Data has surfaced in recent weeks indicating that global economic activity is slowing down, and that we are likely heading for a recession.

In this article, we'll go over some of the specific indicators that are signalling a recession, dig into the root cause of the slowdown, and provide some novel solutions that you can implement in your own life to survive the aftermath of a possible monetary reset.

Keep in mind that some of the numbers below have been reported by the government, so take them with a grain of salt, especially considering they are likely doctored to push a narrative. In fact, some of these agencies have been caught falsifying numbers in the past.

GDP Contracting

The Bureau of Economic Analysis (BEA) released data this week showing that the United States economy contracted by -0.3% in Q1, the first negative print since Q1 2022.

The decline was caused mainly by a reduction in personal consumption, government spending (DOGE), and net exports.

If the GDP contracts again in Q2 then we will technically be in a recession, and that means an increasing number of people will be losing their jobs and seeking alternative forms of income.

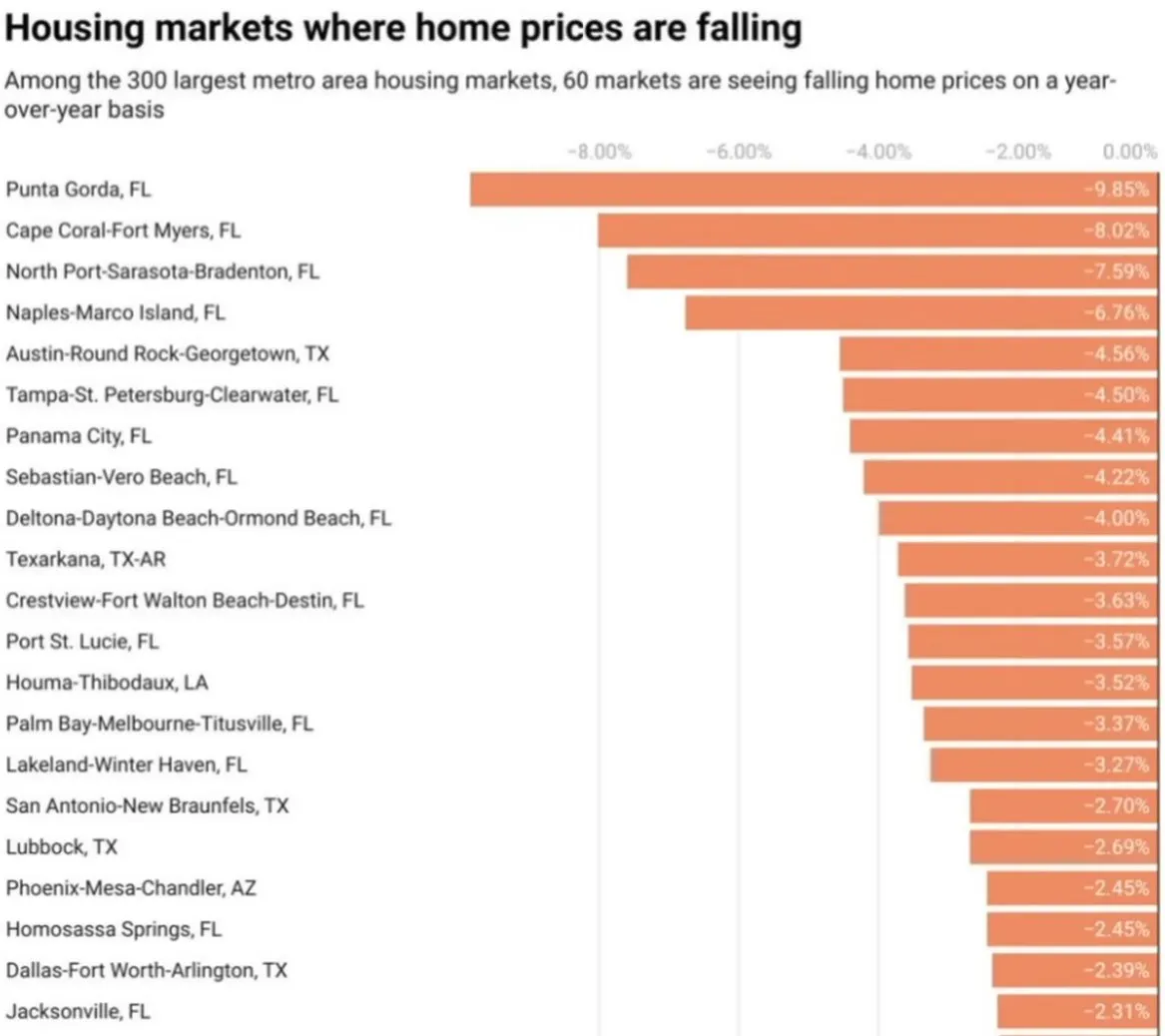

Home Sales Falling

The National Association of Realtors published data showing that home sales are the lowest since the housing crisis of 2008. We have seen home prices starting to fall in many US states, particularly in Florida.

