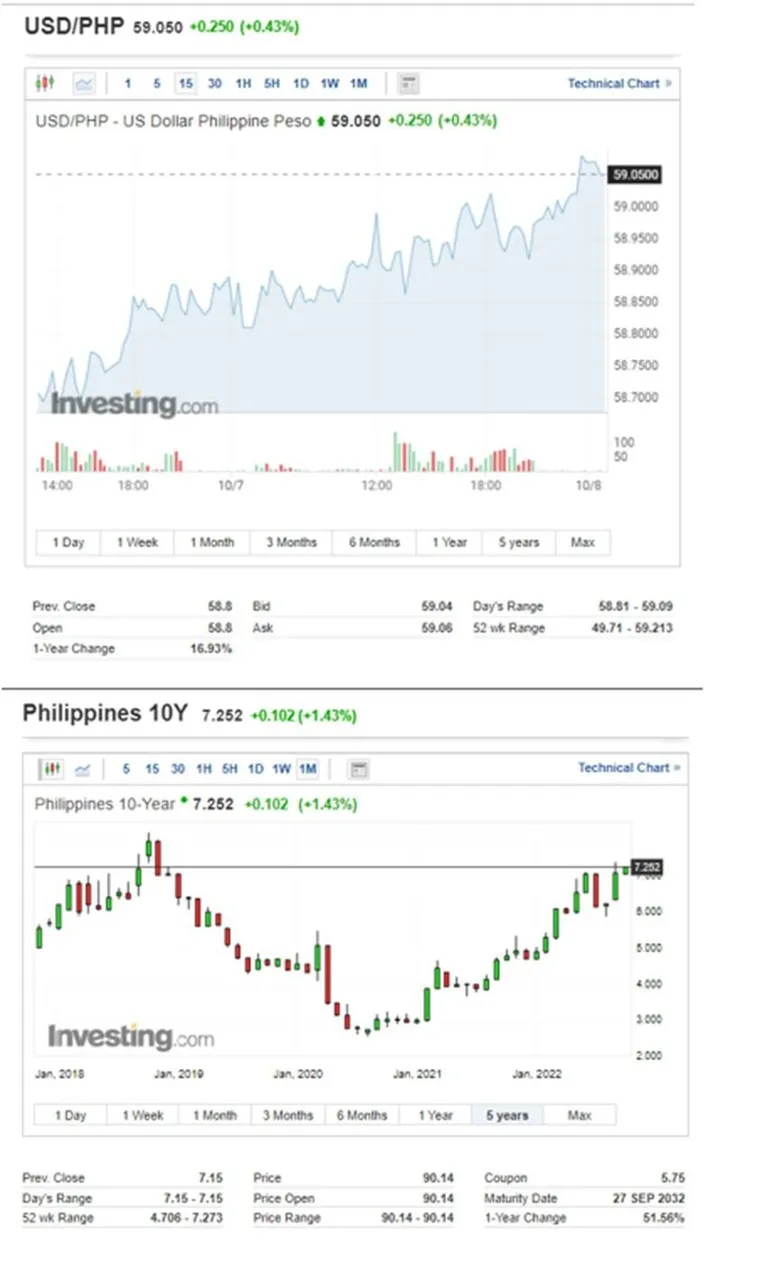

Here are two charts/economic indicators that we need to be aware of;

The first is the USD/PHP which is now at 59.00 levels and may go up near 60.00ish in the next week unless there will be some intervention by the Bangko Sentral ng Pilipinas(BSP) in the forex market.

The second is the Philippine 10-Year bond yield of 7.25 which is a pretty good percentage. This means for me that the riskier stocks should be yielding at least near 10%.

So, the question is, are our stock bets beneficiaries of the weaker peso and /or higher debt yields? Or if not, are they safe against any of their negative impacts?

One impact of higher debt yield or weaker Peso is on money flows. Institutional holders or big shareholders that holding our stock bets are moving out to switch their positions to a better yielding investment in the debt market.

Note: There is nothing wrong on the company that you are betting on, it's just that these big shareholders decided to reallocate their equity investments to a more attractive debt investments.

So, what will your investment strategy be?