It's an interesting thought experiment to contemplate how nation states will be affected as cryptocurrencies continue to garner widespread adoption. In this article, we will go into how the traditional nation state may become an endangered species due to decentralized blockchains.

Every Nation's Kryptonite?

The United States has taken a relatively aggresive stance towards cryptocurrencies, especially compared to smaller nations like El Salvador and Argentina. For example, American citizens are often blocked from accessing crypto exchanges, and participating in airdrops. Self-custody of crypto assets is also under threat in America.

The industry argues that America's anti-crypto position is a net negative for the United States, as it pushes development abroad. But could it be that the country (or rather, the people who control it) is simply trying to protect itself from an existential threat? In this article, we want to pose the question - is it possible to root for your country and the adoption of crypto at the same time?

We often say that America is going to lose entrepreneurs and investment by having such strict regulations, and that crypto startups will instead choose to setup shop in another country, like Dubai for example. But could it be that crypto is ultimately every nation state's Kryptonite?

The Threats

Traditional nation states, as we know them today, were formed far before the invention of cryptocurrencies. In the past, it was a much easier to regulate a country's money. By seizing control of a nation's money supply, a group of people could wield great control over it, as the Rothschild's are famously quoted for:

Give me control over a nation’s currency, and I care not who makes its laws. Mayer Amschel Rothschild (1743–1812)

Although ostensibly controlled by banks and democratic governments, for centuries we have lived in societies where monetary policy was centralized in the hands of a few. With the advent of cryptocurrency however, the power to control money is being stripped from the ruling class (at least those who underestimated the potential of cryptocurrency).

As worldwide debt increases exponentially, and nations continue on their path towards de-dollarization, it becomes ever more apparent that we are entering into a new era of money. Thanks to the decentralized blockchain tech behind Bitcoin, various digital currencies are now able to compete globally in a free market.

We cannot deny the rapid adoption of crypto since it was unleashed on humanity back in 2009. The entire market cap of cryptocurrencies has increased from absolutely zero to $3 trillion in less than 15 years. We have no reason to believe that this trend will not continue, especially considering the unsuccessful attempts of large nations like China to ban cryptocurrency.

Less Demand, Less Value, Less Influence

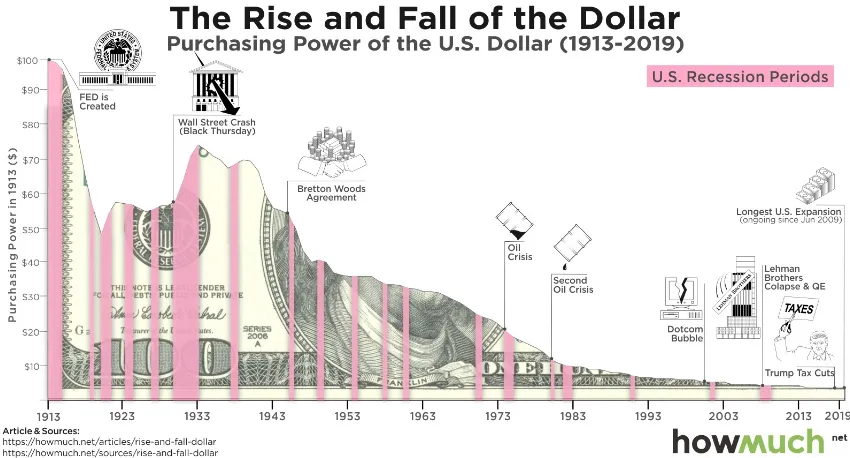

Maybe you have asked yourself at some point, "why does the US dollar have value anyway"? After all, it hasn't been backed by a rare commodity like gold since 1971, and most of it is just digital numbers in a bank's database. At this point, the US dollar is backed solely by faith in the US government, which, if you haven't noticed, has been eroding rapidly. The only reason the dollar has value is because there still exists demand for it.

As of today, most businesses pay for compute power from Amazon with fiat currency. But what if new businesses started to pay for compute power with decentralized tokens instead? Nowadays, most individuals pay for their wireless plans with fiat currency, but what if they started to pay for their wireless access with a decentralized token instead? These days, people vote in elections by casting physical ballots into a box, but what if they started voting digitally on decentralized blockchains instead?

If crypto truly catches on, there will be less and less demand for fiat currencies as more individuals choose to transact in cryptocurrencies. Less demand for fiat means it will continue to lose value, and diminish the power of those who control it. Setting aside the unsustainable debt trajectory of the traditional financial system, crypto alone is a major threat to the traditional power structures that hold nation states together.

A currency is a major component of what keeps a nation unified. If the value of the dollar, euro, yen, and yuan continues to erode slowly due to excessive debts, and then collapses entirely when cryptocurrencies take their place, we could see the dissolving of nation states into much smaller communities.

Power Redistribution

Thanks to the decentralized blockchain technology behind Bitcoin, people are no longer forced to keep their money in the bank. As time goes on, more and more people are learning to secure their private keys, and become their own bank, reducing the power of the state and empowering themselves instead.

While it may be true that the majority of the population is still not ready to secure their own private keys and manage their own money, there is a growing number of people who are, and that trend is not going to stop any time soon.

Instead of having only a few central points of power, like the Federal Reserve, European Central Bank, and Japanese Central Bank, we will end up with more decentralized points of power scattered around the globe. This transition from fiat to crypto will lead to a re-arranging of the power structures we have today.

Some crypto enthusiasts are anarchists who believe we would be better off without any government at all. However, we humans are not like Snow Leopards, who live completely independently in the mountains Central Asia. We still need some form of social structure, because the majority of the population naturally seeks leadership from others.

The End Of Traditional Nation States

As cryptocurrencies take hold in our societies, we will see the United States, China, and other large countries breaking apart into smaller centers of power. We will see the emergence of resilient communities and city states whose economies are based off of this new technology.

A lot of these city states will live under the principles of individual freedom and liberty, allowing individuals and small businesses to freely do business with one another, without state obstructions. Moreover, important decisions will be made transparently using the governance feature of decentralized blockchains.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Resources

America Breaking Up Image [1]

Banks vs Bitcoin Image [2]

US Dollar Losing Value Image [3]

Snow Leopard Image [4]