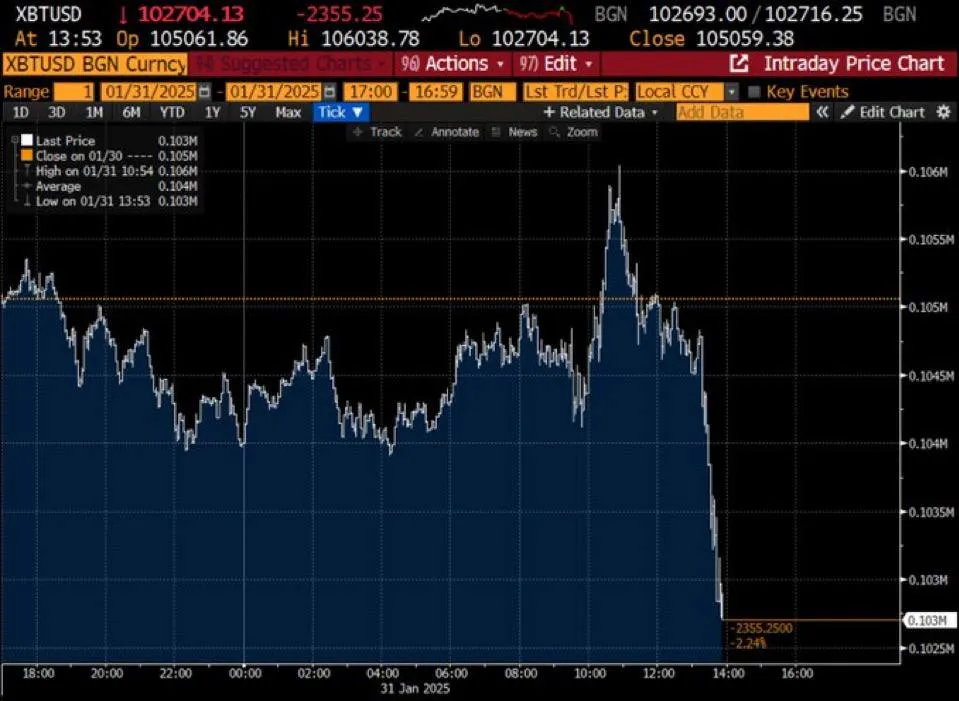

Everything started so well yesterday, but then the market shook up: the United States announced 25% tariffs on Mexico and Canada and 10% on China, and immediately bitcoin went down like a stone into water.

Someone immediately started talking about the expiration of options, but the entire market moved at the same time, which means that the reason is obvious – a macroeconomic shock.

Why did BTC react this way?

- Liquidity shrinks – when the economy is hit by new tariffs, this can increase inflation and force central banks to change their strategy.

And when markets are afraid of a lack of liquidity, the riskiest asset, bitcoin, is the first to be hit.

Dollar Growth – if the trade war strengthens the dollar, then BTC, as an asset traded against it, gets downward pressure.

Correlation with the stock market – The S&P 500 sank, and BTC followed it, because for now, institutions still perceive it as a risky asset.

Automatic liquidations – at the moment, major players and algorithms process the news instantly, closing positions and intensifying the fall.

What to expect next?

Such movements on macroeconomic news are a standard process of capital redistribution. When the market calms down, if the fundamental factors for BTC have not changed, it can quickly return.