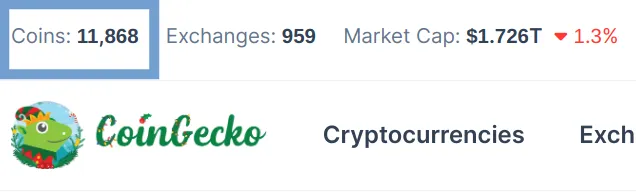

If you look at a crypto tracking website like Coingecko or Coinmarketcap, you will see that there are over 11,000 cryptocurrencies in circulation!

The question we want to address in this post is, where did they all come from, and how many of these 11,000 coins and tokens will actually have value in the future?

What's the difference between a coin and a token?

The primary reason the number of cryptocurrencies has exploded in recent years was the invention of crypto tokens.

A coin is the base layer currency of a blockchain. For example, Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH) would be considered coins.

On the other hand, a token exists atop a blockchain that supports smart contracts (or a token protocol), like Ethereum or Solana.

For example, Tether (USDT) and Chainlink (LINK) are tokens that were originally launched atop Ethereum (that have since expanded to other blockchains too).

Compared to a coin, a token requires very little effort to create, and that's why we have thousands upon thousands of them.

How did we get to this point?

Bitcoin was the first cryptocurrency, launched by Satoshi Nakamoto in 2009.

He left the source code for Bitcoin completely open, meaning anybody could modify it to create their own crypto. Given the financial incentive, a lot of people tried to do so.

Aside from a couple exceptions, most other cryptos created before 2015 were essentially copycats of Bitcoin that offered no innovation and eventually faded into obscurity.

But in 2015 the Ethereum blockchain was launched, which introduced the concept of smart contracts, and suddenly anybody and their dog were able to create a token atop Ethereum by paying a small gas fee to the network.

In 2017 we had the ICO (initial coin offering) craze where crypto startups were accepting Ethereum (ETH) as a capital investment in exchange for their newly issued tokens.

After the hype died, most of the tokens went to zero, but some of the better ones (like Chainlink and Tether) not only survived, but thrived.

Since Ethereum's launch, other crypto startups began to realize that secure and scalable blockchains that support smart contracts were likely the future of finance, and a wave of competing blockchains (that also supported token creation) were born.

For example, BSC (Binance Smart Chain) and EOS improved upon the Ethereum model by making transactions much faster and cheaper. They made it even easier for anyone to create their own token.

What makes a crypto valuable?

Aside from short-term price speculation, the long-term value of a crypto coin or token is proportional to the effort of its community to innovate and provide value.

The blockchain tech invented by Satoshi has opened the financial markets to unbridled competition. And while this has attracted some scammers that we have to watch out for, free-market money is overall a good thing.

If we have the smartest people in the entire world working on these problems and building on each other's ideas, the best form of money will emerge in the end.

How many will survive?

As traditional finance and government structures continue to fracture globally, I think it's likely we'll see a Cambrian explosion of new blockchains and tokens.

We must consider how cryptocurrency is still very much an untapped marketplace. Since the majority of the population is still not participating in crypto, all these blockchains have a lot of room for growth.

You will probably also observe how people are very tribal when it comes to crypto. Throughout history humans have never been able to agree on a single religion, so it's likely that the number of coins and tokens in circulation will continue to increase.

That said, only the communities that innovate, work intelligently, and put in massive effort will retain value in the long run.

Conclusion

If you found this article informative and would like to learn more about finance and crypto, be sure to read my other posts here on HIVE. Also, follow me on InLeo for more frequent updates.

Resources

Coingecko coin list [1]

Dog uses computer [2]

Crumbling bank [3]