Uranium market keeps moving shaking out the weak from the strong. Focusing in on adding stocks closer to producing

Portfolio News

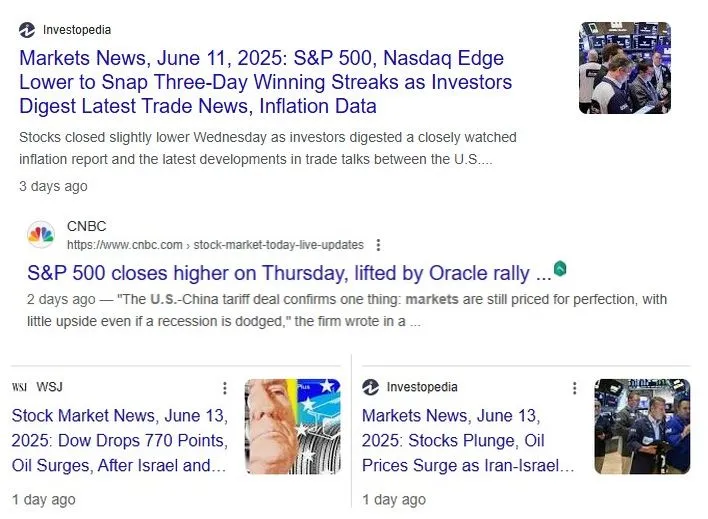

In a week where S&P 500 dropped 0.36% and Europe dropped 0.54%, my pension portfolio rose 0.32%. Clearly a bit more weight from the movers below than the indexes - uranium and nuclear and silver/gold.

Big movers of the week were Stroud Resources (SDR.V) (70%), Resolution Minerals (RML.AX) (59.1%), Sarytogan Graphite (SGA.AX) (51.9%), Grand Gulf Energy (GGE.AX) (50%), TechGen Metals (TG1.AX) (25%), Oklo (OKLO) (26.6%), Lifeist Wellness (LFST.V) (23.1%), Earths Energy (EE1.AX): (20%), Anagenics (AN1.AX) (16.7%), Solid Power (SLDP) (15.9%), Euro Manganese (EMN.AX) (15.8%), GoviEx Uranium (GXU.V) (15.4%), Delivra Health Brands (DHB.V) (15%), AuKing Mining (AKN.AX) (14.3%), Karoon Energy (KAR.AX) (14.1%), Ur-Energy (URG) (13.2%), Halliburton Company (HAL) (13%), NuScale Power Corporation (SMR) (13%), Cameco Corporation (CCJ) (10.3%), Dawson Geophysical (DWSN) (10.5%), Gevo (GEVO) (10.3%), Metcash (MTS.AX) (10%)

22 stocks in the big movers list. A few big themes represented - from the top gold/silver mining (3 stocks), alternate energy (6 stocks), nuclear/uranium (5 stocks), marijuana (2 stocks). Middle East escalation pushed two oil stocks in the list.

US markets ran 3 up days and then got nervous about inflation and then Israel attacked Iran. That set the mood for the end of the week.

Crypto Edging Higher

Bitcoin price pushed higher to test all time highs and then giving much of the gain away finishing the week 1.5% higher with a peak to trough range of 7%.

Ethereum price broke out of a trading range and then fell right back in to the range ending 5.6% higher on the week with a 15.4% peak to trough range

