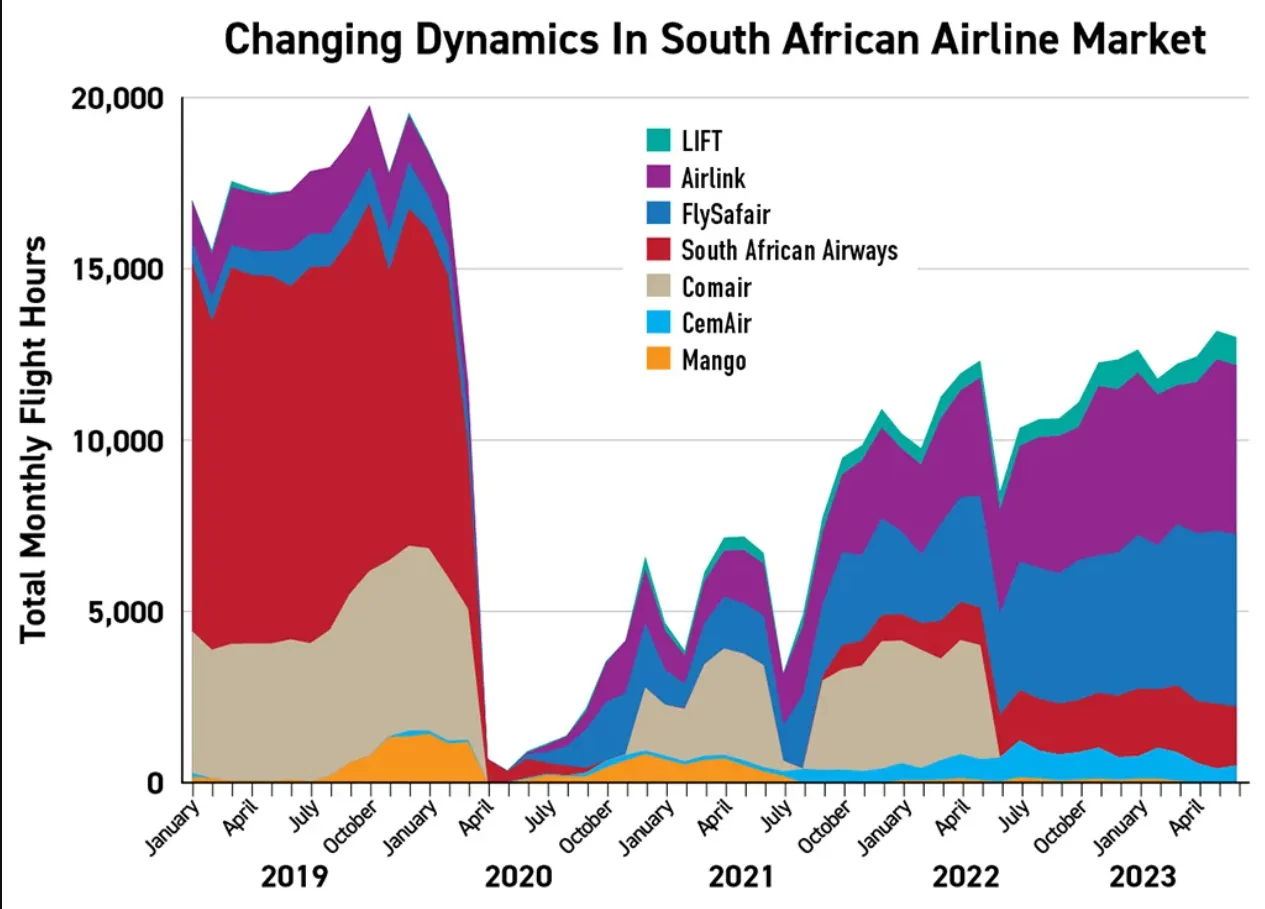

As a business if you could not make any profit with such dominance then what chance do you have when you have lost market share? Look at the red on this graph which shows the decline of SAA.

Yesterday SAA (South African Airways) revealed their financial year for 2023/2024 10 months late showing a loss of R354 million which is roughly R1 million per day. This is actually a good report if one looks at the history of the airline.

R431 Million Accounting Error?

Originally SAA recorded a profit of R60 million, but an accounting error which failed to add in the costs of business rescue which included creditors owed removing R431 million from the books leaving them with a fat loss. This was obviously why there was a delay of 10 months as I am sure there was chaos and red faces behind the scenes. How can mistakes like this happen as you should surely know how profitable the business is and know where you are each day if you are hands on? This highlights what a team of idiots is running this airline business because mistakes don't happen on this scale in privately owned businesses. These fools I would not employ them as a gardener let alone running a national airline.

If you have spent R431 million how could you not account for this and have this as part of your profit which they would have done originally coming out with a R60 million profit. This is mind blowningly bad and why you needs serious people in charge and not so called figure heads who represent the narrative of BEE.

Between 2007 and 2022 the airline had received an average of R3.4 billion per year in government assistance or hand outs so this loss figure is at least 10 x less than normal. The big difference between now and then is the size of the fleet so this is in reality no different than how the business was being managed before and this is a disaster.

When you consider 10 years ago the Johannesburg-Cape Town route was the second most profitable route in the world and now it dos not even feature in the top 10. I guess not having jet fuel made locally and is a full import as an end product may have some bearings on profitability today.

The last time I flew out of Johannesburg in February this year I did not see any SAA aircraft and apparently they have over the years expanded from 7 to 20 aircraft. This is probably enough aircraft to handle the local routes and not internationally and they seem to be trying to run before they are walking.

SAF Air which is the largest air line in South Africa now filled the void left by SAA and has 35 planes in their fleet. This is the difference that has happened over the last decade when SAA was absent having shut down and eventually returned via business rescue. The only time SAA saves any money is when they are non operational and this is no joke.

The 2023/2024 report shows the airline generated R7 billion in revenue which is an increase of 23% from the previous year. The SAA report blamed currency fluctuations for their losses. They blamed a lack of aircraft for leasing and this resulted in a 30% higher rental costs.

The airline has 1.4 billion in cash liquidity so at least we know they wont be asking for another hand out for a few years, but at this rate they have 3 years to fix things or go bust. Personally I just do not see how they can turn things around as many will not fly with this airline ever again. I know if they offered a ticket 50% cheaper I would still not select them as there are major risks and the airline is not like it was 20 years ago. I have seen adverts looking to replace experienced pilots with DEI hire and that does not sit well with me.

I expect by 2030 that this airline will be under new private ownership with no state owned links as this should be a gold mine for investors when run correctly. Ryan Air owns SAF Air and is profitable so the money is there to be made if run like a proper business. Those who have been placed in charge of fixing the airline are not airline people and you need to know this business inside out if you are going to turn a profit.