Full disclosure: Before writing this article I had a long position on XRP, and after writing it I've closed the trade and have taken a short position.

It seems that the expectation out there in the aether is that the ruling in the current court case of Ripple vs SEC will be favorable for Ripple. However, I'm finding myself contrary to that opinion. I feel like I can pretty easily make a case that XRP is in fact a security issued and sold by Ripple according to the Howey test. While I don't know if the presiding judge in this case would be convinced of it, after considering the situation I'm certainly convinced based on my understanding of the law, which admittedly is limited, and previous court precedents that Ripple has indeed issued and sold securities.

Any bit of sleuthing into this case will inevitably lead you to learning about the 'Howey Test" and how this is what the entire case depends on for both the SEC, Ripple, and the entire cryptocurrency industry.

But just what the hell is the Howey test and why is everyone talking about it?

Here's the jist - in 1946 an orange farmer in Florida named Howey needed to raise money for his orange grove. So he kept 50% of the land and sold the other 50% to real estate investors. These investors weren't farmers and had no intentions of working the land to produce and sell oranges. So Howey offered investors the option of leasing back the land to his company 'Howey in the Hills' to manage the land and grow the oranges. Presto! Howey got the money for his orange grove operation.

The question here was whether the sales involved were sales of securities subject to regulations under the Securities Act of 1933. The problem that the Securities Act of 1933 did not explicitly define what an 'investment contract' actually is.

The question was resolved in the Supreme Court case SEC vs WJ Howey Company and lead to a legal definition for an 'investment contract.'

Frank Murphy, was a justice and he reasoned that,

"...an investment contract for purposes of the Securities Act means a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party, it being immaterial whether the shares in the enterprise are evidenced by formal certificates or by nominal interests in the physical assets employed in the enterprise."

"The test is whether the scheme involves an investment of money in a common enterprise with profits to come solely from the efforts of others. If that test be satisfied, it is immaterial whether the enterprise is speculative or non-speculative or whether there is a sale of property with or without intrinsic value."

This became known as the Howey test and became the defacto test to determine whether some kind of activity constitutes an investment contract subject to the Securities Act of 1933.

Spoiler alert: Howey's enterprise sold securities and his companies were subject to the securities regulations. Justice Murphy was probably bummed the Howey test did not become known as the Murphy test.

Great! So how does this relate to XRP and Ripple!

By now many of us have seen what that Justice said in a 4 point list but just in case you haven't here it is.

- An investment of money

- In a common enterprise

- A reasonable expectation of profit

- Derived from the efforts of others

It answers a simple question - is this 'thing,' this 'scheme,' activity, or enterprise an 'investment contract' and subject to regulation under the Securities act of 1933? If it can be reasonably argued that some kind of activity meets these four criteria then it is in fact an investment contract regulated by the Securities Act of 1933, aka a security, regardless of whether there is an actual formal contract that spells out a specific investment agreement.

So lets answer the first question was there an an investment of money? Yes absolutely. People have been buying XRP as an investment as long as there's been a way to trade it and Ripple has sold XRP they created directly to markets.

