I have to admit I haven't paid too much attention to DJED even though I do benefit in an around about way by having COTI staked in the Treasury. The fees generated filter back to the Treasury boosting the APR on offer even though this boost lasts on average 3-4 days. The main reason is the COTI team were taking the slow approach phasing DJED in slowly so there was never going to be any fireworks. The numbers are still small when we are talking about a stable coin combined with DeFi.

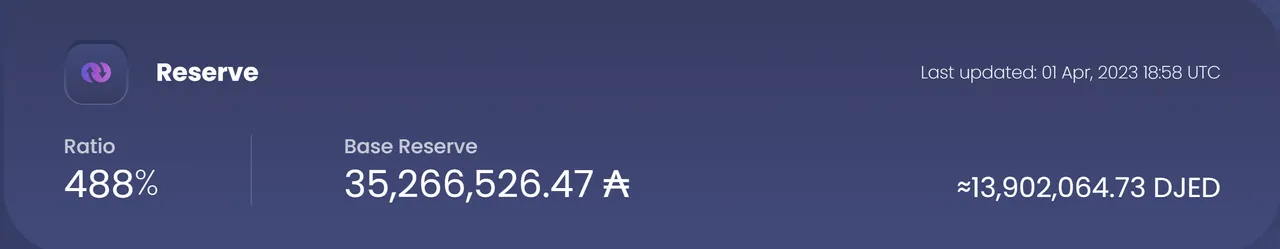

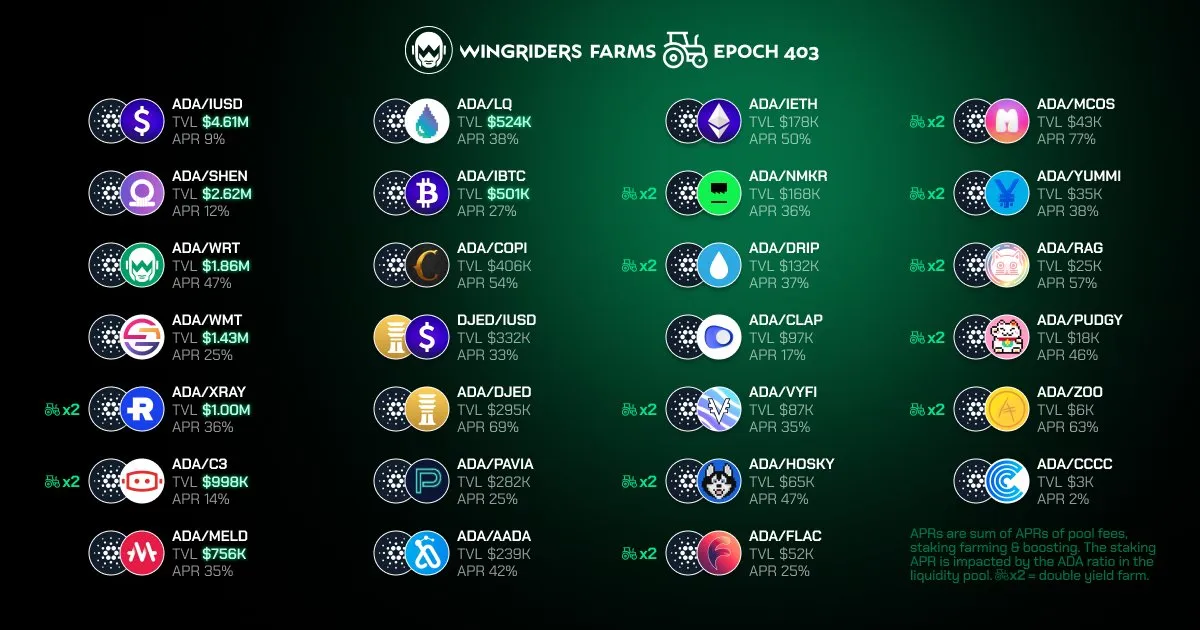

DJED has been climbing slowly and over the last couple of weeks has added another 30% being just shy of 14 million. These numbers will change as I was looking at the WingRiders Farms earlier and ADA/DJED is offering the highest APR being 69%.

DJED is due to launch on BSC (Binance Smart Chain) and Eth shortly which should see the numbers climb to a whole new level. This I am certain will only happen once they have finished the roll out on the Cardano eco system bringing in the new phase being growth taking the training wheels off and no holding back.

