Mars Finance APP reported frontline January 5 , US Comptroller of the Currency (OCC) issued an interpretative letter said Commonwealth Bank and Federal savings associations can use the common block chain and a stable currency for settlement.

Note: OCC is affiliated to the U.S. Department of the Treasury and is one of the five main regulatory agencies of the U.S. federal government. It is mainly responsible for issuing licenses and supervising federal banks.

OCC pointed out that as long as it complies with laws and good banking practices, “the Federal Bank or the Federal Reserve Association can verify, store and record payment transactions by acting as nodes on the Independent Node Verification Network (INVN). Similarly, banks can use stablecoins to facilitate Customers verify payment transactions on the network at independent nodes, including the issuance of stable coins and the exchange of stable coins for legal tender.

As an example, the regulator stated that one entity (payer) may wish to send U.S. dollar payments to another entity (payee). The payer does not use a centralized payment system, but converts U.S. dollars into stablecoins and transfers the stablecoins to the payee through INVN. The recipient then converts the stable currency back to U.S. dollars. In a common use case in reality, payments are cross-border remittances. "

Decrypt pointed out that the OCC letter clearly shows that as financial intermediaries, banks face competition in accelerating capital flows. In OCC's view, INVN, such as blockchain and other distributed ledger technologies, is an effective and rapid way to transfer funds.

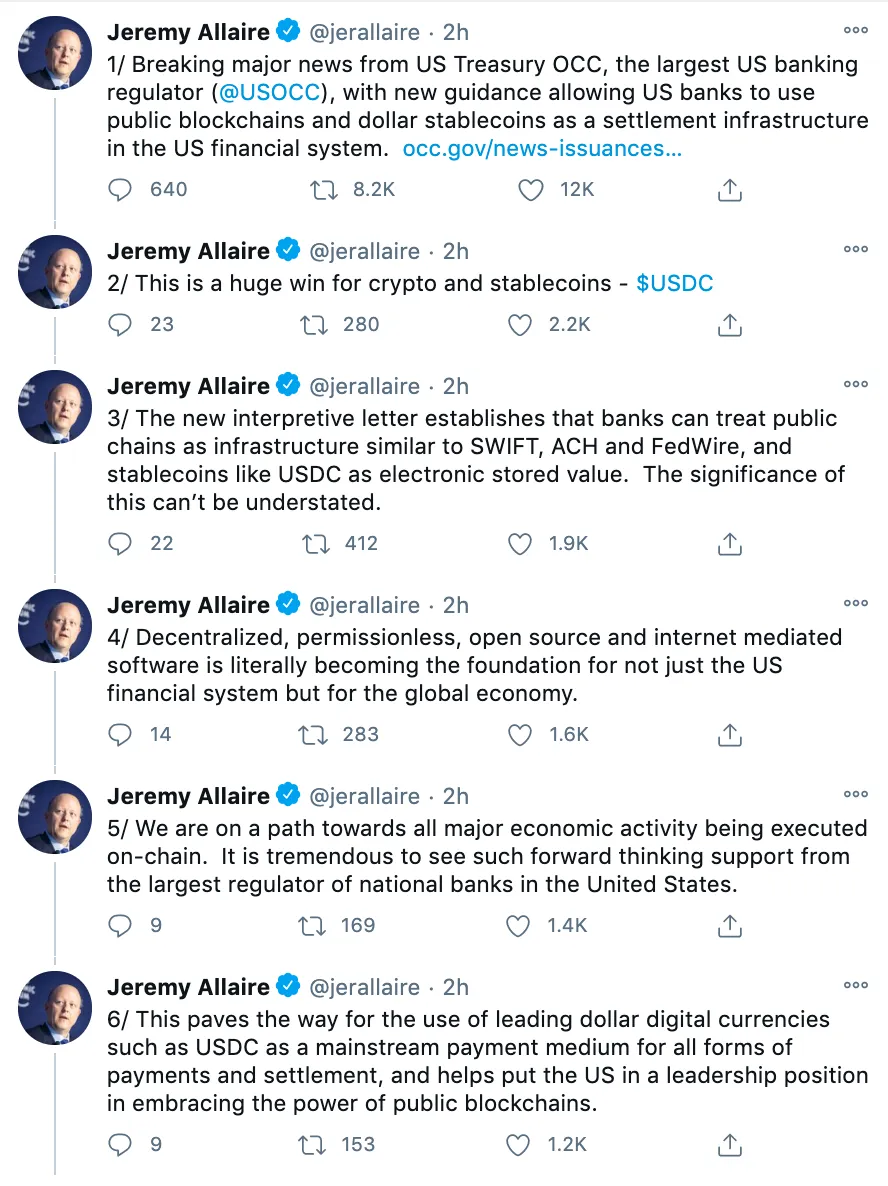

In this regard, the stable currency USDC issuer Circle Joint Creation Jeremy Allaire tweeted, “This is a huge victory for cryptocurrencies and stablecoins. Because according to the letter of explanation, banks can treat public chains as similar to SWIFT and ACH. It has the same financial infrastructure as FedWire and treats stablecoins (such as USDC) as electronic storage of value. This importance cannot be underestimated."

"We are on the path to execute all major economic activities on the chain. It is great to see the forward-thinking support provided by the largest national bank regulator in the United States."