Sadly it takes terrible events occurring to see the value of some investments as they more often than not go up during times of crisis. We are not seeing the doubling of the gold price like it did way back in 1980, but a double digit gain is still exceptional. Not only that but once the crisis is over this sets you ahead of where the rest of the market is and the advantage can and will be worth far more than double digits.

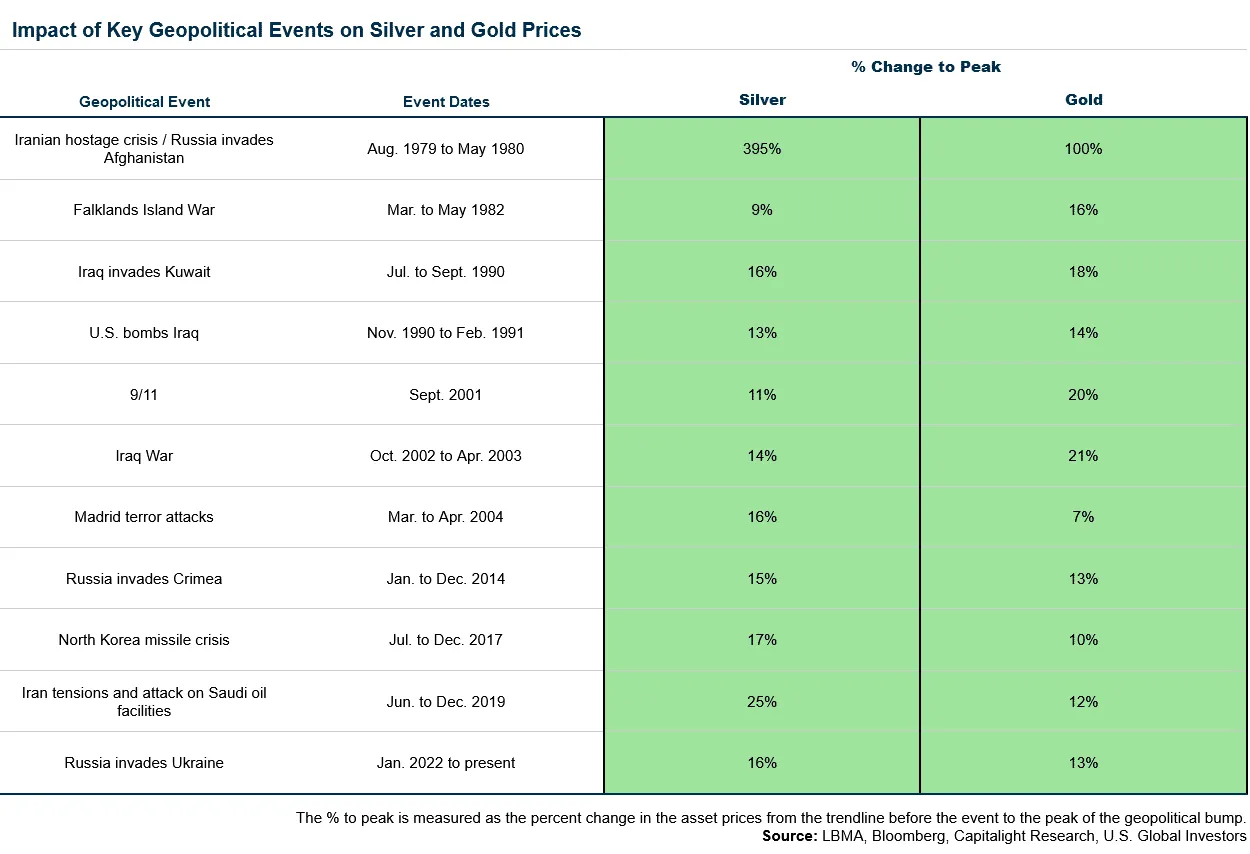

Over the last 40 years events around the world have never failed to deliver when it comes to providing gains for silver and gold. The percentages highlight the price before the event and to the peak. As you can see Russia invading Ukraine earned investors of Silver 16% and Gold 13%.

Investors tend to turn to investments that they find a safe haven when the markets are in turmoil. Gold and Silver are not only seen as a safe haven but also an opportunity to make a quick return whilst everything else is losing value.

Over the last year or two we have seen institutions making a move into crypto currencies not only as an investment but also as a hedge against the dollar. This wouldn't have been the case 5 years ago as crypto has been that volatile as it was still seen as a new area for investing with high risk.

Over the next 10 years this may all change as crypto starts to gain more maturity with less volatility. Bitcoin halving every 4 years means there should be far less liquidity around with prices reflecting that. What is interesting to note this time around is Bitcoin is up over 25% since the Russia - Ukraine conflict. We may have to wait till the next global crisis to see if this is going to be a new trend and Bitcoin become a new safe haven along with other crypto options.

Stable coins may also be an answer as a coin like UST offering a 19.2% return no matter what the markets or economies around the world are doing. Investments are slowly changing even though Gold has a history of being reliable. Property used to be seen as a safe bet and is still worth having but not necessarily as reliable as it once was. Gold may have risen by 13% from when Russia entered Ukraine but you are not making more Gold at the same time whereas in crypto you are adding more coins every day through staking.

Many investors tell you to diversify your portfolio limiting your risk and crypto has now become part of that portfolio. The one big advantage crypto has over everything else is that it can be stored in a cold wallet and taken with you on the move. In the past when people were in a crisis they used to wear jewelry as it had a value whether it was gold or diamonds. That is not necessary with crypto and why it is so easy to move from one country to another taking your wealth with you.

Personally I think we will still see portfolios with Gold and Silver along with Government bonds but a portfolio will definitely be not complete without crypto. I can see more and more investors who were once reluctant to get involved start to become increasingly active in the crypto space. How many have said they wouldn't touch crypto and have somehow changed their minds and eaten those words.