Watched some green shoots emerging in uranium and nuclear energy markets - time to start tidying up the portfolios into better quality names

Portfolio News

In a week where S&P 500 dropped 2.28% and Europe dropped 1.2%, my pension portfolio rose 0.17% - quite a divergence only marginally expalied by uranium and nuclear and less exposure to Europe

Big movers of the week were Bayhorse Silver (BHS.V) (50%), Azincourt Energy (AAZ.V) (33.3%), Standard Uranium (STND.V) (33.3%), Cobalt Blue Holdings (COB.AX) (32.7%), GoviEx Uranium (GXU.V) (28.6%), Metals X (MLX.AX) (24.3%), Earths Energy (EE1.AX) (16.7%), Condor Energy (CND.AX) (15%), Lifeist Wellness (LFST.V) (14.3%), NANO Nuclear Energy (NNE) (12.2%), NuScale Power Corporation (SMR) (12%), Cauldron Energy (CXU.AX) (11.1%), Vault Minerals (VAU.AX) (11%), ClearView Wealth (CVW.AX) (10.7%), Heavy Minerals (HVY.AX) (10.2%)

A modest list of 15 big movers in a down market week. A few big themes represented - from the top - gold/silver mining (2 stocks), uranium (3 stocks), alternate energy (2 stocks), marijuana (1 stock), rare earths (1 stock)

In the absence of earnings, US markets went on the slide driven by Trump tariff talks - soft inflation read on Friday broke the slide

Crypto Bumbles

Bitcoin price kept sagging to test February lows and then found buyers ending the week 0.6% higher with a trough to peak range of 11.3%

Ethereum was not finding buyers other than the first bar of the week - ending the week 8.2% lower with a peak to trough range of 18%

There were a few altcoins showing life some in surprising places - like there was life emerging - Binance Coin (BNB) popping 11% and keeping going

Ripple (XRP) doing even better with a 29% pop giving maybe a third away

And the big move in Cosmos (ATOM) rising 29% against Bitcoin - moving averages not quite crossed over to suggest a reversal.