Uniswap pops 39% versus Bitcoin (UNIBTC) - looks like a buy signal

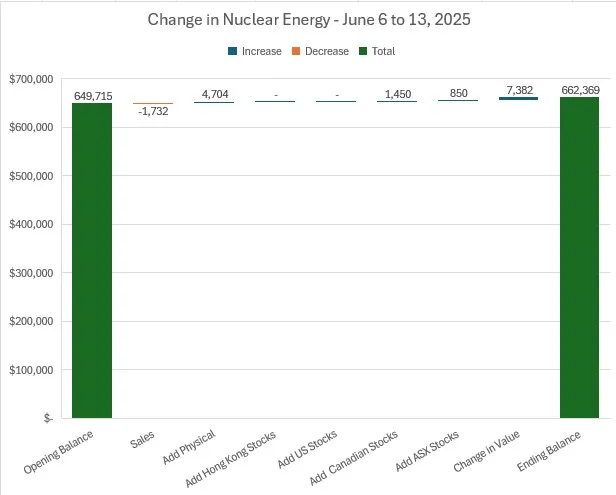

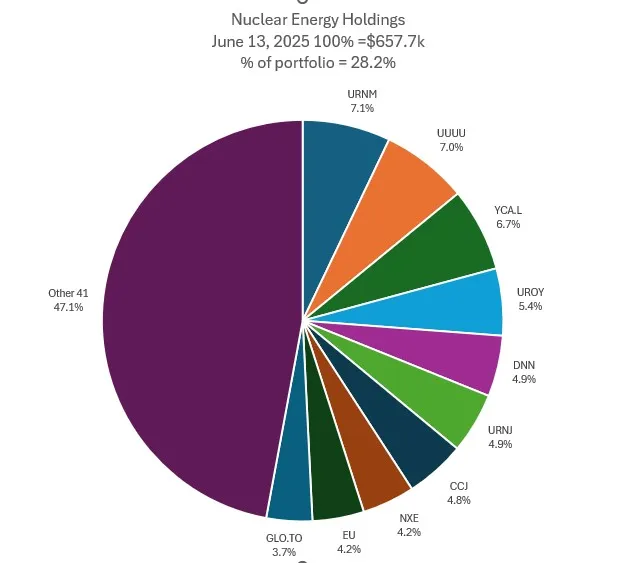

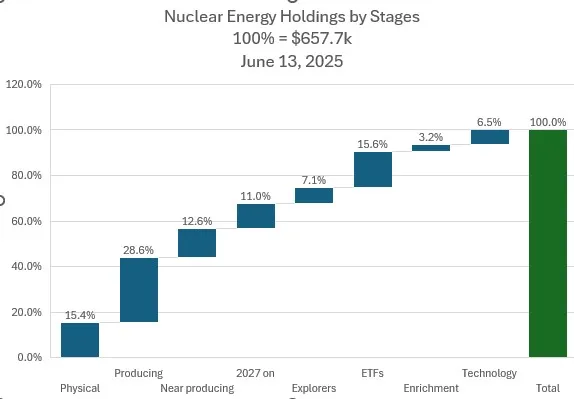

Nuclear Energy Holdings

A few additions in Africa and in royalty investments and one profit taking sale. Valuation goes up 1.1%

A few changes in the middle order of the mix with Denison Resources (DNN) dropping two places to slot 7 and Cameco Corporation and Sprott Junior Uranium Miners ETF (URNJ) swapping places. Share of portfolios comes off a little to 28.2%

Holdings by stage changes with an addition in Physical and a sale in Near Producing.

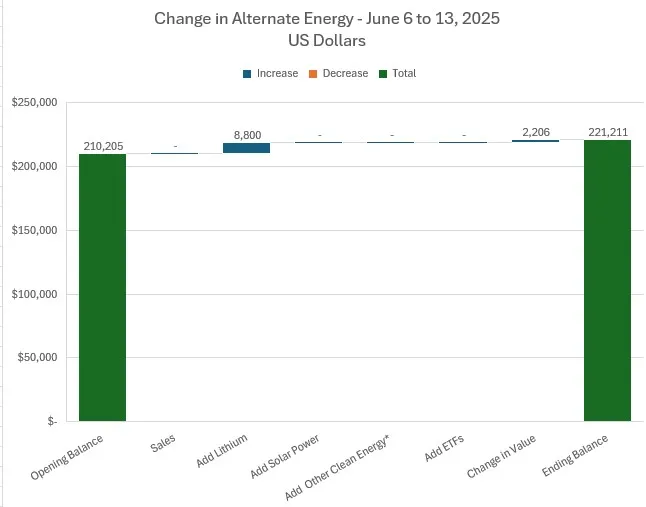

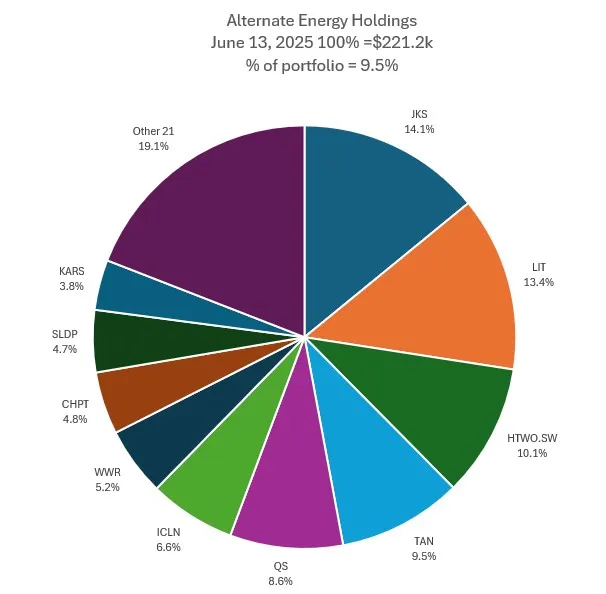

Alternate Energy Holdings

One change in holdings and a 1% increase in valuation

One change in the mix with Westwater Resources, Inc. (WWR) moving up a place into slot 7. Global X Lithium (LIT) takes it share up nearly 3 points. Share of portfolios rise 0.4 points to 9.5%

Bought

GoviEx Uranium Inc (GXU.V): Uranium. Scaled into holding in pension portfolio on the back of news of potential delay into production for NexGen (NXE) to 2031. Heading to Africa for a developer likely to get to production sooner. Wrote covered call on NexGen to exit at breakeven - out of patience with management and official delays.

