Hey Jessinvestors

The stock market is at all-time high record valuations, and it seems to continue on a rampage, with Tesla now joining the S&P500 on Monday. There have been so many so-called winners in the last few years it just seems like investing in the stock market is a no brainer.

Looking at the data

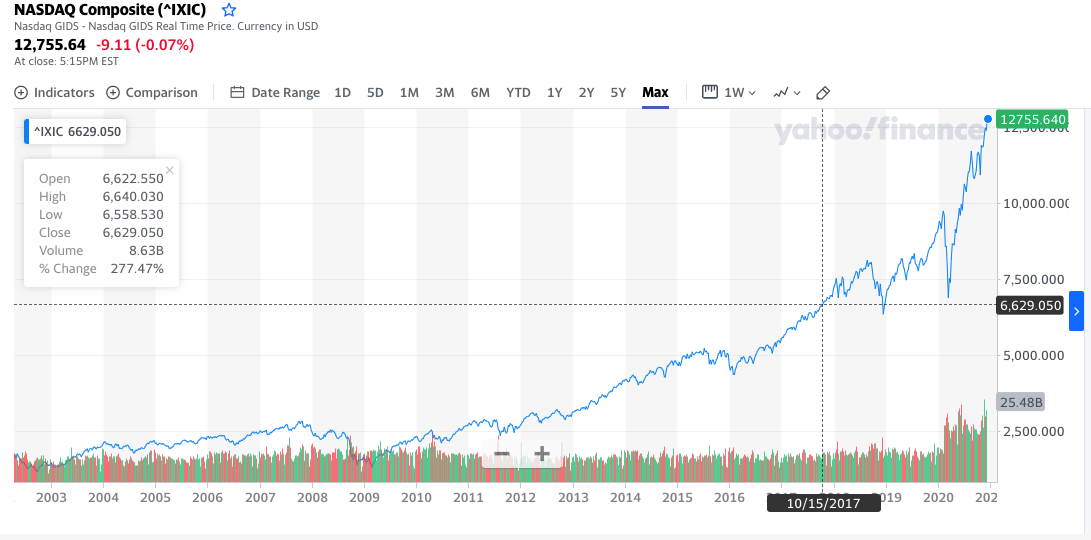

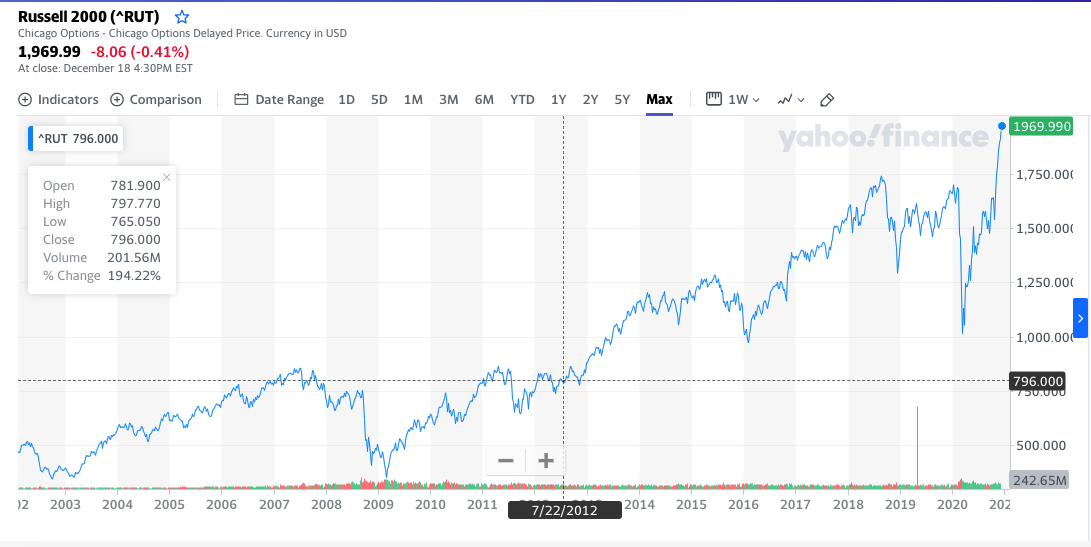

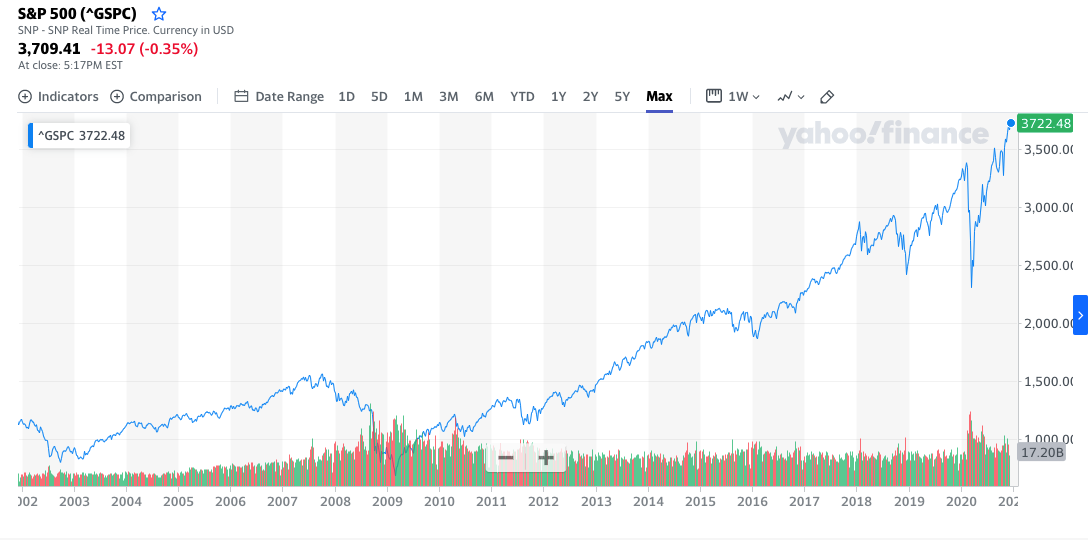

If we pull the data for markets like the S&P500, Dow Jones, Russell 2000 and the Nasdaq if all you did was put your money in either 20 years ago, or dollar cost averaged into the market over the last 20 years you would have made a killing.

All these markets have been on one trend since the early 2000s, a 45-degree angle to the right. I know it's impossible to have predicted what markets would do and it's easy to look in hindsight and make assumptions, but this has to be one of the longest bull markets in stock market history.

Dow Jones

Nasdaq

Russell 2000

S&P 500

Buy the dip

As markets are at all-time highs and have continued to surge over the last 20 years, the strategy of buying the dip has been insanely profitable for anyone who was consistent and spent time in the market. If you can't lose, and when others take profits, you can buy the dip only to have it turn into profit, the bullish sentiment tends to become overwhelming.

Retail continues to get sucked in

We've even seen the influx of retail flowing in as the stock market seems like it simply cannot fail. Even now during the pandemic, when people were stuck at home, those who used to bet on sports, those with stimulus cheques, those with extra cash, those looking to earn additional streams of income have all begun to play in the stock market.

Apps like Robinhood, eToro, Plus500 or more have made to easy for people to download an app on their phones and then load up some cash and begin to play in the stock market.

