Funny how within 12 months something that looked like a good idea doesn't look so good anymore. 12 months is along time in crypto to learn so much more and understand what opportunities are around and how much can be made.

I mentioned the other day in a comment to @revisesocioligy that I was keen to get involved in some other type of crypto investment like property. I had to go and hunt for the company I looked up about 1 year ago (January) called curveblock.io website

When I first looked at the site I was pleasantly surprised to see the offerings and it looked fairly simple to use and understand. The only problem is 12 months later there has been no changes made and exactly what I saw then is still there. This is a major concern and a red flag as one thing we know about crypto is the speed at which things happen especially being development.

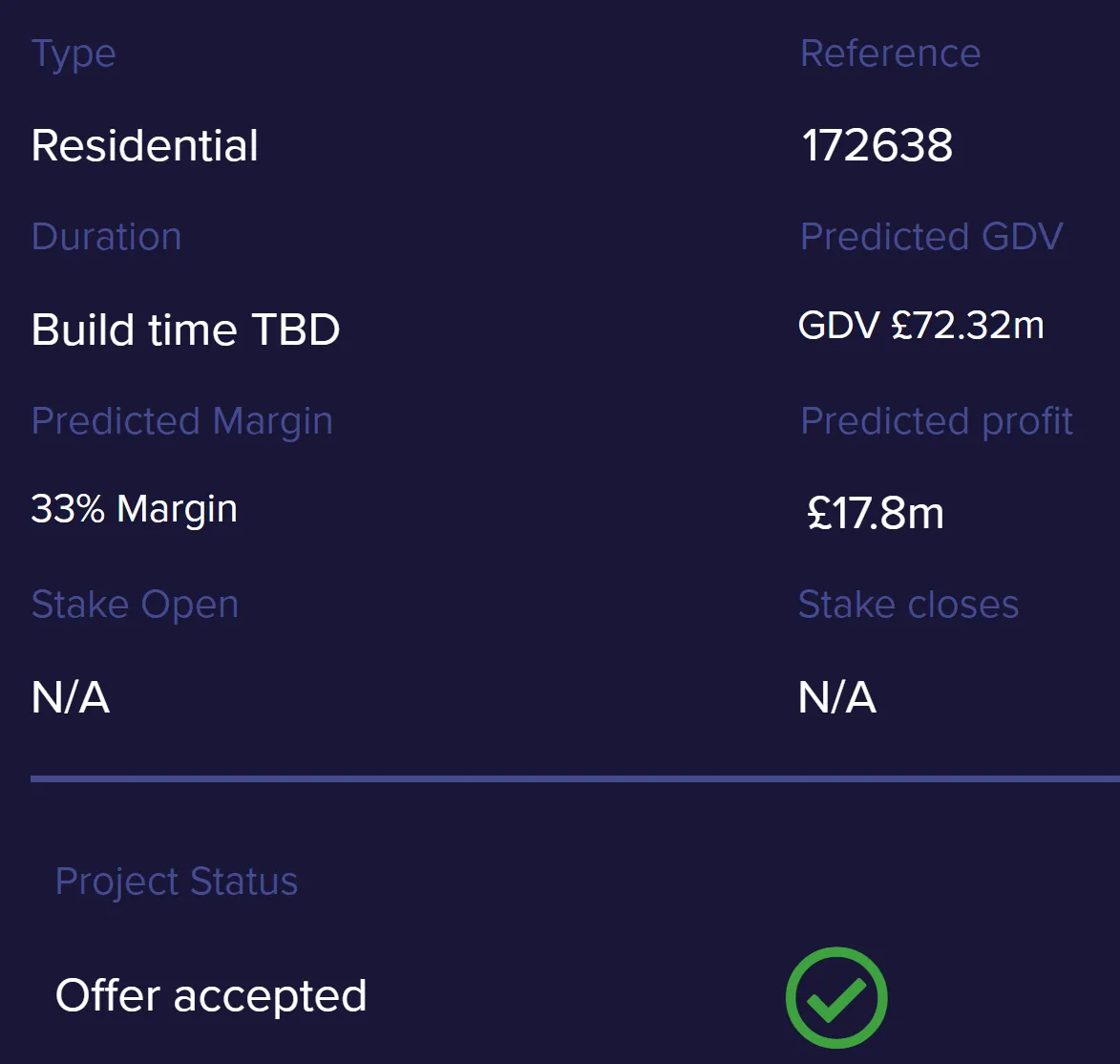

33% margin so as a return on investment this could be far less over a 3 year period or possibly even longer.