Despite the lower prices, the US home ownership rate has fallen to its lowest level in 5 years.

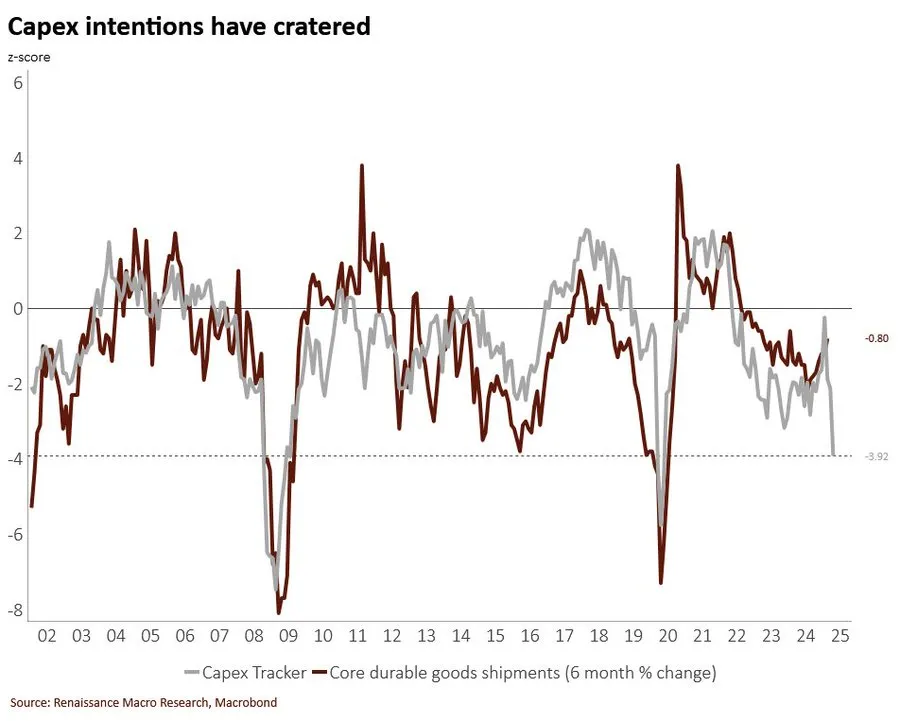

Manufacturing & CapEx Down

Regional manufacturing PMIs are down -3.8 indicating that factory output, orders, and supplier delivery times have decreased.

CapEx (capital expenditure) expectations are also down, as investors hesitate to invest in an economy that's contracting.

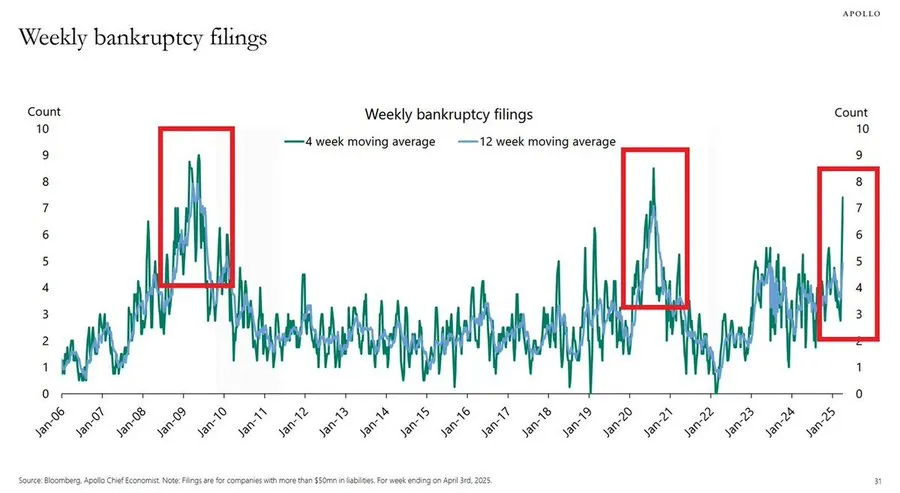

Bankruptcies Surging

Bankruptcies of large US companies have been skyrocketing as well, and are at their highest levels since the covid lockdowns of 2020.

Additionally, consumer confidence is down the most since May 2020, and Southwest Airlines CEO Bob Jordan warned that the US airline industry has already entered into a recession.

Cause of Slowdown

Many people are going to react to the upcoming recession by simply blaming it on Trump and his tariffs. And while the trade war may have certainly been the trigger, we need to zoom out a bit to find the root cause.

