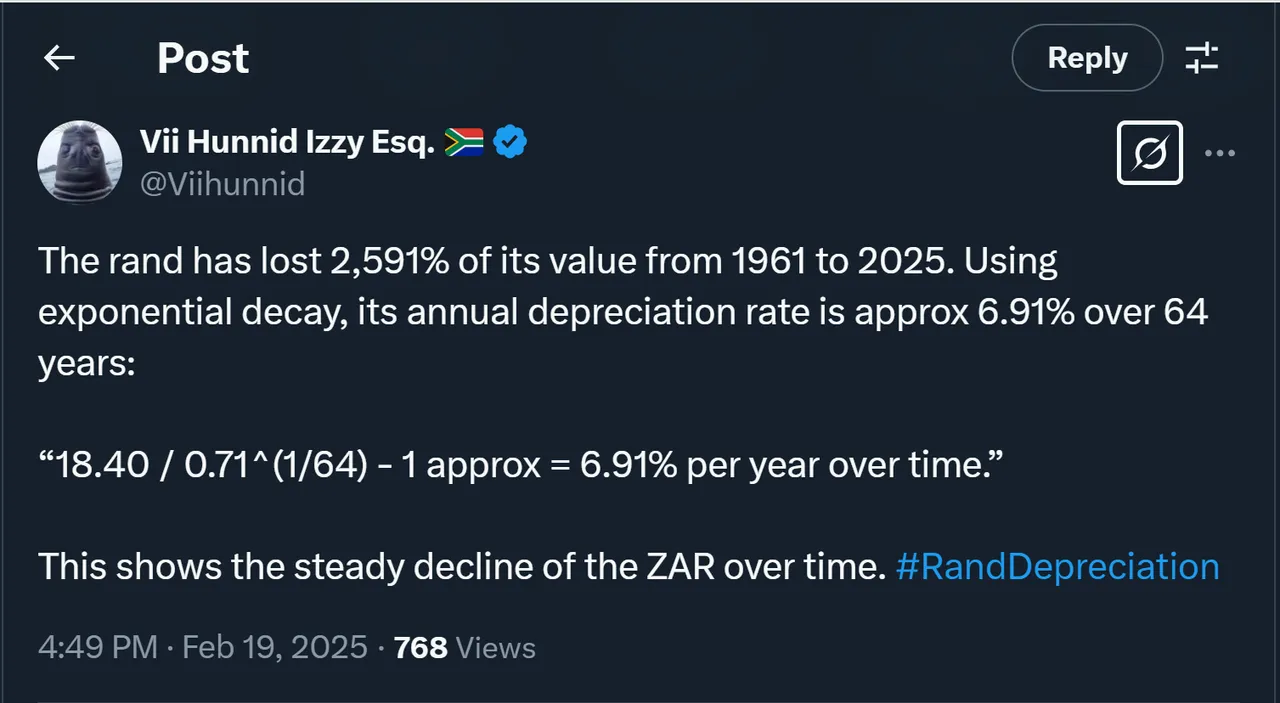

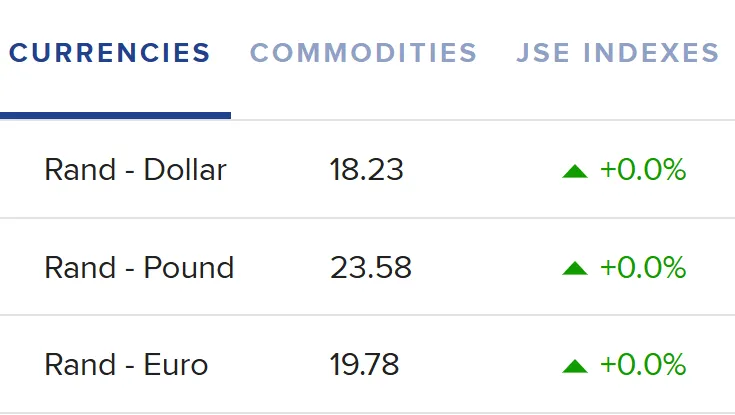

Last month on February 3rd the Rand touched R19.03 to the Dollar and has since recovered some lost ground. I would rather say the Dollar lost some ground due to the tariff news and when the dollar bounce back the true value of the Rand will be revealed.

The above table tells you all you need to know and why you cannot afford to be thinking in Rand's even when you are earing Rand's. My thinking has already switched and it is in Dollars and not much else. This way you can try and counter act the losses by moving Rands out the country into foreign currency. Not that easy to keep doing as this method requires moving cash via other means and not the use of bank accounts. I am done dealing with banks when having to explain to them the origin of the funds even when it is coming from your bank account.

The depreciation is a real worry and the need to stay ahead of the slide is real as this is eroding your value continuously. One cannot afford to keep their wealth in Rand's as the losses are that big year on year. Even if one was to stay here permanently most of the bigger items are imported and continuously rising in price so you would eventually be left with far less which would impact your buying power and life style.

I have seen families who are regarded as middle class become trapped within South Africa as thy can no longer afford to travel let alone consider immigrating. This I can see happening more and more and only the seriously wealthy would have the options of staying or leaving. A Rand at R25 to the $1 would leave 99% stranded here for good. This is not that far way and expect to see this number before 2030.

My strategy up till now is to move funds on a regular basis to foreign bank accounts outside the country so there is a security blanket if and when required. This is not getting ahead financially, but more about maintaining status quo on what I have. The problem is most families are already mixed out on their budget and they have no surplus funds to move abroad.

The yearly budget was postponed until Wednesday next week with rumors that VAT will be increased from 14% to 17% which is really bad news if true. This not only impacts the poor but also affects the middle class by impacting their spending power. The business environment is under severe pressure and the last thing we need to see is reduced spending. The country is being propped up by the few that are working and milking them even more only reduces the buying power. South Africans are already taxed to the max wit the burden of propping up the economy so this is heart breaking and demoralizing if another 3% is thrown into the mix. Inflation has been bad enough so adding another 3% is very short sighted and kind of sums up the SA Government.