The company has built or nearly built a demo construction showing how green their buildings are. On the other property developments I see no further movement and that worries me. This tells me this is all still way too early and to rather build our portfolios before ever considering this. I would rather by a NFT having a share of a property earning rental every month than getting into development.

Back then the Crypto market was not like it is today as most of our portfolios had some serious value. With prices having retracted by 90 percent in most cases this would not be the time to invest into one of these property schemes.

source

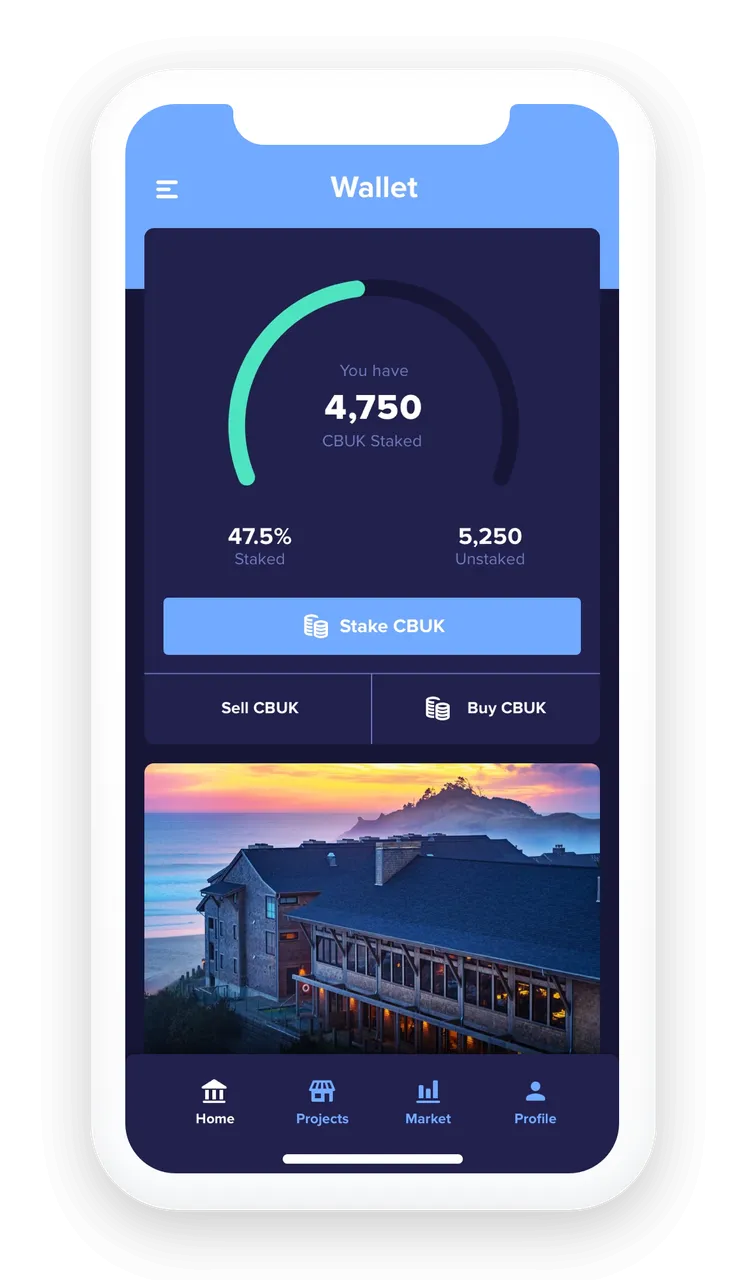

They do have their own token called CBUK (curveblocks UK) which is not listed on the exchanges we know. The price I can find is $0.26c each and personally wont be investing in these projects right now for a number of reasons.

Firstly when your crypto portfolio is at an all time high you don't mind spending some diversifying. When crypto is at the bottom of a bear market I fancy my chances holding on to what I have out performing the property sector comfortably.

I think coming from a crypto mindset we do think differentially to someone coming from FIAT as 33% return on an investment sounds great, but not over a 3 year period. Just take HBD for example as one would have a 60% return over 3 years with all the compounding added in equates to around a 27% gain per year. Curveblocks would give you back 33% which is 48% less an why it is not in the running as an investment. I see this attracting crypto investors who have no clue what they are doing.

Maybe we just know too much and since January my ideas have certainly changed as this may have looked like a good deal then, but that is definitely not the case now. This company looks like a company with no real crypto background trying to attract the crypto space, but doesn't fully understand what is on offer in crypto as 33% is not a good return over 3 years.