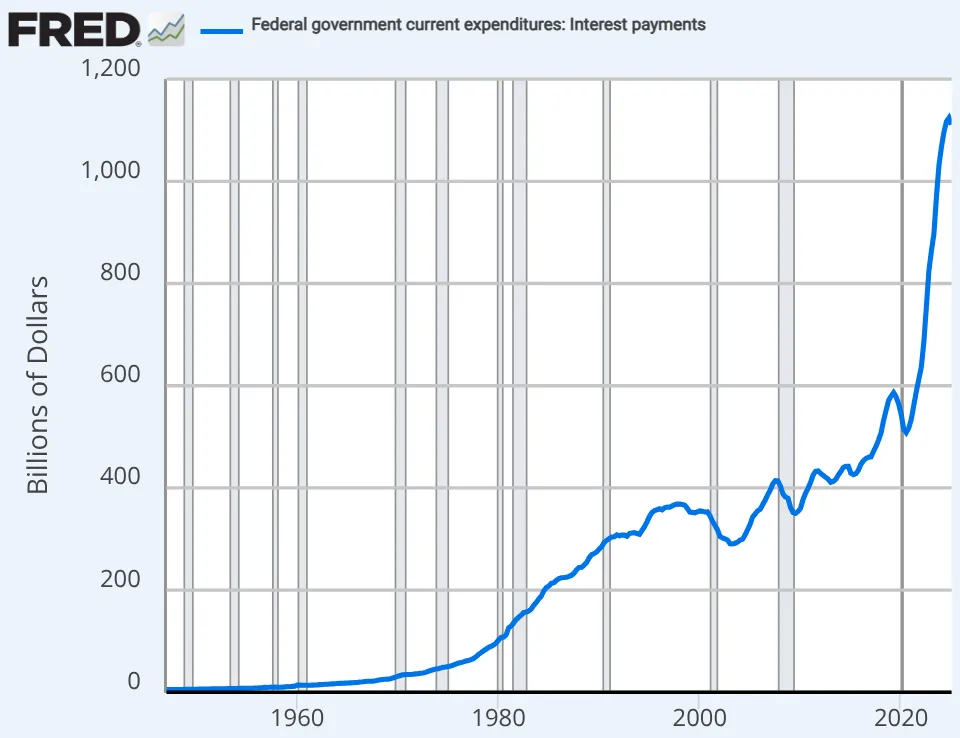

During the covid plandemic the Federal Reserve and the US government injected absurd amounts of money into the economy to prevent it from stalling. Due to the resulting inflation, in 2022 the Fed had to start quantitative tightening (QT) and hike interest rates to ~5% (the highest they had been since 2007) in order to drain excess liquidity from the financial system.

5% interest rates weren't so bad back in 2006/2007 when US government debt was about $8 trillion, but the debt has since grown more than 4x to nearly $37 trillion, causing interest payments to skyrocket.

The bottom line is that interest rates are too high for all the world's indebted nations, corporations, and individuals.

Instead of spending their revenue on expansion and production, countries and companies are using it to service their massive debt burdens, and that causes the real economy to slow down. Unfortunately, lowering interest rates at this point would only worsen inflation.

What's The Solution?

For decades, the "solution" to a recession has always been to stimulate the economy by injecting more debt/currency into the system. The stimulus has become ever more extreme since the 2008 financial crisis, when the central banks started buying long-term bonds with money printed out of thin air (QE) and dropping interest rates to zero (ZIRP).

In 2020, helicopter money to citizens/migrants and other bailouts took stimulus spending to new heights, nearly doubling our global debt levels. Keep in mind that each round of stimulus has made the population more dependent on the banks and enriched the elite further, allowing them to push ridiculous agendas and steadily consolidate their power.

Will yet another round of QE and fiscal stimulus "solve" the impending recession? The problem is that as our debt levels rise exponentially, each new unit of debt produces less economic output. Global investors are beginning to catch on to this, and that's why long-term interest rates have started to surge, along with the price of gold.

As we have been talking about for years, this experimental debt-based economy is coming to an end, and there needs to be a monetary reset of some kind. Perhaps a "Great Reset"? When you factor in the plandemic, mass migration, and other woke policies, you start to realize that there's more being transformed here than just economic and financial systems.

The pandemic represents a rare but narrow window of opportunity to reflect, reimagine, and reset our world.

The World Economic Forum can't stop talking about their Great Reset ever since the covid-19 virus was unleashed on the population. They have spent years preparing for a monetary reset to replace existing currencies with CBDCs. In fact, Europe has already announced they will be implementing their "digital Euro" by this October.

Meanwhile, China has been growing and expanding their influence throughout the world, buiding partnerships with many nations. In particular, they have been working with Russia to build a new payment system that will supposedly be backed by gold, a commodity that China has been accumulating in earnest since 2008.

