Have you ever wondered how a cryptocurrency like Dogecoin, which offers little to no innovation over Bitcoin, managed to reach a market capitalization of $60 billion dollars, or how tokens like Shiba Inu, Pepe, and Bonk have all achieved valuations of over $1 billion dollars?

Meanwhile, projects that are actually building out real-world infrastructure may only be worth 10s of millions of dollars or less.

In this article, we will discuss the fundamental properties of cryptocurrencies which enable them to form such strong communities, and which tokens have the potential to hold value long-term.

Fundamental Value Of A Crypto Token

Why do cryptocurrencies have value in the first place? After all, they aren't backed by physical commodities or powerful governments.

Setting aside speculation for a moment, communities gather around crypto tokens due to their fundamental properties of transparency, immutability, and permissionlessness:

- We can verify a token's total supply, number of holders, etc. on the blockchain.

- Our tokens cannot be stolen or confiscated, IF we hold the private keys.

- We can purchase or earn tokens without the permission of a government or bank.

Crypto tokens differ from the equity of a public company, for example, where the number of oustanding shares, shareholders, etc. is only known by the financial institutions. We must trust them to relay that data honestly to the public.

Also, when you dig into the details, you will discover that your traditional financial assets are only leased to you, and could technically be confiscated from you in the event of a financial crisis.

Credit-Fueled Speculation

Getting back to the issue of speculation - we are living in unprecedented times. Debt and currency (which are the same thing, by the way) have been expanding exponentially in recent decades, especially since the financial crisis of 2008, and even more so since the plandemic.

A lot of the newly issued currency has been used to bid up assets such as bonds, stocks, and real estate, resulting in the "Everything Bubble" we are living in today. Since Bitcoin's launch in 2009, and subsequent listing on exchanges in 2010, cryptocurrencies have been added to the list of overpriced assets.

Some of the excess liquidity floating about has found its way into speculative digital assets, including Dogecoin, Shiba Inu, Bonk, and others. That's not to say that cryptocurrencies do not have fundamental value, but we must acknowledge the underlying credit bubble that has distorted their valuations.

Ultimately, the credit bubble we find ourselves in is unsustainable, especially at today's 5% interest rates. Eventually the bubble will pop, and value will have to return to the protocols that facilitate real-world economic activity.

Bitcoin vs "Shitcoins"

Bitcoin started out as a small project, and cryptography enthusiasts joined the network early out of curiosity, casually earning Bitcoins along the way. It wasn't until Bitcoin was listed on exchanges in 2010 that it represented dollars, providing a catalyst to expand the community.

As time went on, and the price of Bitcoin increased, more people were attracted to the project. Those who got in early saw incredible fiat gains in their portfolios, which I believe may have clouded their judgement. At this point, many BTC holders value Bitcoin based on the fiat dollars it represents, rather than the economic activity it can facilitate.

That said, Bitcoin is indeed the most proven cryptocurrency so far, and is backed by the most compute power, energy, and hash rate of any other. Regardless of whether or not people are buying Bitcoin on exchanges, the network chugs along producing blocks day after day, week after week.

