June has arrived, and by most historical accounts the bull-run should be in full swing by now.

By this time of year in 2017 and 2021, the bull-run had already kicked off, with both Bitcoin and the altcoin market off to the races.

While some coins have performed well in the past few months, it still feels like a bear market for much of the crypto space.

2025 Has Arrived

Now we find ourselves in 2025. Another four-year cycle has passed, and we should be heading into a bull-run right about now.

Bitcoin has done relatively well. No, it hasn't 20x'd like it did in 2017, and it hasn't 3x'd like it did in 2021, but it has pretty much doubled since last September.

Many altcoin price charts, however, are still looking quite sad since 2021. Except for some exceptions like Solana, very few have recovered well.

Eyes On Macro

How the crypto markets will perform for the rest of the year will have a lot to do with what happens in the traditional financial system.

The massive debt/currency creation of 2020 sent the crypto markets into overdrive in 2021. Now all that additional debt needs to be serviced at much higher interest rates.

The yield on the 30y treasury has been increasing steadily since 2020, recently topping 5%. $9 trillion of US federal debt needs to be refinanced this year at these higher rates.

Despite the tight monetary conditions and excessive debt burden, we still haven't had an official financial crisis that requires liquidity injections.

That said, gold's rising price indicates that investors are worried about something.

M2 vs BTC

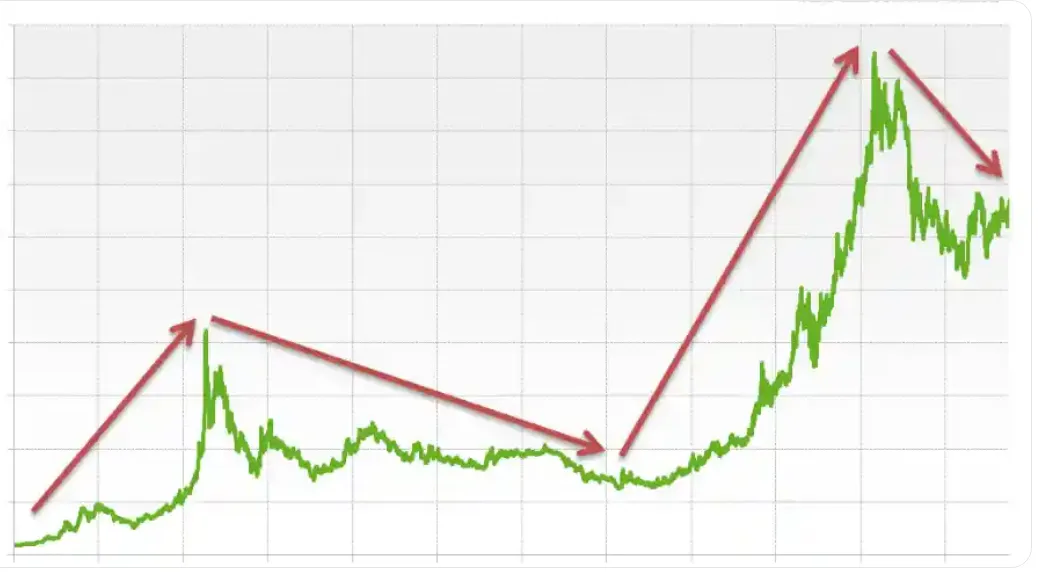

Bitcoin has been following the M2 money supply closely, which has been increasing due to lower rates, the tapering of QT, and massive fiscal spending (despite Elon's efforts to make cuts).

Bitcoin recently had a spike up to $111k in tandem with M2 supply, with a pullback shortly thereafter. According to the chart, we should see another green candle soon.

The question is, will the altcoins follow, or will they need more time to catch up.

Thinking Rationally

One must always ask themselves if they could be wrong. Could Bitcoin crash, and the dollar continue to reign supreme?

Could all the altcoins go to zero against Bitcoin?

Humans tend to be more emotional than rational. Many are emotionally attached to the fiat system. Some are emotionally attached to Bitcoin.

Mathematically, the fiat system is unsustainable, and needs to be reset. While Bitcoin remains digital gold, other projects are laying the foundation for a crypto-based economy.

Even though the altcoin market is in shambles right now, pressure is building within it like an elastic band and it will snap when the traditional system fails, Bitcoin surges, and eventually finds support.

Until next time...

If you found this article interesting, be sure to check out my other posts on crypto and finance here on the Hive blockchain. You can also follow me on InLeo for more frequent updates.