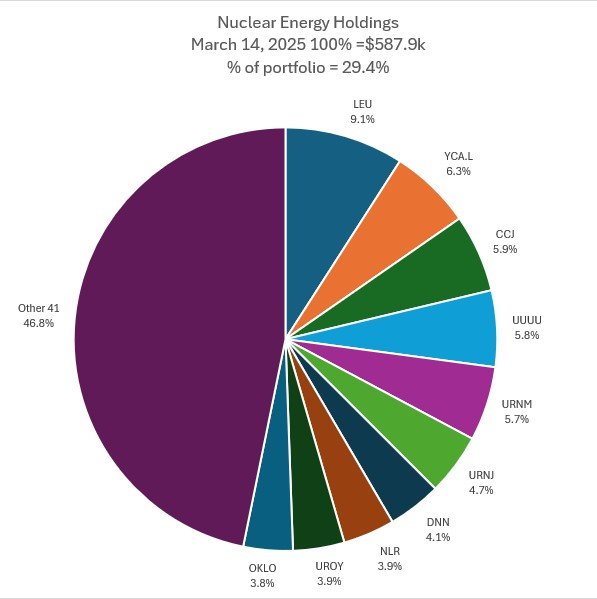

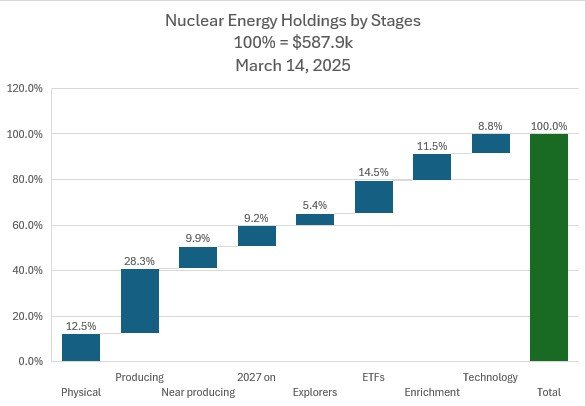

Nuclear Energy Holdings

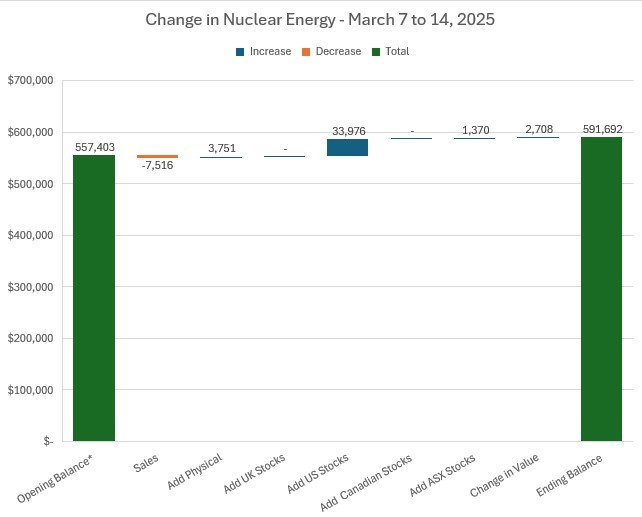

A few changes in holdings in the week moving the focus toward quality names and a wider nuclear view in ETF holdings. On top a 0.5% increase in valuation.

Note: Opening balance adjusted to remove Star Minerals (SMS.AX) who cancelled the farm-in agreement on Cobra project in Namibia - now a gold explorer only.

Mix of holdings shows a few changes with the additions and sales - no changes in the order of the Top 7. VanEck Uranium and Nuclear ETF (NLR) comes into slot 8 ad Oklo (OKLO) comes into slot 10. Uranium Royalty Corp (UROY) moves up a place into slot 9. Percentage of portfolios was incorrect last week (understated) - at 29.4% now. Others are now reduced by two stocks to 41.

The additions and sales changes to holdings by stage a bit - Producing is down 2.5 points, 2027 on is up 0.6 points, ETF's are up 2.5 points and Technology up 1 point. Options expiry next week will bring along some more changes.

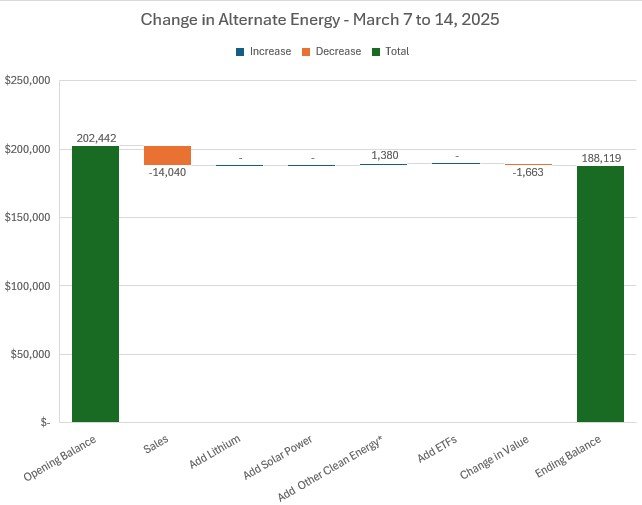

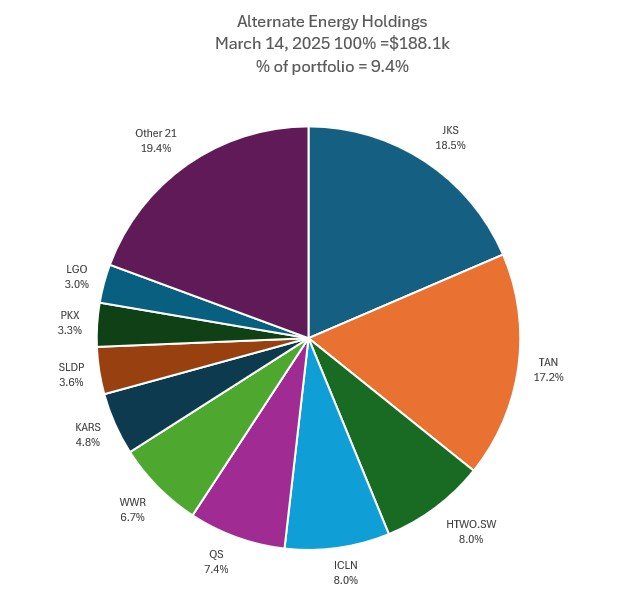

Alternate Energy Holdings

A few changes in holdings and a modest 0.8% drop in valuations.

Mix changes with the merger of Arcadium Lithium taking it out of the Top 10. No change in the Top 5. Westwater Resources rises 2 places to slot 6. Largo (LGO) comes into the top 10 in slot 10. Share of portfolios drops to 9.4% - will make a plan to replace the lithium stock - maybe by adding the Global X Lithium ETF - got some sold puts that could be assigned this week.