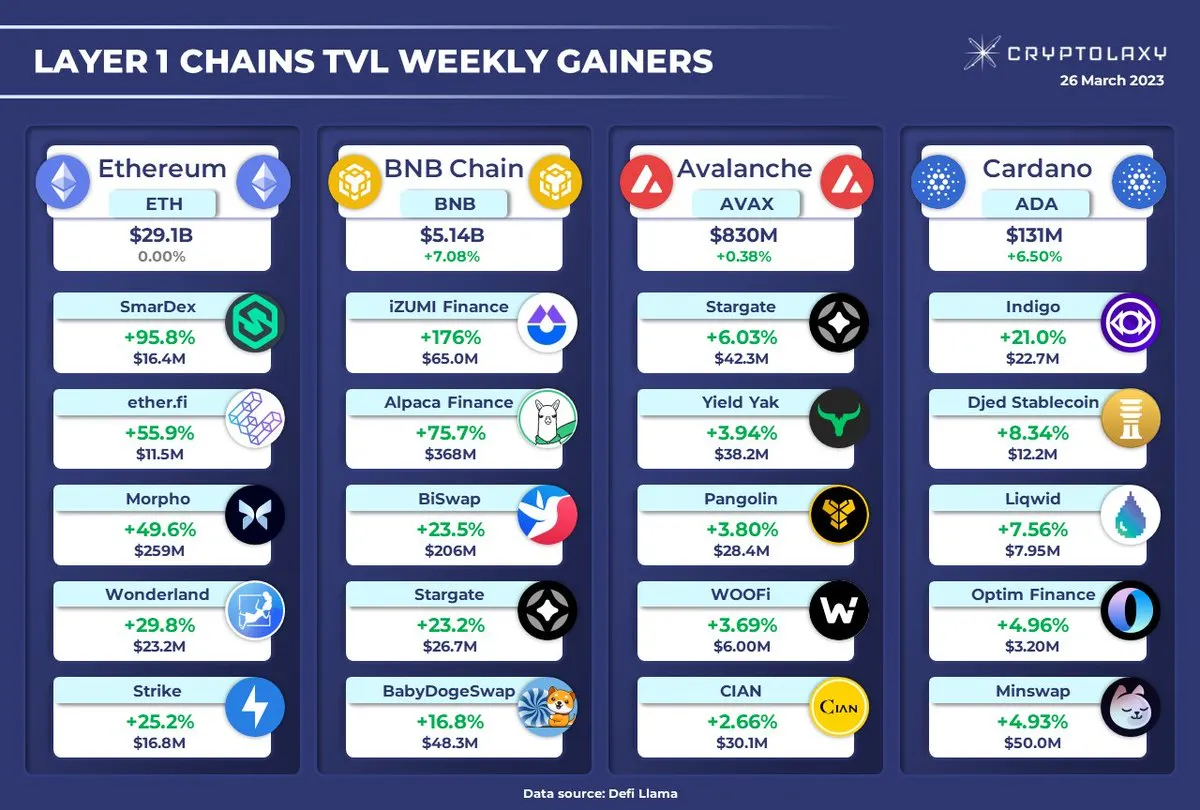

When it comes to DeFi Cardano is still very small in comparison to it's competitors as the numbers clearly show how small they are. Eth at $29.1 billion and even BNB chain at $5.1 Billion dwarfs Cardano at only $131 million.

The positive news is DJED is not just for Cardano and will be in other eco systems so the chances of seeing real growth will happen. The numbers we see now could and should do a 10 x over the remainder of the year and I don't think that is unrealistic expectations either.

The hope is the fees being generated by DJED do start to become more consistent along with being slightly larger so they have a positive impact on the COTI APR I am currently earning. This will just be one revenue stream for COTI over and above the others they are developing and creating.

This is one investment I do have high hopes on as I have stayed patient slowly growing the stake and over time do expect to see somewhere between 12 and 15% APR. This is a sustainable number and not expecting too much in my opinion and a number I would be comfortable seeing. The more stake you have the less APR you actually need to grow as the stake grows itself due to the size.

GCOTI launches from the 3rd of April which is this Monday coming and possibly may offer an extra 1 or 2% in APR which would only require the other projects that are still to be launched including DJED's full roll out finding between them another 3-7% APR in fees. This should not be difficult and why I feel this is a realistic scenario long term as a passive income generator.