The S&P and the NASDAQ tumbled early this week after contagion from the Bank of Japan's (BoJ) rate hike spilled over into the American markets.

The panic was exasperated when customers of Vanguard, Fidelity, Schwab and other brokerages were unable to sign in to their trading accounts Monday morning due to technical "glitches".

In this post, we cover the cause of the market crash, what went wrong, and how DeFi could be the solution to protecting yourself from these dubious brokerages.

The Yen Carry Trade Unravels

After more than a decade of suppressing interest rates at zero, and facilitating super cheap international loans, the BoJ has done what nobody thought was possible.

On July 31st, they raised their benchmark interest rate by 0.25%, setting off a chain reaction that pummeled traders who had borrowed cheap yen to invest in US assets.

The hike not only increased the value of the yen, but also raised its borrowing costs. In effect, this forced traders to sell off assets in order to repay their yen-denominated loans.

Why did the BoJ do it?

Japan is a nation that is highly dependent on foreign commodities such as oil. In July the yen had surpassed 160 per USD, making petro imports extremely expensive for them.

Ostensibly that is the reason they took such drastic action to save the yen, but there may be other factors at play that we are not privy to.

The modest interest rate hike caused the Japanese stock market to decline by a record 12%, and fears developed that the financial carnage would spread offshore.

Brokerage Firms "Glitch"

American traders were panicking before the open, anticipating that there would be a Monday morning selloff of dollar-denominated assets to settle the yen loans.

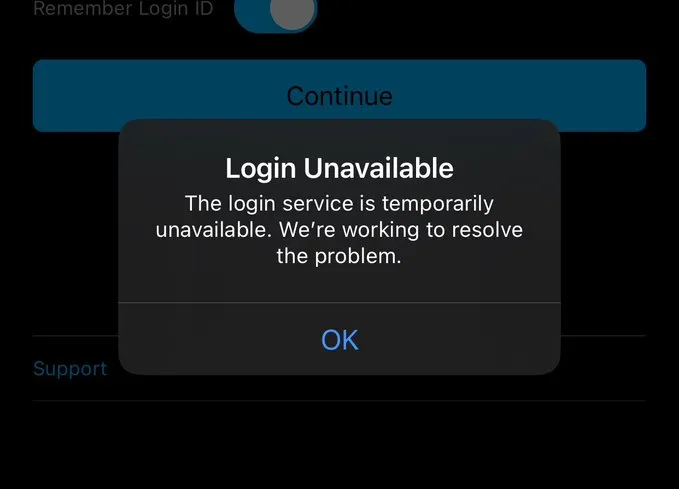

They were in for another surprise when they tried to access their brokerage accounts, as they were met with "coincidental" technical difficulties.

Brokerages including Charles Schwab, Ameritrade, Fidelity and Vanguard were all reported down by DownDetector around the time the market opened, and X users were posting about being locked out.

https://x.com/itscoltongroves/status/1820454177866146211

What better way to prevent instability than by denying market participants access to their accounts, especially by way of an "incidental" technical issue (one that just happened to affect multiple brokerages at the same time).

Robinhood pulled off something similar in early 2021 when they restricted retail trading of Gamestop in order to protect institutions who were shorting the stock.

Decentralized Exchanges Fix This

The next time we have another market crash or credit crunch, financial institutions could use similar tactics to block customers from trading their assets.

We can sit around and complain about how these financial institutions are meddling with our transactions, or we can take matters into our own hands and transition into the world of decentralized finance.

Decentralized exchanges (DEXs) such as Uniswap and Jupiter are virtually impossible to stop, as they run in a trustless manner over thousands of geographically distributed nodes.

There is no central party that can block access to a DEX, because there are multiple front-ends to the blockchain available the user.

Free Markets

Imagine if the stocks you owned were represented by tokens on a decentralized blockchain like Ethereum or Solana, and you could use a DEX to trade them 24/7.

In an unexpected market swing like we witnessed Monday morning, you would be able to trade the tokens without any interference (accidental or intentional) from a brokerage.

This is the inevitable future of finance.

In the coming months we will see more similar black swan events, causing the traditional financial system to become even more restrictive. This will only draw more attention to the benefits of decentralized finance, perhaps the last free market we have left.

If you enjoyed this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...