Bought

Watched a really good interview with Rick Rule with Triangle Investor going through 10 stocks in gold, silver, copper and uranium. Taking action on a few of his ideas which will result in a few switches to reduce the number of holdings - have to wait for the market to pick up a little to do the sells. Watch the interview here

Uranium Royalty Corp (UROY): Uranium. First addition ahead of the sells - added to this as Rick Rule felt the portfolio was better leveraged to upside in uranium price than Uranium Energy Corp (UEC) - starting the rotation by buying this up front in managed portfolio. $1.70 - price as a marker

Deep Yellow Limited (DYL.AX): Uranium. Rick Rule really likes John Borshoff - if anybody can pull this off, it is him. Added a parcel in personal portfolio when ASX showed a bit of green for uranium stocks.

Westwater Resources (WWR): Graphite Mining. Assigned early on sold put in personal portfolio (partial tranche). Breakeven after two cycles of sold puts is $0.575 vs $0.62 close (Mar 11) - going to be just fine.

enCore Energy Corp (EU): Uranium. Price slid almost as far as the horror level seen after earnings - added back a parcel to pension portfolio. Going to trade this a while. Added another parcel later in the week.

VanEck Uranium and Nuclear ETF (NLR): Nuclear Energy. Added another tranche to average down entry price in managed portfolio. Wrote covered call for 1.95% premium with 7.6% price coverage.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Added another tranche to average down entry price in managed portfolio. Rick Rule said to pick 10 good juniors - a bit lazy to do that - add the index of juniors for now. Wrote covered call for 1.3% premium with 7.9% price coverage.

OKLO Inc (OKLO): Nuclear Technology. Saw the pre-announcement from Amazon and Google about the scaling up nuclear power for data centres - added a parcel of shares in the managed portfolio - this could well be the turning point. Will average down prices for stocks that could be assigned on sold puts in coming times. First add in personal portfolio same day Wrote covered call for 3.9% premium with 15.1% price coverage.

Centrus Energy Corp (LEU): Uranium Enrichment. Have a few sold puts out at high prices - bought parcel in personal portfolio to average down forward entry price.

Sold

Arcadium Lithium plc (LTM.AX): Lithium. Received proceeds from the merger with Rio Tinto (RIO.AX) - 124.6% blended profit in personal portfolio on ASX holdings since August 2021/January 2024. This has been a long time holding starting with Galaxy Resources in August 2013 through the mergers with Orocobre to form Allkem and with Livent to form Arcadium Lithium. In this portfolio overall profit percentage was 96%. Holdings in US portfolio (ALTM and predecessor LTHM) made 12.9% profit over the life of the holdings (not including income trades)

Uranium Energy Corp (UEC): Uranium. Sold in managed portfolio to switch out to better quality stock (see above) - triggers 25% blended loss since September/December 2024. Time will tell if Rick Rule is right. $4.99. Sold next day at 10.4% higher price in pension portfolio for 27.5% blended loss since November/December 2024. $5.51

It seems that somebody (apart from Rick Rule) agrees with me on X.com

GoGold Resources Inc (GGD.TO): Gold Mining. Reduced holding by one third in pension portfolio at 52 week high just as the whole holding went profitable - raises capital to pay accountants bills. FIFO accounting makes for a loss. LIFO accounting makes for a tidy profit. Booking at average cost offers a 1.3% blended profit since January/June/August 2022/July/December 2023/May/October 2024. Probably not the smartest exit given Rick Rule quite likes the stock as a gold mining play with good resource.

De Grey Mining Limited (DEG.AX): Gold Mining. Sold a parcel of shares in pension portfolio to fund accounting bills and next pension payment. Locks in 3,520% (yep three thousand) profit since November 2016. De Grey is subject to a takeover offer from NorthStar Resources (NST.AX) with the record date some time in April 2025 - might be the right time to find alternate drivers of gold value. Still holding a large holding.

CGN Mining Company (1164.HK): Uranium. CGN announced earnings with improved pre-tax profits and a massive increase in Kazakhstan income taxes - took the exits for 14.2% profit since September 2024. Am increasingly becoming nervous about exposure to Kazakhstan - government and Russia relationships are unpredictable

The trade idea was to find a way to invest in a uranium play that was more oriented to the east than the West. In TIB726 analysis showed that the leaning to the east was in fact small but price was lagging 20 points behind Sprott Uranium Miners ETF (URNM - crimson line). Update of the chart shows that the gap has been reversed and CGN is now outperforming by 20 points and is in line with the broader nuclear market represented by the Global X Uranium ETF (URA - blue line)

