*image from pixabay

Last year, I made the mistake of going big investing in crypto (mostly DOGE, LTC) and well, it lost much value.. The good news is that it was easy for me to switch those funds into HIVE and so I managed to salvage much of that loss.

Besides doing hive, I was also trading stock options. I did better than I ever hoped doing so, but too bad the loss in crypto far outweighed my gains in trading. :(

I do have some real estate holdings as well as a very small amount (just a few coins so far) of gold and silver.

I would say 2022 was 50% crypto, 40% stocks, and 10% hive. (this is just me powering up each month)

In 2023 and on I want to invest better.. that, to me, means diversification as well as choosing to invest (at least the most % of my disposable funds into things that are more stable)((NOT crypto!)

I like to have many different things that I can list as my invested assets so here is my current list:

- Real Estate

- hive (HIVE and HBD)

- Trading

- Metals (gold and silver)

- INCOME (token ETF)

- A very very small amount of crypto

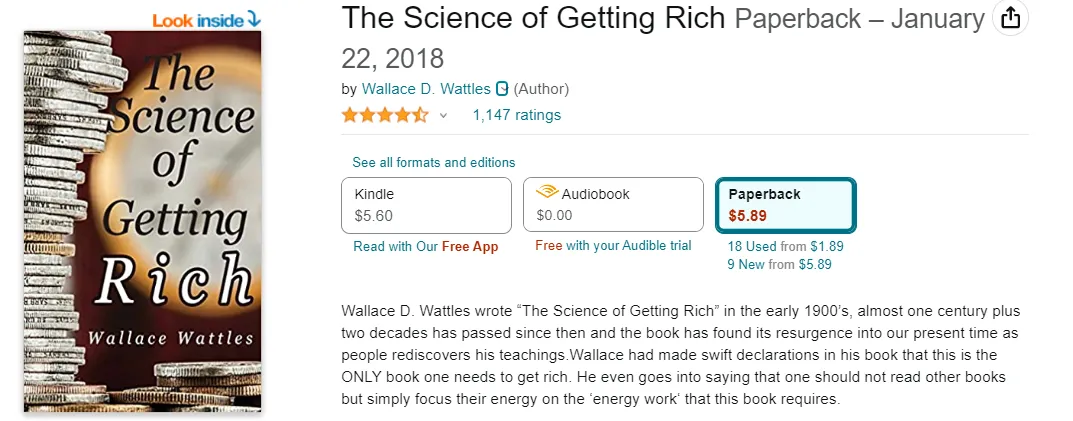

This is the short list I want to focus on now. I am trying to follow a concept I learned in Science of Getting Rich

which was always INCREASE your net worth (assets), small but stable gains, and never lose something once gained. Another way to say it might be just take babysteps.

In my Brazilian Jiu Jitsu training before, I learned.. position (and that also means to secure that position) BEFORE submission. It's easy to get tempted to go for the finish and the dream of a quick win before ever doing what is needed to get yourself in good position to try anything. I say crypto lures an investor into a false sense of winning big, or fast gain, when it's actually very volatile and NOT stable. (not saying it doesn't have a place in a diversified portfolio.. just needs to be traded wisely)