Hello Hive,

Hope you are doing well. :)

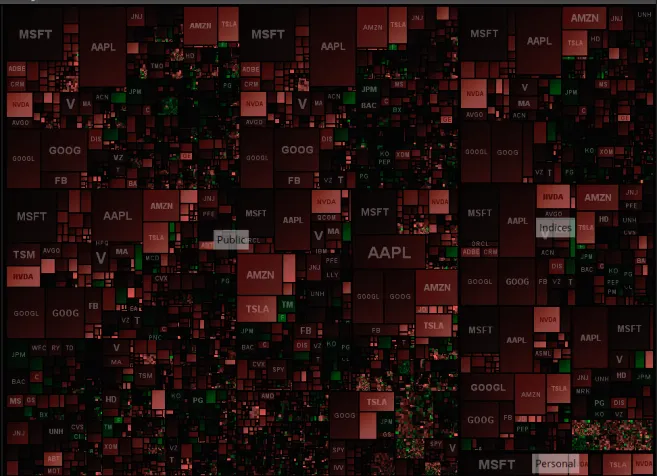

This is my trade from yesterday, Feb. 18. This is what I saw on marketwatch..

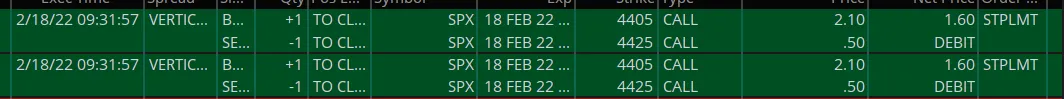

It looked very red overall and so I thought surely the market would continue to fall in prices. I sold a call credit spread, which wins when price stays and ends below a certain price. (a higher price then what is current)

Here are snaps of my chart as the market day went on..

Looking ok so far, but price kept on RISING.. not what I wanted it to do. Then my stop was hit and I was out..

Here's a close-up of when I got stopped. (notice how price turned and stayed down right afterwards.) 😤

I only lost 4% of my total trading account, but it still sucks to lose.

According to my records I am 1 win / 3 ccs

When I trade put credit spread I am 2/2, and iron condors are winning 84% for me.

I think its because the market tends to always go up, so it's a good bet to try and always trade as if it's gonna go up.

So, I will stop trading CCS and just stick to a iron condor and PCS strategy.

Do you have any questions for me or maybe a comment for me? Thanks,

:)