ASX Portfolio

No trades

Hedging Trades

Pan American Silver Corp (PAAS): Silver Mining. Rick Rule liked this stock - more of a gold miner than a silver miner. Bought a parcel of stock in personal portfolio. Took two options approaches - bought April expiry 26/29/25 call spread risk reversal in managed portfolio. Bought 26/29 call spread for a net premium of $0.93 offering maximum profit potential of 223% if price moves 11.7% from $25.96 opening price (Mar 14). Funded this premium fully by selling 25 strike put option with 3.7% price coverage and 4.3% return. In the other portfolio, wrote a 26/22 credit spread with 42.9% ROI and 0.4% in-the-money. In pension portfolio, bought stock and 25/22 credit spread with 30% ROI and 3.1% coverage.

Barrick Gold Corporation (GOLD): Gold Mining. Added to holding in managed portfolio at 2.9% premium to price holding could be assigned at on covered call. Also sold naked put at assigned price to bring that premium down to 1.6%.

Income Trades

Six covered calls written across 3 portfolios - all US

Naked Puts

Income trade activity was in put options

Sold puts on stocks likely to be assigned on covered calls

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 0.81% Coverage 7.8%

- Barrick Gold Corporation (GOLD): Gold Mining. Return 1.3% Coverage 1.5%

Sold puts on stocks happy to hold at lower prices

- NuScale Power Corporation (SMR): Nuclear Technology. Return 4.6% Coverage 3.1%

- Uranium Royalty Corp (UROY): Uranium. Return 3.3% Coverage 8%

Sold puts at lower strike than other sold puts will be assigned at - averaging down potential

- HelloFresh SE (HFG.DE): Europe Restaurants. Return 7.9% Coverage -1.3%

Rolled out a few sold puts - waiting for markets to realign after the selloff

- ASP Isotopes Inc. (ASPI): Nuclear Technology. 44% loss on buy back. 10.7% cash positive

- ASP Isotopes Inc. (ASPI): Nuclear Technology. 31% loss on buy back. 4.4% cash positive

- Builders FirstSource (BLDR): Building Materials 72% loss on buy back. 21.4% cash positive

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 166% loss on buy back. 12.1% cash positive

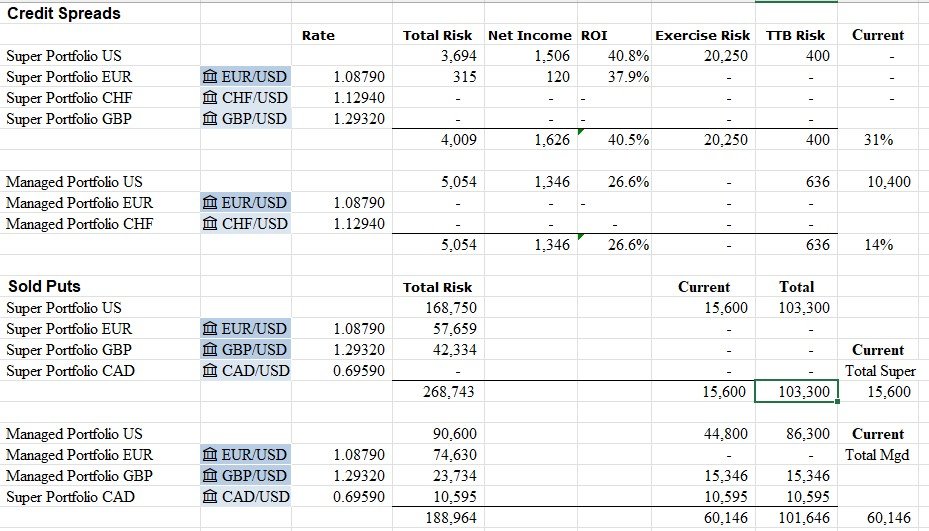

Credit Spreads

- Centrus Energy Corp (LEU): Uranium Enrichment. ROI 29.4% Coverage 5.7%

- VanEck Uranium and Nuclear ETF (NLR): Nuclear Energy. ROI 83.5% Coverage 1.9%

TSP added to a few of their holdings in the selloff. Rather than buy stocks chose to run March expiry close to in-the-money credit spreads around their purchase prices

- Dutch Bros Inc. (BROS): US Restaurants. ROI 42.9% Coverage 0.8% - across 3 portfolios

- Marvell Technology, Inc. (MRVL): US Semiconductors. ROI 81.2% Coverage -0.4% - across 3 portfolios

Exercise risk is under control for the current expiry BUT edging to uncomfortable for April expiry

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

March 10-14, 2025