I do not think anyone knows the right answer to this question and one day we will find out. My head says it is bad, but that is just common sense talking.

I think looking at the debt figures for each country tells you all you need to know on how well or how badly a country is being run. The numbers are big and in theory should be treated in the same way as your household budget by not spending more than you have.

I say in theory as sometimes countries have no choice ad may need to help boo the economy by getting people back to work which costs money, but you should also see an increase in tax revenue so it is not all bad debt.

What makes no sense is when countries start going way over their GDP like Japan (287%), USA (101%), UK (112%), France (122%), Italy (158%) and I could go on and on highlighting others. There are many counties however who are the total opposite and have kept their debt in balance like Sweden (35%), Poland (55%) Russia (20%) and Taiwan (31%) to give some examples.

What I do find fascinating is how if ever this will ever be paid back because I think we know this is not ever happening and these umbers will just keep on climbing. No one seems to be accountable for their spend and will justify it via whatever means necessary.

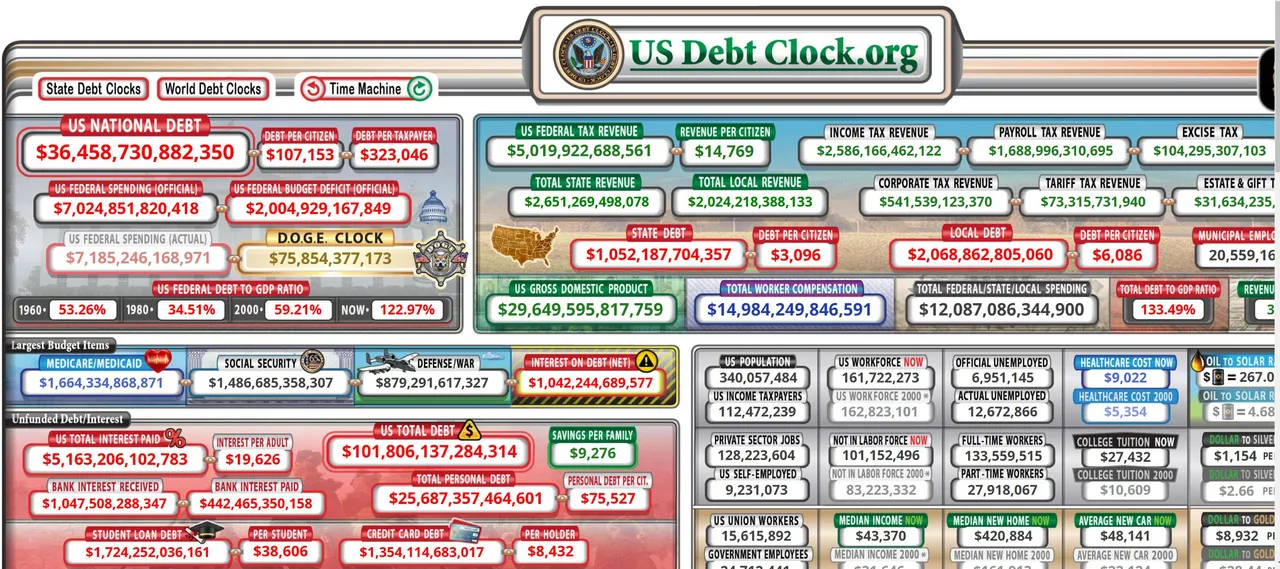

Looking at the interest alone for the US tis has a cost of 1 trillion dollars which equates to $107K per citizen or $323K per tax payer which is why this is never going to be paid back.

I think what DOGE s doing in America is starting to wake people up in other countries around the world that no one is really accountable for their spend like you would expect them to be. Where and how funds are spent and is it benefitting the economy should be where the focus is for every citizen..

Economists will tell you debt is good for the economy but you have to ask yourself is there a limit to how much debt before it becomes a burden on the country? I don't think we have got to that point yet and over the next decade we may find out some more answers to this question.

Back in 2021 there was a reported $300 trillion in global debt that represented 360% of global GDP. Since 2016 that debt rose by an estimated 30% so the spending has only increased which is adding to the total debt.

