If you are like me, a person who keeps checking the charts regularly, perhaps even too often, you've probably noticed that stocks, Bitcoin, and everything else are down. Except for BTC.D & USDT.D, of course.

Dips often provide some very good opportunities to grow our bags; all we have to do is be brave. That being said, we also have to be smart and not go all in, hoping this is the last dip ever. Because it most certainly is not.

In this article, I'm sharing my HypurrFi lending/borrowing strategy that is now in full effect thanks to the recent dip.

What is HypurrFi?

HypurrFi is a lending/borrowing protocol on HyperEVM, which is the side chain of Hyperliquid. Basically, Hyperliquid (or HyperCore) is focused on perps trading while all the defi, NFT, memecoin, etc, stuff happens on HyperEVM.

The idea is you lend either stablecoins or crypto such as BTC, ETH, SOL and use those as collateral so you can borrow more assets against your initial deposit.

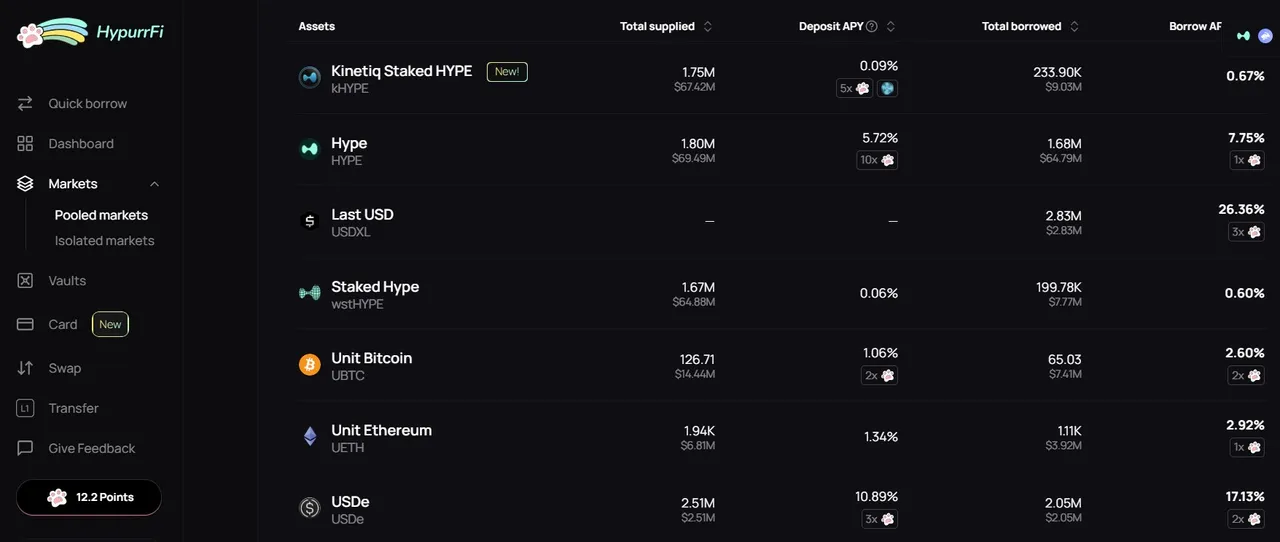

Each asset has its own APR, which increases the amount of your deposit or your debt over time. Also, each lent or borrowed asset has a different points multiplier.

My Strategy

Until yesterday, I was only lending $USDT on the platform and had been doing that for quite some time. The reason I wasn't borrowing anything was that the crypto market was going up, and I just couldn't find good enough entries.

You see, my idea is to borrow other stablecoins against my USDT deposit, then use those stables to buy BTC, HYPE, ETH, or SOL, and deposit those again to increase my APY, points, and health level.

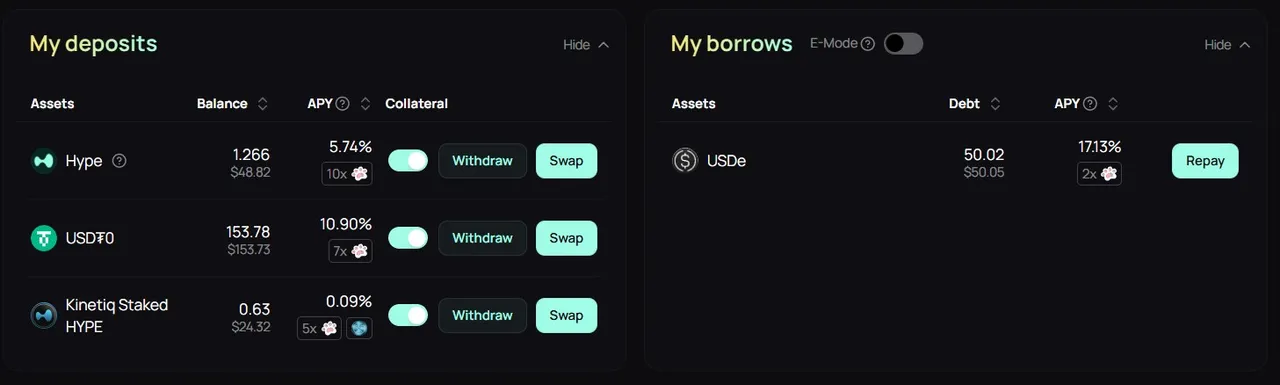

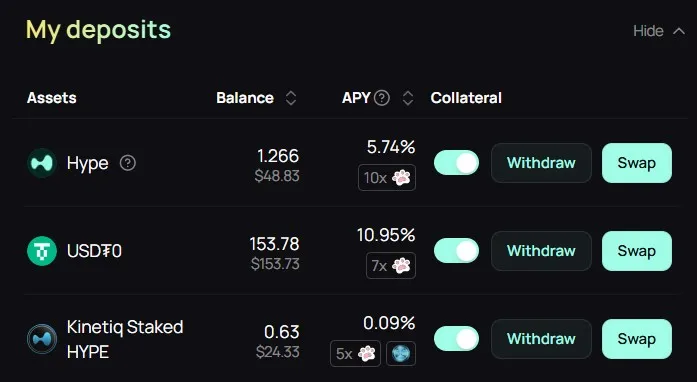

Here in the pic above, you can see my Hypurrfi dashboard. My initial deposit was $153 in USDT, and that allowed me to borrow about $100 against it.

