The whole crypto world is abuzz with the new proposed rules. The largest impact is likely to be on what they call "unhosted" wallets. What crypto people would call REAL wallets, ones that we control the keys for.

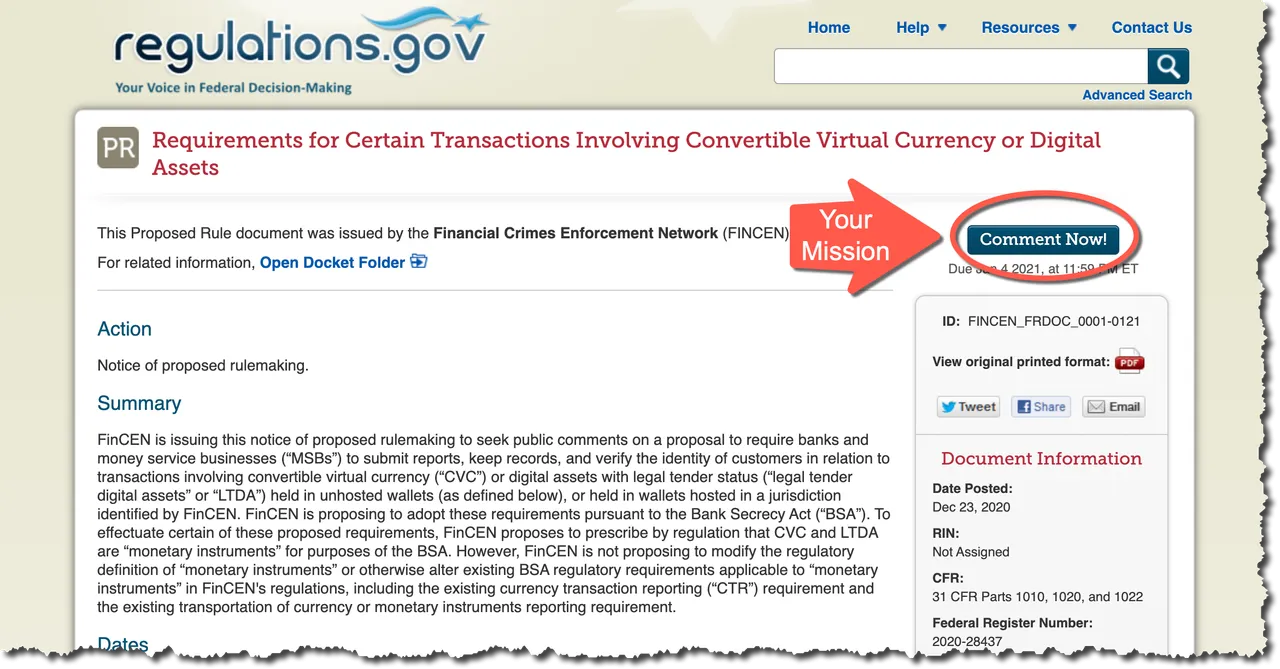

FinCEN is providing a 15-day period for public comments

You now have a few days in which to register thoughtful comments and constructive criticism. Obviously they spring this over Christmas!

This would appear to me to be an important topic to do this on. Many of you here on LeoFinance and Hive especially will have useful and worthy comments to send in on this, for sure post them here, but also send them direct to the regulator who is obliged to read them!

Requirements for Certain Transactions Involving Convertible Virtual Currency or Digital Assets

I. Executive Summary

Through this proposed rule, FinCEN is seeking to address the illicit finance threat created by one segment of the CVC market and the anticipated growth in LTDAs based on similar technological principles. FinCEN proposes to address this threat by establishing a new reporting requirement with respect to certain transactions in CVC or LTDA, that is similar to the existing currency transaction reporting requirement, and by establishing a new recordkeeping requirement for certain CVC/LTDA transactions, that is similar to the recordkeeping and travel rule regulations pertaining to funds transfers and transmittals of funds.

FinCEN is providing a 15-day period for public comments with respect to this proposed rule. FinCEN has determined that such a comment period is appropriate for several reasons. (1)

First, FinCEN assesses that there are significant national security imperatives that necessitate an efficient process for proposal and implementation of this rule. As explained further below, U.S. authorities have found that malign actors are increasingly using CVC to facilitate international terrorist financing, weapons proliferation, sanctions evasion, and transnational money laundering, as well as to buy and sell controlled substances, stolen and fraudulent identification documents and access devices, counterfeit goods, malware and other computer hacking tools, firearms, and toxic chemicals. (2) In addition, ransomware attacks and associated demands for payment, which are almost exclusively denominated in CVC, are increasing in severity, (3) and the G7 has specifically noted concern regarding ransomware attacks “in light of malicious actors targeting critical sectors amid the COVID-19 pandemic.” (4)

Second, the new requirements FinCEN is proposing to adopt represent a targeted expansion of BSA reporting and recordkeeping obligations, and FinCEN has engaged with the cryptocurrency industry on multiple occasions on the AML risks presented in the cryptocurrency space and carefully considered information and feedback received from industry participants. These engagements have included a FinCEN Exchange event in May 2019, visits to cryptocurrency businesses in California in February 2020, an industry roundtable with the Secretary of the Treasury in March 2020, and a FinCEN Exchange event on cryptocurrency and ransomware in November 2020. FinCEN also has received outreach on unhosted wallets in response to anticipated FinCEN regulatory action, including letters from CoinCenter, the Blockchain Association, Blockchain.com, Global Digital Asset & Cryptocurrency Association, Circle, and the Association for Digital Asset Markets.

Third, although FinCEN is publishing this proposal in the Federal Record and invites public comment, FinCEN has noted that notice-and-comment rulemaking requirements are inapplicable because this proposal involves a foreign affairs function of the United States and because “notice and public procedure thereon are impracticable, unnecessary, or contrary to the public interest.” (5) The proposal seeks to establish appropriate controls to protect United States national security from a variety of threats from foreign nations and foreign actors, including state-sponsored ransomware and cybersecurity attacks, sanctions evasion, and financing of global terrorism, among others. Furthermore, undue delay in the implementation of the proposed rule would encourage movement of unreported or unrecorded assets implicated in illicit finance from hosted wallets at financial institutions to unhosted or otherwise covered wallets, such as by moving CVC to exchanges that do not comply with AML/CFT requirements.

This section provides an overview of the relevant technology and the requirements of the proposed rule.