Fantom & Excalibur

One of my favorite networks had some serious issues while there was speculations about a huge whale about to get liquidated. Well, apparently he did, for 32M FTM.

According to Mark Jeffrey here on Twitter, the network has survived and things are starting to look positive again for Fantom.

Due to this extreme FUD and overall market sentiment Fantom dropped from $1.06 to $0.67 in 7 days but has since been slowly recovering.

Excalibur

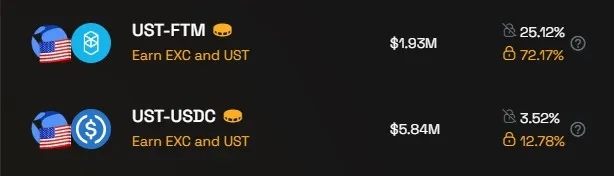

My deposits on Excalibur exchange also took some pretty nasty hits. I have three LP pair there: UST-USDC which is fine being a stable pair, UST-FTM that is not so fine and EXC-FTM which is really not doing well.

EXC is a native token of Excalibur and has been in slow decline for a longer period now. By providing liquidity to EXC-FTM you'll earn GRAIL which is pegged to EXC price. GRAIL holders can earn dividends and it's supposed to get scarce because it cannot be bought directly(not a liquid token).

Needless to say that this pair has had a really rough ride. I am at the point where I'm not considering exit with this one anymore. It's the same thing with USDC-PolyCub. I would make huge losses if exiting now and I still believe in both projects. So holding them both with diamond hands.

As for the stable pair, I'm thinking about changing protocol to one with a little bit better APR than 12.78%. Maybe to HBD, PolyCuB or Anchor. With the UST-FTM pair I'm probably going to continue farming and hoping for the FTM recovery.

SmartBCH & Goblins

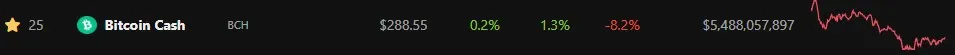

With Goblins Cash I'm actually doing quite well because they launched new bonding options pretty much the same time market started to dip.

I managed to find some really good bond discounts and by combining bonding, staking, buying and selling I succeeded to grow my GOB amount from 2 GOB to over 3 GOB. Their new elastic supply token, gBCH, is also providing some good opportunities because it's rebasing once a day towards the BCH price.

I'm not gonna go into details right now because I'm about to write an article about Goblins pretty soon and covering all this in more depth!

Terra & Prism Protocol

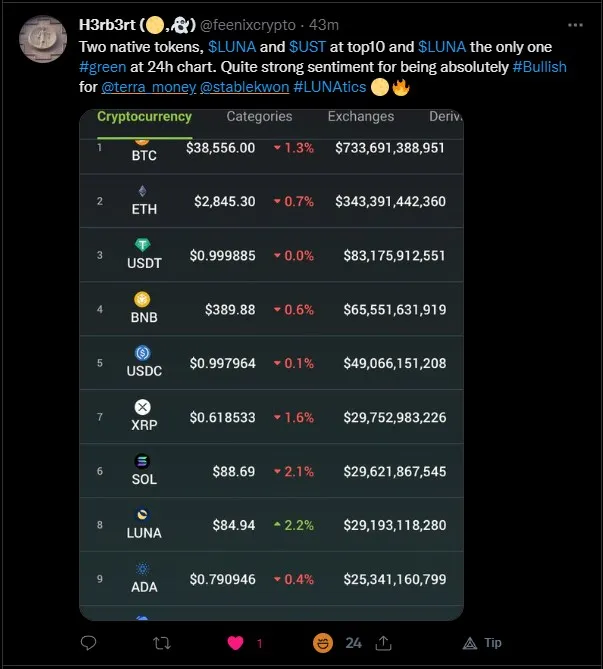

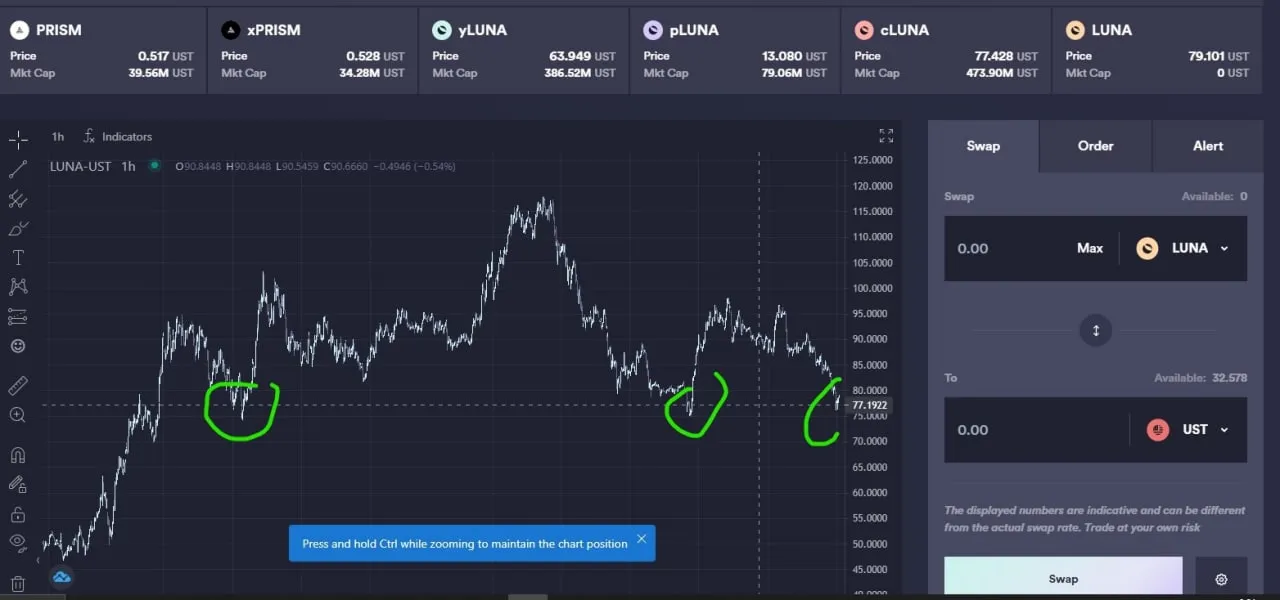

Terra's LUNA has been quite resilient during the market downwards movement. It's not yet ETH in that sense but I can see it moving towards that direction. Below you can see a good 24h chart by feenixcrypto.

So it seems to me that while LUNA lost 13.1% in seven days it is also recovering pretty well.

So with the current situation of Fantom and me being long term bullish on LUNA, it was time to add to my Terra holdings.

Prism

My investments suffered also on Prism Protocol but I did saw an opportunity in the midst of the market dip. I decided to acquire more yLUNA and PRISM tokens at the time LUNA touched this support level for the third time.

In my opinion yLUNA and PRISM are good investments since they move pretty much hand in hand with LUNA. That is if you believe that LUNA is yet to go higher.

I raised my yLUNA holdings by 30% and PRISM by 20%. I was investing with stables I got from Fantom network when the situation back there was really uncertain. So my total stakes and APR are now higher on Prism and I'm very happy that I got to buy cheap because I was planning to do it anyways.

If you are unfamiliar with Prism Protocol and how it works, you can check out this post of mine: Amping the Prism Protocol.

So all in all it wasn't that awful week, there was some good little moves made also.

Thank you for reading for and do leave a comment!

And keep in mind that this is not a financial advice.

Join my team at ListNerds

Twitter brando

Thumbnail background by Elias Jonkers Pixabay