Aura Energy (AEE.AX): Uranium. Released news of new CEO - market reacted with a price markdown on a day all other stocks went up. Added to holding in a partial fill - which means brokerage will be doubled up if the rest of the order fills. Fill completed next day - double the brokerage

Resolution Minerals (RML.AX): Antimony Mining. RML is acquiring an antimony, gold, silver and tungsten project in Idaho, USA. 90% of global antimony supply is controlled by China, Russia and Tajikistan.

The US currently has ZERO local antimony production… yet has the world's biggest military. Next Investors idea.

A few blue sky options trades in uranium on a day that started with a bit of a pullback in some counters.

Uranium Royalty Corp (UROY): Uranium. With price opening at $2.23 (Jun 13) put in place a January 2026 expiry 2.5/5/2 call spread risk reversal. This offers maximum profit potential of 1216% for 124% price move. The sold put (2) fully funds the call spread premium with 10.3% price coverage.

Charts is a bit crowded showing on the left side an existing trade which is trading over the top. The new trade is shown in pale blue and pale pink rays. The blue sky nature stands out as trade will need at least two blue arrow price scenarios to play out. As the trade is fully funded it does not matter if maximum profit at strike 5 is not reached - the resulting stock holding can run open-ended after that.

enCore Energy Corp (EU): Uranium. With price opening at $2.03 (Jun 13) put in place a January expiry 3/4/2 call spread risk reversal. This offers maximum profit potential of 848% for 97% price move. The July expiry sold put (2) mostly funds the call spread premium with 1.5% price coverage. Breakeven is current $2.01 if the sold put is assigned. Plenty of months to roll the sold put to get to full funding - potential return currently stands at 10,100%

Global X Lithium ETF (LIT): Lithium. Assigned early on sold put. Breakeven $21.12 vs $36.93 close (Jun 13) after 12 months sold put action. Chose to let this go to assignment as there are analysts talks of lithium price moving off the bottom

Sold

Koonenberry Gold (KNB.AX): Gold Mining. Koonenberry announced

New and existing institutional and high net worth shareholders have purchased Company shares from Datt Capital though a cross trade.

Feels like another dilution for small shareholders. This stuff drives me nuts. Closed the holding for 180% profit since October 2024 to fund the Resolution Minerals (RML.AX) purchase above. See TIB730 - bought stock after "Global Uranium and Enrichment Limited (GUE.AX) had sold Enmore gold assets to Koonenberry to form one of the largest NSW gold explorers" - My idea

Deep Yellow Limited (DYL.AX): Uranium. Sold portion to take out profits and to fund purchase of Aura Energy (AEE.AX) above. It is time to bank profits in the sector. Locks in 19.4% blended profit since August 2023/April 2024 on a FIFO basis. Did knock out one high cost tranche.

Gemfields Group (GEM.L): Gem Mining. Sold rights - residents of Australia not permitted to participate. Two tranches in the week where trading costs are higher than proceeds. London is a high cost marketplace - often as bad as Paris - especially on these sorts of contracts.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

ANZ Group Holdings (ANZ.AX): Financial Services. Dividend yield 5.60%

Chose to add the holding with the sale of Bank of Queensland (BOQ.AX) below and Commonwealth Bank. (CBA.X) making an all time high same day.

Chart suggests price will need to go past previous highs to make a 52 week high target. Chart also shows the relative gap to Bank of Queensland (BOQ.AX) - close that gap and profit target will be hit.

Super Retail Group Limited (SUL.AX): Automotive - third time entering the stock - each time price cycles to a new high to allow profitable exit. Dividend yield 4.90%

Chart shows price reversing at the same sort of levels as the last big reversal - plenty scope for 52 week high profit target to be reached

Yancoal Australia (YAL.AX): Coal Mining. Second time entry for this stock - coal prices ticking higher. Dividend yield 8.90%

Chart shows price has traded down since the last exit to support and reversed. Plenty headroom to achieve the main profit target.

Top Ups

Dyno Nobel was Incitec Pivot Ltd (DNL.AX): Agriculture. Dividend yield 3.70%. Averages down entry price.

