, I made a lot of random buys and way too many of them. Needless to say that many of these have now lost a lion's share of their value. This time around, my strategy is far more conservative; the main focus will be on large-caps (SOL, SUI, HYPE) while increasing my risk-taking a bit with these beta plays and smaller caps.

That being said, these are not for holding throughout multiple cycles, and the plan is to first rotate back into the large-caps I mentioned above, and then to even safer waters (BTC, stablecoins).

I know many of us are still shell-shocked after altcoin dumps, but that's part of the game, as is a little risk-taking when the tide is turning again. Trend is a friend, and I'm following the current uptrend until further notice.

Thank you for reading!

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 Hybra Finance - New protocol! earn points by providing liquidity, we're still early

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 HypurrFi - farm airdrop points with stables by entering ref code BRANDO28

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 Huma Finance - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points

🔹 Kaito - monetize your X activity by creating quality crypto content

tag list: @gentleshaid