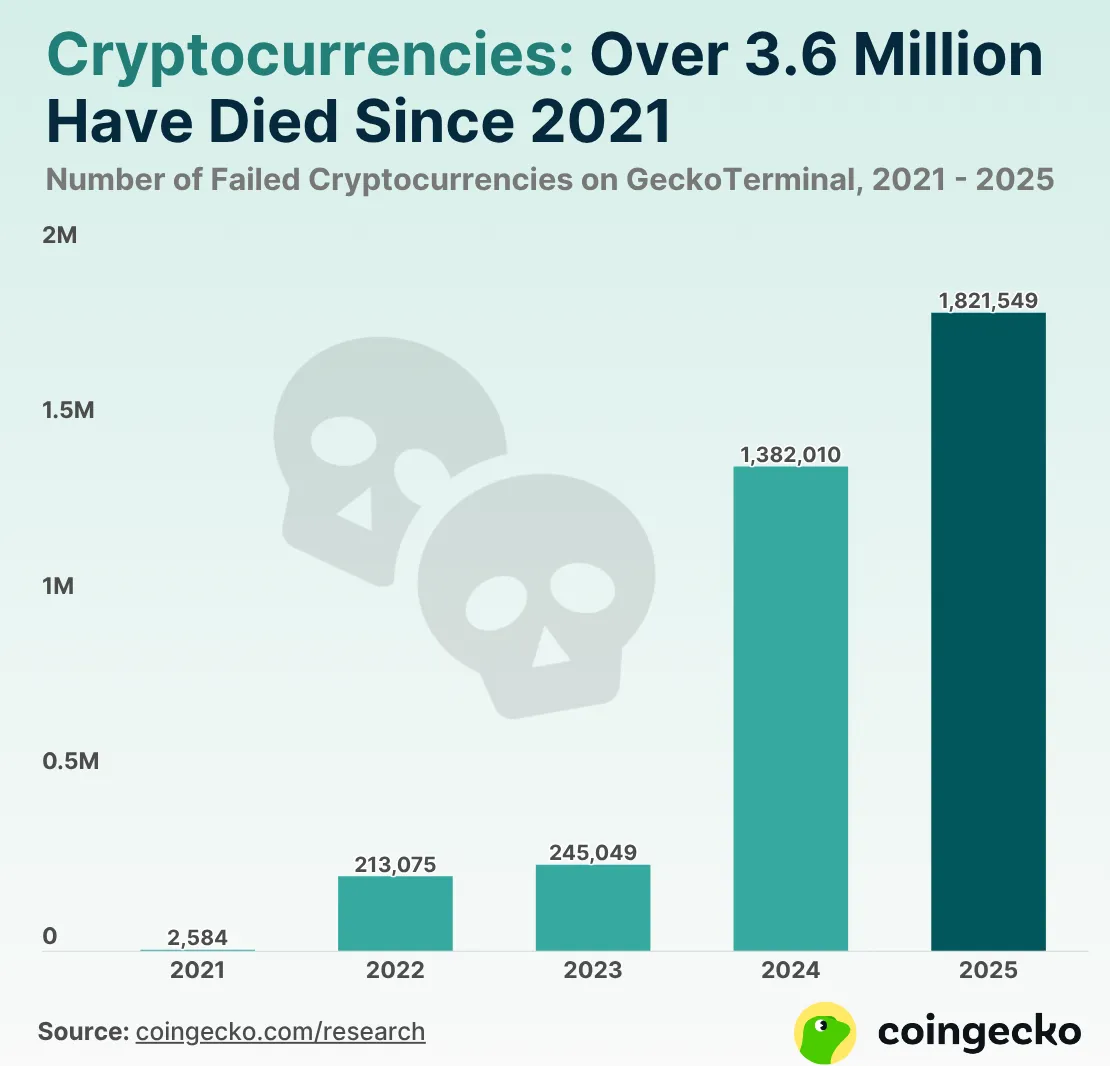

Nowadays, anyone can easily create a crypto token using a service like pump.fun for example. Of course, most of these memecoins end up worthless shortly after their creation. In fact, over 1,800,000 have already failed since the beginning 2025, according to Coingecko.

If configured properly, memecoins possess all of the properties we discussed earlier (transparency, immutability, and permissionlessness) but only survive if they manage to form a hardcore community.

Even then, they are driven mainly by speculation (hopium that the dollar value of their tokens will go up), without a specific use-case.

DePINs Stimulate Economic Activity

As degens pump out memecoins, decentralized physical infrastructure (DePIN) projects are building on Solana too. DePIN tokens differ from memecoins however, because they have actual economic activity to back them up.

DePIN tokens separate themselves from memecoins because they facilitate real-world economic activity. DePINs use token incentives to spur the installation and ongoing operation of wireless hotspots, weather stations, dashcams, and more.

Similar to Bitcoin, DePINs continue to chug along providing decentralized infrastructure such as energy, wireless, and compute, whether or not people are trading their respective tokens on exchanges.

The tokens earned by the infra operators can then be used to pay for the service they are providing, resulting in a circular economy that accrues value to the token. A memecoin, unless converted into a DePIN after the fact, is priced mainly on speculation.

Keep in mind that DePIN tokens have their disadvantages, such as uneven initial token allocations, the potential for minting/freezing if misconfigured, and the fact that they are relatively new and experimental.

Taking into account that virtually anyone can create a DePIN token on a permissionless blockchain, you may be wondering which ones will hold value in the future.

DePIN Network Effects

Consider that back in 2006, anyone could have created an alternative to Facebook. At this point, however, Facebook has already captured most of the global social media market.

DePIN projects, on the other hand, are just getting started in a relatively untapped marketplace.

At this point in time, anyone could launch another Helium-like network, for example, and "compete" in the carrier offload market. In fact, there are others in the space like XNET, World Mobile, and Karrier One that are building similar decentralized wireless networks.

These alternative projects aren't necessarily competing with one another though, because market penetration worldwide is still quite low, so they aren't stepping on each other's toes yet.

Eventually we will reach market saturation and new DePIN projects will find it hard to gain marketshare. Until then, there is plenty of room for token-backed DePIN communities to form and expand.

Until next time...

The value of most cryptocurrencies, especially memecoins, has been skewed by the exponential credit bubble we currently find ourselves in.

DePIN tokens separate themselves from memecoins because they are backed by real-world economic activity such as the roll-out of wireless, energy, and compute infrastructure.

As the industry is still nascent, there is plenty of room for growth. It's best to keep an open mind when considering the possible future outcomes of this novel use-case of blockchain technology.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- DePIN Spotlight: How Fluence Powers Verifiable, Lock-In-Free Compute

- Three Emerging DePIN Projects On The Polygon Blockchain

- Three Up-And-Coming DePIN Projects On The Solana Blockchain

- The Great Taking by Peak Prosperity

Sources

Weather XM node [1]