This extra cash, incentives and lower barrier to entry along with a trend that hasn't changed in years have all mixed nicely to suck everyone with a few bucks to spare into the stock market.

I am no stock trader; I don't own any momentum stocks, I own local value stocks and have held them for years for their dividends, this isn't really my game. So when I see people who have no business being active investors, come to me and ask about stocks, I tend to get a little worried.

Suprsessd volatility always returns

As money printing continues to suppress volatility and push markets higher, all it does is suck more investors into the stock market, thinking they can buy and sell higher. While others are thinking they're not ready to sell as they keep making money by staying in the market.

The more buyers become holders, that means the pool of sellers becomes less and less. So when the market becomes a net seller to take profits, there won't be enough buying demand to take it over driving prices lower.

If central banks don't step in with freshly printed money and devalue the dollar to be the buyer of last resort a generation of active investors and to an extent, passive investors will be hurt.

Saving one by sacrificing another

If active investors are to be saved, it will come at the cost of those who are currency holders, and wage earners. Inflation will remove purchasing power from the currency and migrate it to the stock market as it has done for aggressively since 2008 until now.

We're now in a position where we either allow the stock market to correct, companies to shut down, jobs to be lost, and investors to be cleaned out or let the currency take the burnt of it, so investors holding cash gets hurt.

The irony of it all is that even if you are rich in nominal terms from stock market gains, it's still measured and paid out in a devalued/devaluing currency.

Either way, something has got to give!

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |