You'll come across a lot of new vocabulary as you continue your journey into the world of crypto. Perhaps you've heard of the term "staking" before, and want to know exactly what it means, and if you should do it.

In this post, we'll cover the pros and cons of staking your coins to blockchain validators, as well as locking up tokens to earn interest on them.

Staking Coins to Blockchain Validators

It only became possible to stake crypto with the introduction of Proof of Stake (PoS) blockchains and smart contracts. With the birth of blockchains like EOS, Cosmos, Polkadot (and the recent upgrade of Ethereum) staking became a reality.

Staking is not possible on first generation blockchains like Bitcoin or Litecoin, because those chains are maintained by miners who verify transactions using the energy-intensive Proof of Work (PoW) consensys algorithm.

Proof of Stake Overview

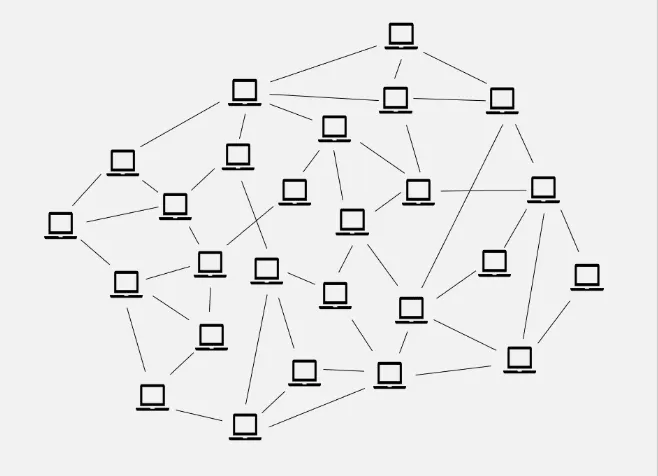

PoS blockchains are composed of a set of independent validators (computer servers) that verify transactions on a decentralized network. The network assigns a validator (at random) to sign a block of transactions and add it to the blockchain.

When a validator proposes a new block, it puts up their coins as stake. If a validator attempts to steal money or experiences downtime, its coins will be slashed by the network, meaning they (and their delegators) will lose money. Therefore, choosing a responsible validator is and important decision.

In this scenario, you are the delegator who stakes coins to one of the validators on the network. You are rewarded with new coins (from inflation) for securing the network and helping to keep the coin's price stable.

Each PoS cryptocurrency inflates programatically to reward the participants of the network. Part of that inflation goes to the validators, who then automatically distribute it to its delegators. The validator usually takes a small commission from your rewards, as compensation for maintaining the blockchain infrastructure.

Keep in mind that staking your tokens will lock them for a specified time frame. For example, Solana locks staked tokens for two days, whereas Cosmos locks them for twenty one days.

If you decide to unstake your coins, for example to trade or sell them, you'll need to wait the specified time before you have access to them.

If you're not staking your coins, their value will be diluted as new coins are distributed to the validators and their delegators. Therefore, if you're not planning to trade or sell your coins any time soon, it's best to delegate them to a reputable validator on the network.

It's important to know that despite delegating to a validator, you always remain the owner of your coins, meaning that you can re-delegate them at any time, and it's not possible for a validator to steal your funds!

Staking Tokens to Earn Interest

Thanks to the introduction of smart contracts by Ethereum, projects can reward holders for staking their tokens.

In this case, rather than staking to a validator, you are simply locking your tokens up in a smart contract for a specified amount of time to earn interest on them.

For example, Carbon Browser ($CSIX) on Binance Smart Chain (BSC) offers their holders a staking program, where users can lock up their tokens for a specified time and receive rewards.

One risk of staking your tokens is that a bug is found in the smart contract and a hacker exploits it to steal everyone's funds. For that reason, software audits are very important.

Conclusion

If you're planning to hold your crypto long-term, staking it for rewards is probably in your best interest. However, if you are planning to sell or trade soon, it would be better to leave it unstaked.

If you learned something from reading this article, consider following me here on Hive, and on InLeo to learn more about finance and crypto on the daily.