Perhaps Trump and his team have their own plans to reset the monetary system in favor of the United States, thwarting the globalists' agenda. However, unless Trump is truly playing 4D chess, we must consider that everything is just a show to achieve to the same end result - a new world order controlled via centralized digital currencies.

However, an important question remains...

How will economic activity be incentivized when the debt-based system collapses and traditional fiat currencies become worthless? Will the WEF, China or Trump use their centralized control to spur production and consumption through force and coercion? That would fly in the face of capitalism, where the free market is supposed to shape the economy.

Those who think a monetary/economic reset is imminent fall primarily into two camps. Those who think precious metals like gold and silver are the solution, and those who think Bitcoin is the ultimate remedy. While both assets may protect you temporarily in a reset scenario, the question is how do we stimulate economic activity without reverting to a debt-based system?

Token-Based Economy

Bitcoin was revolutionary because it introduced a new form of money that is decentralized, limited in supply, and unconfiscatable.

Unfortunately, rather than stimulate economic activity in a new economy, present-day Bitcoin's (digital gold) primary purpose is to preserve wealth generated from the existing unsustainable debt-based economy.

That said, the blockchain technology behind Bitcoin has been innovated upon ever since Bitcoin's launch in 2009. Nowadays, we have cryptocurrencies that support smart contracts, governance structures, decentralized exchanges (DEXs), prediction markets, NFTs, and more.

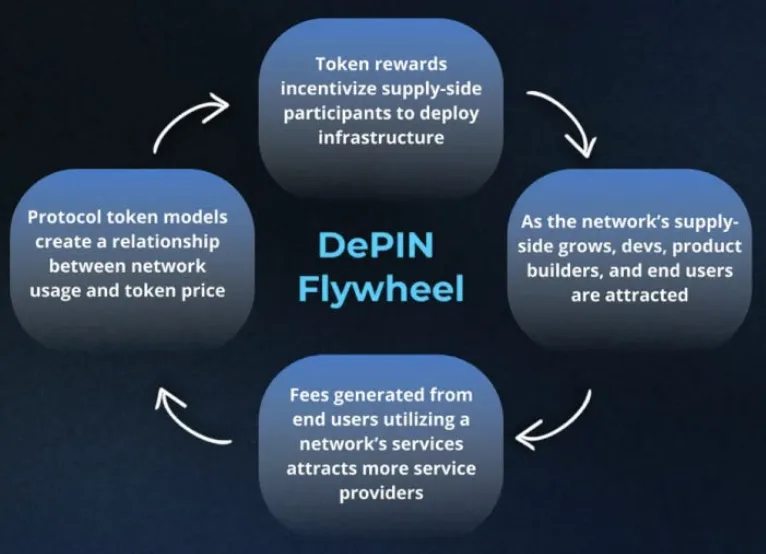

One particularly interesting use-case of blockchain is called "DePIN".

DePIN projects use something called token incentives to stimulate real-world economic activity. For example, Helium Mobile uses smart-contracts to reward you in HNT tokens for installing WiFi hotspots that offload data from cellular towers. There are other DePINs that reward you for lending spare compute and storage to decentralized marketplaces.

DePIN tokenomics are designed in such a way that a network's token can be earned and spent in a circular economy that gathers momentum autonomously.

The industry is still very nascent, and the possible applications of DePIN extend far beyond wireless, compute, and storage. In the future, energy grids, food production/distribution, and data collection could all be powered via smart contracts and token incentives.

These blockchain-based tokens completely eliminate the need for middle-men (banks) to facilitate our financial transactions or lend us money at interest, offering a level of economic freedom humanity has never seen before.

Consider too that a tokenized society would no longer have to rely on corruptible government agencies to monitor economic indicators. We would be able to gauge economic activity ourselves using transparent blockchain-based data that is both verifiable and incorruptible.

Until next time...

As people start to lose their jobs in the traditional debt-based fiat economy due to recession, new opportunities will arise to earn blockchain-based income by participating in DePIN projects that build out real-world infrastructure using token incentives.

DePIN has the potential to revolutionize the world economy and completely change the way we think about money. You may be feeling powerless now as we fall into this recession, but crypto will empower you to earn a living for yourself without having to rely on solutions from the government.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.

Further Reading

- Fiat Currency Is Fucked. What's Going To Replace It?

- Are Decentralized Blockchains The Solution To Flawed Economic Data?

- Bitcoin Blues: Did El Salvador Just Surrender To The IMF?

- Three Emerging DePIN Projects On The Polygon Blockchain

- Three Up-And-Coming DePIN Projects On The Solana Blockchain

- Three Promising DePIN Projects In The Cardano Ecosystem

Sources

GDP Contracting Chart [1]

Home Prices Chart [2]

DePIN Flywheel [3]

Powell Printing Money [4]

Putin BRICS Payment System Image [5]