Chart shows the challenges of the strategy - the first entry was on a reversal of a long downtrend from 2022 into 2023. Too bad that momentum fell away after the first top up. Next two top ups are also after a break in the downtrend from a lower level than the one before = out of momentum again. Maybe this time the reversal off a level from a weekly chart (the green line) is a stronger level.

Johns Lyng Group Ltd (JLG.AX): Engineering Services. Dividend yield 2.80%. Price spiked on a takeover bid (price not made available). Took the chance to average down entry price and hope the offer price is above breakeven.

Chart does show price appears to have bottomed out. Getting to the lower of the broker targets will help matters.

Sold

Bank of Queensland (BOQ.AX): Financial Services. Closed at 52 week high target for 29.2% blended profit since August/November 2022/August/December 2023/March/July 2024. See the chart above for ANZ purchase to see the spike in performance.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. RF Kennedy Jr removes all CDC panel members and replaces them with 8 new members. Figuring the time will come for the court cases against Pfizer (PFE) and Moderna (MRNA).

With price opening at $24.33 (Jun 11) put in place a July expiry 24/22 ratio put spread. Bought put premium was not fully funded by the ratio leaving a breakeven of $23.75. This gives a profit range for a drop in price between 2.4% and 10.5%

The chart shows this is something of a contrarian trade as price is cycling higher after a reversal - it really depends on news breaking about a potential court case. What the cycles suggest is the sold put level (where the ratio operates) is below the 2nd to last higher low = a good spot. If price does reverse and follow a modest read arrow rice scenario the trade will not reach the sold put level (22) at expiry and will be profitable.

Income Trades

One US covered calls written all week

Naked Puts

Sold puts on stocks happy to hold at lower entry price:

- KeyCorp (KEY): US Regional Bank. Return 1.16% Coverage 6.2%

- Cameco Corporation (CCJ): Uranium. Return 2.23% Coverage 11.5%

Sold puts on stocks likely to be assigned on covered calls

- Aurora Cannabis Inc. (ACB.TO): Marijuana. Return 9.1% Coverage 1.9%

- iShares Silver Trust (SLV): Silver. Return 2.25% Coverage 3.1%

Kicked the can down the road on sold puts likely to be assigned to preserve capital:

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 71% profit on the buy back and 74% cash positive. Return on this sequence of trades is becoming impressive at 37%

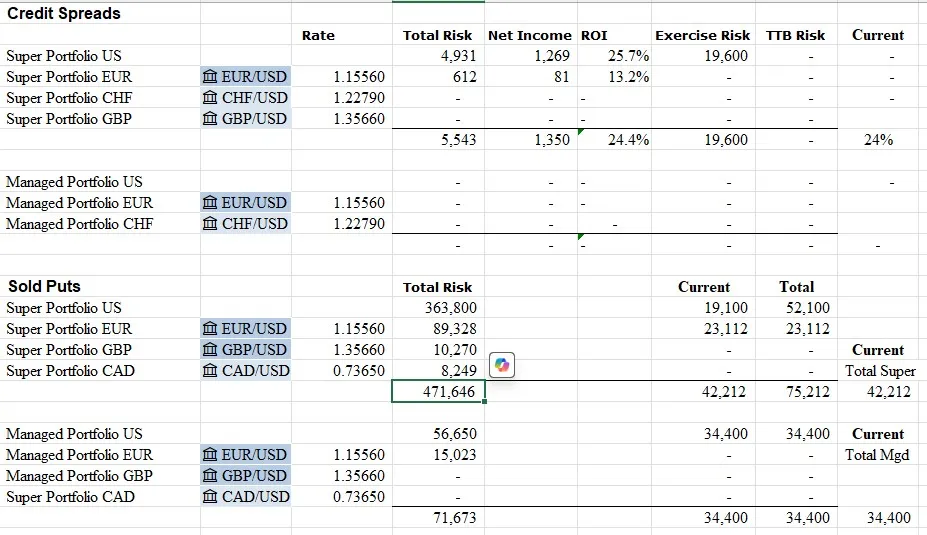

Credit Spreads

A few new credit spreads

- Elastic N.V. (ESTC): AI Software. ROI 23.5% Coverage 7.1% - TSP idea to add to holdings

- Marvell Technology, Inc. (MRVL): US Semiconductors. ROI 34.4% Coverage 6.4% - TSP idea to add to holdings _ Alerian MLP ETF (AMLP): US Oil. ROI 19.5% Coverage 0.3% - Middle East escalation has to be good for all oil producers.

Exercise risk is well within cash limits. Total risk is a bit high - keen to get past this week's options expiry

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

June 9-13, 2025