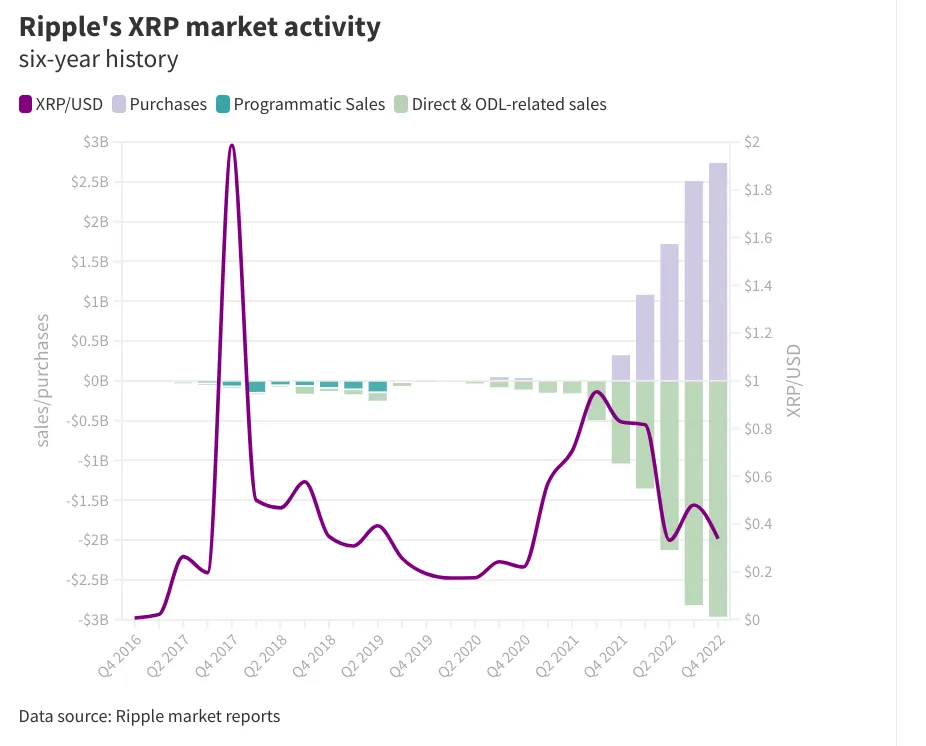

Second - Were there investments in a common enterprise? Again, absolutely. For most of XRPs life Ripple has held over 50% of its supply. Although sometime in 2022 it seems Ripple has sold enough to now be a bit below that. Those sales were used to fund operations at Ripple.

In the second half of 2022 alone Ripple raised over half a billion dollars from net sales of XRP.

And there it is, the second criteria was satisfied. I would argue that XRPL is the common enterprise and Ripple has been selling XRP to finance operations and development of XRPL.

How about criteria 3? Is there a reasonable expectation of profit? To answer this let me reiterate what Justice Murphy had to say.

"The test is whether the scheme involves an investment of money in a common enterprise with profits to come solely from the efforts of others."

It seems to me the answer is again, yes. It is reasonable to expect a profit if Ripple is a good steward of XRP and the common enterprise XRPL. Then the value of XRPL should reasonably accrue to the XRP token and both XRP investors and Ripple would profit.

In fact Ripple has been buying XRP too as you can see in the chart above. Recently Ripple has "shelled out nearly $8.4 billion throughout a sustained XRP buying campaign initially pitched to protect the token’s markets and its customers, averaging more than $1 billion per quarter." This seems to me like Ripple is doing work here for the common enterprise.

Ripple has also given 1 billion XRP to a grants program with the purpose of advancing XRPL

They actively market this on their blog showcasing projects they have encouraged to adopt and use XRPL. Anything Ripple does to encourage adoption and use of XRPL would reasonably lead to higher prices on XRP, being the platform's utility token. Both Ripple and XRP investors would profit from this common enterprise.

Of course this isn't just Ripple making XRPL what it is. It's all the other developers and users that can be attracted to and use the platform. Ripple has been paramount in driving that.

So do investors in XRP have a reasonable expectation of profit? And is that profit derived from the work of others? (Criteria #4 of the Howey Test) Yes. Absolutely.

Conclusion

Mr. Howey did not specifically issue any single formal investment contract that constituted a security under the Securities Act of 1933. However, the overall scheme of selling tracts of land, and leasing back the property to his company and others was determined to be, in total, an investment agreement that constituted sales of securities.

Likewise taken as a whole: the overall scheme of Ripple creating XRP, selling XRP, air dropping XRP, developing XRPL, attempting to decentralize the ledger adding value to it, marketing XRP/XRPL, encouraging and funding XRPL adoption - as a whole, all seems to me to involve an investment of money in a common enterprise where investors have a reasonable expectation of profit from the work of others. Since Ripple is the primary issuer of XRP, and has performed most of the work responsible for developing XRPL it seems to me XRP would be a security that Ripple has issued and sold to finance a common enterprise.

What do you think? What is your understanding of securities? Does it seem to you Ripple sales of XRP was effectively selling securities like Howey? Perhaps not? If you were a judge asked to determine, based on the law, if XRP is a security or whether Ripple sold securities what would you decide?