The long-term strategy here is to take advantage of the $HYPE dip, get it cheaper, wait for the price to bounce back up again, and eventually pay back the debt with the profit I've made. Sounds easy, but there are a few things to take into consideration.

Risks

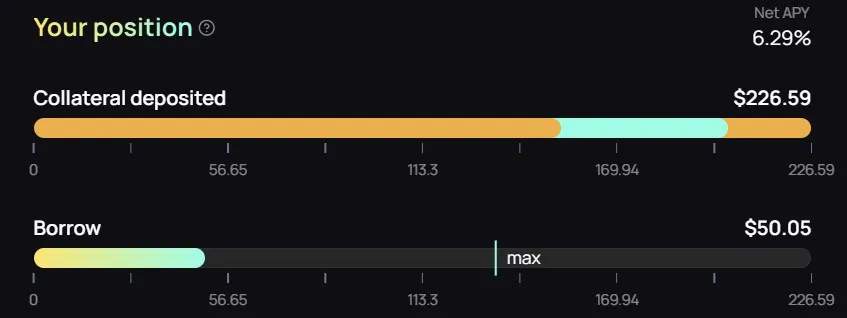

Every time you borrow against your collateral, you'll see this slider displaying how risky your borrowing will be. The more you try to borrow, the riskier it gets. The same thing is also shown on your dashboard as the Health Factor indicator, which is good to keep monitoring regularly if your levels are close to 1.

So, how could a liquidation event happen?

Let's say your collateral is 100% in $HYPE, for example, and you deposited when the price was near $50. You then borrowed against it at an aggressive level, and your health factor dropped between 1 and 1.5. Now, this is perfectly fine if $HYPE price keeps going up, but if it doesn't, you'll have to add more collateral or pay some of your debt, or you risk getting liquidated.

My Approach

To avoid this and not have to stress about the health factor, I'm playing it safe here. Instead of using volatile assets (BTC, ETH, HYPE, SOL) as collateral, I'm lending stables (USDT) and borrowing stables(USDT.e). This way, the volatility between the borrowed & lent assets is extremely small, and I could take a bit more risk if I wanted to.

In other words, a further $HYPE dip wouldn't have any effect when it comes to the risk of getting liquidated.

In the end, my strategy comes down to profit taking. That's the key: remembering to sell some of my extra collateral assets when their price peaks, pay the debt, and deposit profits back in as stables. Then, when the time is right again and there's a dip, I'll just repeat the whole process and borrow stablecoins again to buy volatile assets. Only this time with increased capacity.

APYs

Each lent or borrowed asset has its own APY, which is constantly changing based on demand and market movements.

In the previous screenshot, you can see that the APY of my borrowed USDe is currently 17%, while the APY of my deposited USDT is 10.90% and HYPE with $5.74. So in time, my borrows grow more than deposits, but since the amount is smaller, my total net APY is currently on the positive side at 6.29%.

Even if it was negative, it wouldn't matter much if I kept following my strategy and kept on paying my debt every now and then.

Points

As the whole HyperEVM is a relatively new chain, there are a lot of new, tokenless protocols, but with the points program, meaning they are launching their own token in the future. These are happy times for the airdrop farmers.

On HypurrFi, different assets have different point multipliers. For example, here you can see my deposited assets and their multipliers:

Same goes for the borrowed assets as well, and you get points for those, too. Besides that, some assets like the kHYPE here at the bottom also earn points from their native protocols, so who knows how many airdrops we might be farming simultaneously.

Using different looping strategies could potentially earn us a significant number of points, even with a modest initial deposit. However, my main focus is on increasing my bags and not playing it too risky. So for me, points are a nice addition that will hopefully reward me sometime soon.

Conclusion

Lending/borrowing strategies are a great way to increase your exposure to assets you believe will do well in the future. In my opinion, the main thing to consider is paying your debt during uptrends and when you believe the asset has reached the local top and is about to cool off a bit. Likewise, dips and bottoms are for borrowing more stablecoin assets and using those to buy more volatile assets. Points and airdrop farming is just a side hustle, but could be very lucrative as well. Note that this isn't financial advice, and you should always do your own research. That being said, HypurrFi is definitely worth checking out.

Thank you for reading!

🔹 Hyperliquid - the best perp DEX out there. Trade, stake & farm the next big airdrop!

🔹 Hybra Finance - New protocol! earn points by providing liquidity, we're still early

🔹 HyperSwap - Swap & provide liquidity on HyperEVM, earn points for the airdrop

🔹 HypurrFi - farm airdrop points with stables by entering ref code BRANDO28

🔹 LeoDex - multi-chain, multi-wallet dex for all of your swaps

🔹 VOLO - stake SUI to earn APR & airdrop points!

🔹 Pawtato Land - very useful SUI dashboard, earn XP for the airdrop by completing small tasks

🔹 Huma Finance - easy to farm an airdrop on Solana. Deposit USDC, earn APR % points

🔹 Magma - concentrated LPs on Sui. Very good APRs!