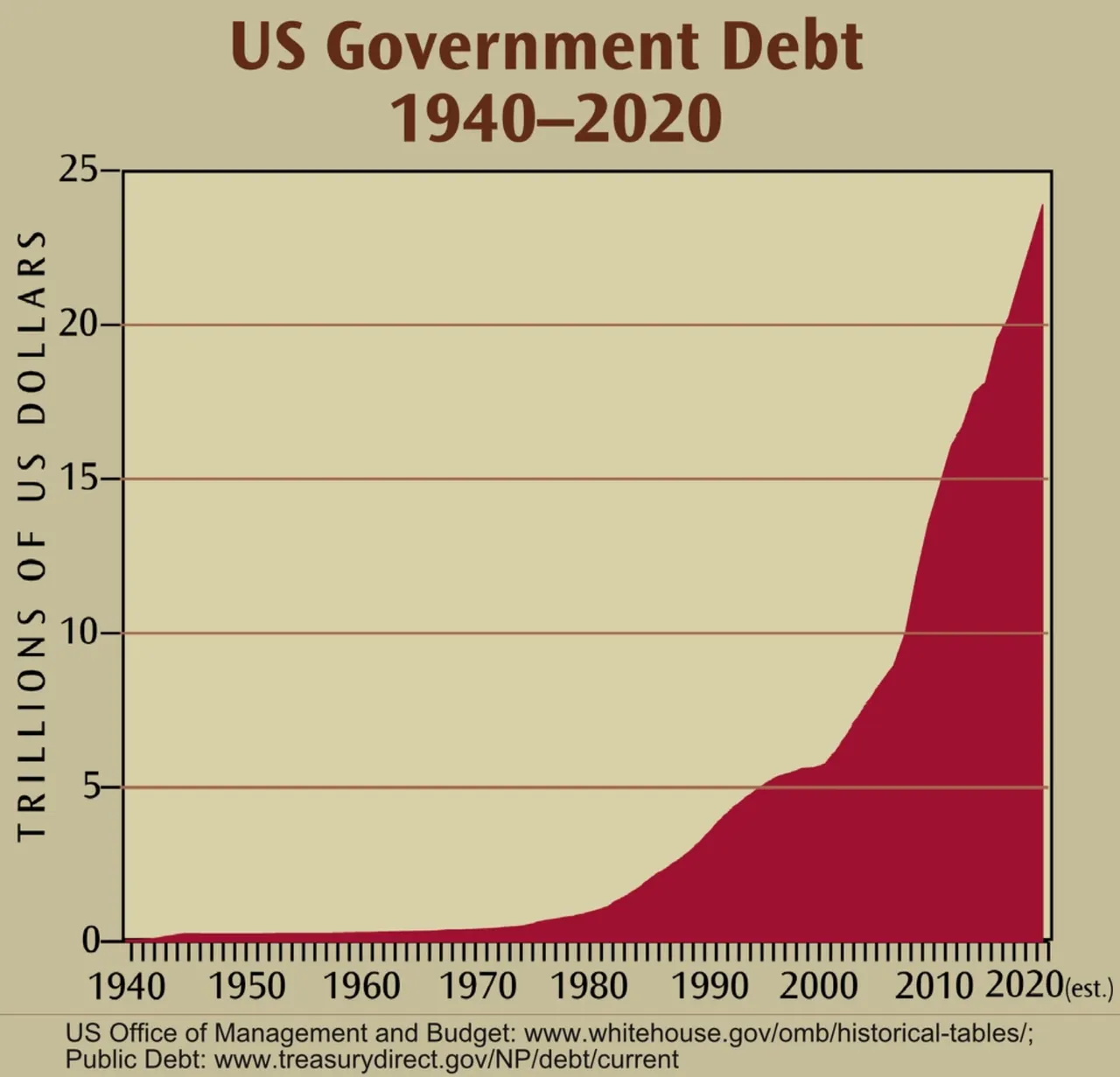

I am no economist who understand all of this, but it is quite obvious over the last 40 years there has been no worries when it has come to spending and borrowing money. At some point in the future when the debt is a problem those that caused it do not care as they would have been long gone already. Back in 2020 the US was under 25 trillion in debt and in the last 4 years has added an additional 50% which is serious amounts of money. The government raised the debt within 4 years that the previous 70 years took to achieve being from 1940-2010 and they had the second world war in that time period. What is going wrong and is this just a bubble that could burst?

Maybe there is some truth to having a great reset as I believe their is no other alternative solution to sorting this mess out as many countries are all in the same boat.