As you wander about the modern world you will likely encounter 5G radios, satellite ground stations, solar panels, mapping vehicles, and more. Have you ever stopped to wonder how all this infrastructure was established?

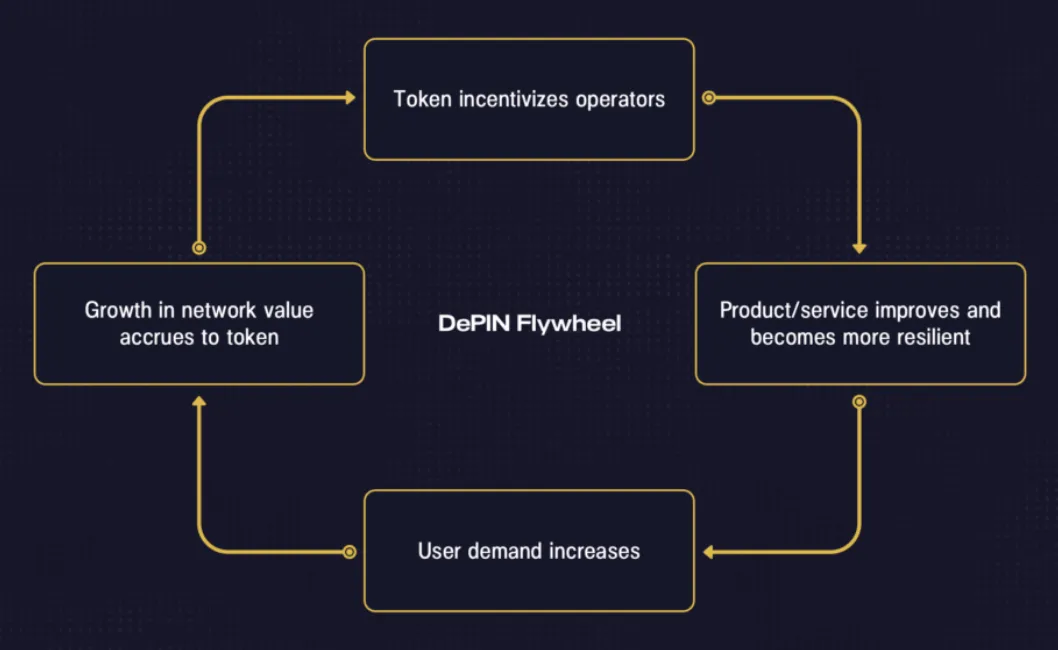

Traditionally, corporations have coordinated the deployment of cellular networks, energy grids, data centers, and more. While this type of roll-out has served us in decades past, there now exists a more efficient way to build out physical infrastructure, and it involves blockchain technology.

In this post, we discuss the advantages of decentralized infrastructure roll-outs, and the drawbacks of their centralized counterparts. We also cover three specific up-and-coming projects that are building out decentralized physical infrastructure networks (DePIN).

Disadvantages of Traditional Infrastructure Rollouts

Let's identify some of the disadvantages of building out infrastructure in the conventional way, using Google Maps as an example:

- Large capital expenditures - Google has to pay hundreds of thousands of dollars for each vehicle that is set off to map the world's streets. Similarly, coordinating the deployment of 5G radios, solar panels, and data center resources is also expensive.

- Inefficient payments - Paying thousands of independent workers across different international banking jurisdictions for mapping data is a pain. Transferring currency through the traditional banking system is a path full of friction and roadblocks.

- Misaligned incentives - Unless the workers own company stock, the people building out Google Maps care mainly about their paycheck, and are not invested in the long-term success of the network. They do their part, get paid, and move on.

In contrast to centralized infrastructure roll-outs, decentralized deployments offer many advantages. Here we will use Hivemapper as an example.

Benefits of Decentralized Infrastructure

Aligned incentives - The lead of Hivemapper mentioned in a recent interview how senior members in the discord channel are helping newcomers properly setup their dashcams, in order to capture the best road imagery possible. If you are part owner of the network, you are more motivated to produce a high quality product.

Efficient payments - Instead of sending money to workers through the traditional banking system, tokens are distributed directly to the recipient's self-custody wallet. Although real-world identities are kept anonymous, the payments themselves are are totally transparent, and can be easily audited by anyone.

Hivemapper's community token is called HONEY, and it was minted on the Solana blockchain. It can be obtained from decentralized exchange (DEX) Raydium, using a crypto wallet like Phantom.

Let's briefly cover two other DePIN projects that are in rapid development.

GEODNET

GEODNET is using token incentives to foster a community of satellite miners who produce extremely accurate GPS data. In fact, their system is able to provide more precise (to 1cm) GPS data than existing solutions. People who setup base stations are rewarded in the network's GEOD token for their contributions to the network.

The GEOD token remains on the Ethereum sidechain Polygon for the time being, but it could eventually be migrated to a different blockchain, as was the case with DePIN project XNET. For now though, the GEOD token can be obtained via a DEX like Quickswap or Sushiswap using a crypto wallet like Metamask.

Akash Network

Unlike Hivemapper and GEODNET, Akash operates on its own application-specific blockchain in the Cosmos ecosystem. Akash is a decentralized marketplace for compute power where participants bid on CPU/GPU resources with the network's native AKT token.

The AKT token can be acquired via the Osmosis DEX after installing a crypto wallet like Keplr. Thanks to a solid foundation, open-source artificial intelligence projects like Venice.ai are already being built atop Akash's decentralized infrastructure.

If your interest has been piqued, you can watch an interview with the leaders of Akash, Hivemapper, and GEODNET on Pantera Capital's website. Each founder explains the advantages of using DePIN for their infrastructure rollouts.

Pitfalls

Unfortunately not all is rainbows and butterflies in the world of DePIN, and there are potential pitfalls that we need to watch out for. For example, we have already discussed the potential for token censorship in a previous article.

In a nutshell, the issue is that the HONEY contract on Solana has a "freeze authority" associated with it, indicating that the team has the ability to suspend accounts.

That said, when compared to traditional finance, the difference is that any censorship would be transparent, and the community would demand answers as to why certain wallets were suspended.

There is also potential for congestion on Solana as various DePIN projects and meme coins compete amongst each other for blockchain resources.

Even though Solana has been performing well lately, we need to keep in mind that most validators have been receiving subsidized delegations from the Solana Foundation, and that model may turn out to be unsustainable in the long-run.

In the future we could see most popular DePIN networks migrate to their own blockchains, to prevent competition for resources with other dapps.

Crypto-Powered Economy

The projects outlined above are just a few examples of how blockchain technology is revolutionizing the way we build out new physical infrastructure. The deployment of token-based energy grids, cellular networks, and data storage systems is also happening right now.

We are gradually transitioning into a world where the primary purpose of cryptocurrencies will no longer be speculation. Instead, we will value decentralized networks based on the economic activity they produce, and their real-world utility.

The inherent transparency and accountability of the crypto-powered economy will become increasingly valuable as confidence erodes in traditional finance and flawed economic reporting. The blockchain technology behind Bitcoin is enabling a new trustless economy to emerge.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...