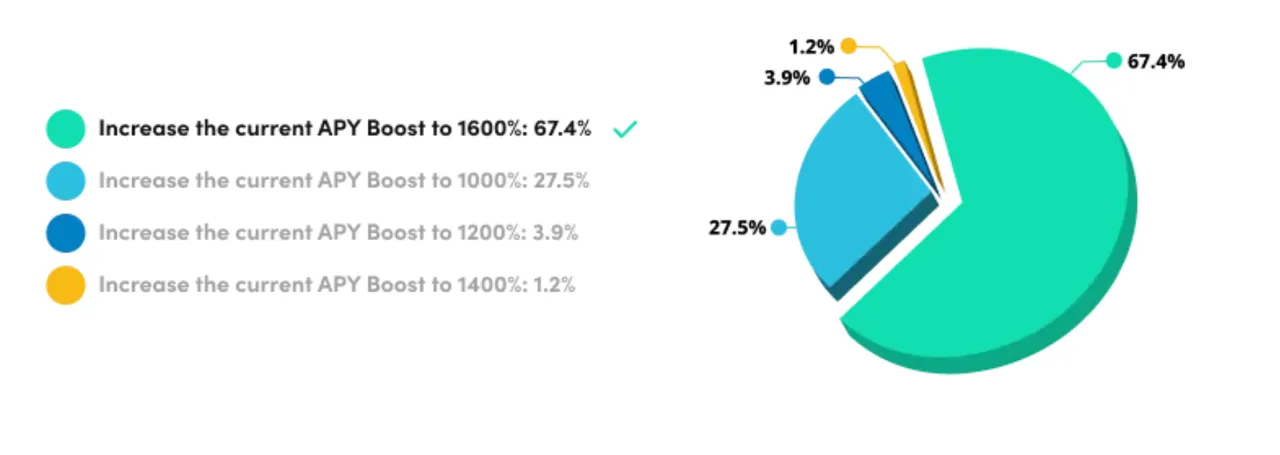

There are no surprises with this vote result when they published the results last night. What do you think would happen when you ask a community to vote and select an APR? Obviously the majority will go with the highest offering on the table and that is exactly what happened.

I do think it was something COTI needed to do however and now have an example of the project being community driven and more decentralised than what it was. The 1600% is sustainable for now and will only come into effect later this week once the rewards from DJED and other service fee projects have finished paying out the latest batch of rewards to those investors already staked within the Treasury.

The COTI team did state that the APR boost will be subject to change in the future and I believe that will not be a community vote or if it is the parameters they will be offering will not be as generous.

This new rate will take effect as of next week. We will inform you of the exact timing in the next few days. Please note that the APY boost is subject to change in the future.

What tis means for now though is if you have no GCOTI you are going to be disadvantaged when it comes to earning rewards. The current base APR is slightly inflated due to the rewards being paid out and will drop off within the next few days and fall back to around 3.2% for normal staking and double that in the locked airdrop staking pool as in the above example.

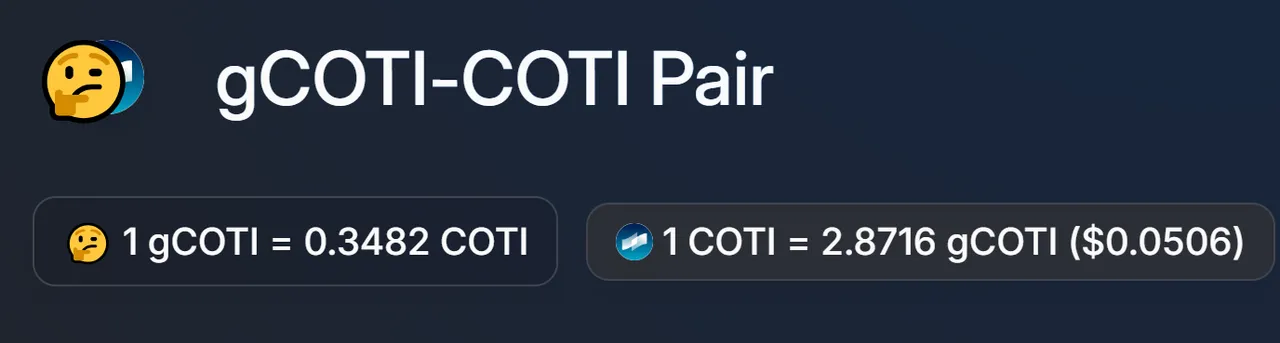

The only problem is that the more stake you have the more it is going to cost investing in GCOTI. The price has been fluctuating as you would expect due to there being low liquidity and the urgent need to get your hands on some like everyone else is doing.

This was taken from Uniswap earlier today and as you can see GCOTI is costing roughly 33% of 1 COTI. In my case I would need roughly 120K GCOTI to maximise the APR rewards as you need 1 for 1 staked. This works out to an added investment cost of $1800 which was not exactly planned for and was never a priority like it has suddenly become. By the end of this week the plan is to have another 10K GCOTI taking the total over 30K and the positive has to be seen that the prices will go up and this will just be adding to the crypto portfolio.

There are many other projects I would rather be spending the $1800 with one being VET which would see me pass my 100K target. Unfortunately this is the needs of now and have no choice, but to invest if I want to achieve the rewards that are on offer. This extra 10K GCOTI would push my earning on this airdrop pool to an APR of around 14.4% so an extra increase of 2.6% plus taking into account the base APR dropping earning just shy of 24 COTI daily out of a maximum of a possible 40 COTI daily just on this one pool alone. This would represent around $780 per month when the ATH's return and why I need to do this now.

When you start calculating the differences they are rather alarming with the remainder of the stake not having GCOTI as yet would only be earning around 4 COTI per day in total. Once the GCOTI is staked in those other pools it will add another 26 COTI daily adding 30 COTI to a grand total of just over 70 COTI per day which at the ATH would represent around $1400 per month. The extra $1800 required now seems insignificant once you crunch the numbers as this could be paid back within 40 days or less at those prices.