The year 2022 has already started bringing with it a Bear Market. Those who have known the blockchain universe well for a long time were not so scared when they realized that another long period of downturn was approaching. But even the most seasoned investor must have experienced some anxious moments in 2022.

It is true that during this period several projects were perfected, important things for the entire crypto universe happened, and we observed a different experience in a bear market, with web3 flourishing and establishing itself. But we also had numerous moments of apprehension, didn't we?

It is important to note that every Bear Marketing is a period for builders to build projects that will live on in crypto history, and while we have seen many challenges this year, it has certainly also served as a lesson learned and new projects evolving.

Retrospective

The history of cryptocurrencies, although relatively recent, already has countless chapters with impressive plots that would leave even the most skilled screenwriters stunned. And we are always adding more content to it. In the last year, some of her most important events have unfolded.

And to ensure we don't forget the valuable lessons they taught us, I thought I'd share this brief retrospective. So, read until the end and engrave in your memory the teachings on what to do and not to do, because next year things can change very quickly, and you won't want to hesitate, will you?

Wormhole Bridge Hack

In February, when the market was already showing signs of contraction, the second-biggest hack in the history of cryptoassets so far happened, shaking the ground and leaving all investors apprehensive. That's because the victim was one of the bridges considered the safest so far.

Over $320 million worth of WETH was stolen from the platform, which connected the Ethereum, Solana, Binance Smart Chain, Polygon, Avalanche, Oasis and Terra networks. A reward of ten million dollars was offered to the criminal for him to return the tokens, as a reward for locating the bug that made the attack possible. So far we have no news that this has happened.

Ronin Bridge Hack

What nobody expected was that in March another gigantic hack would happen, this time involving the bridge between Ronin, linked to the parent company of the game Axie Infinity, and Katana DEX. The amount subtracted this time was around 600 million dollars, almost twice as much as the previous hack.

According to official sources, the hacker would have gained access to the funds by appropriating private keys. Furthermore, he would have benefited from access offered to Axie Infinity's DAO that had not been revoked as it should have been. The game and the company, which were not going through a good time, ended up being even more harmed, dragging the market with it.

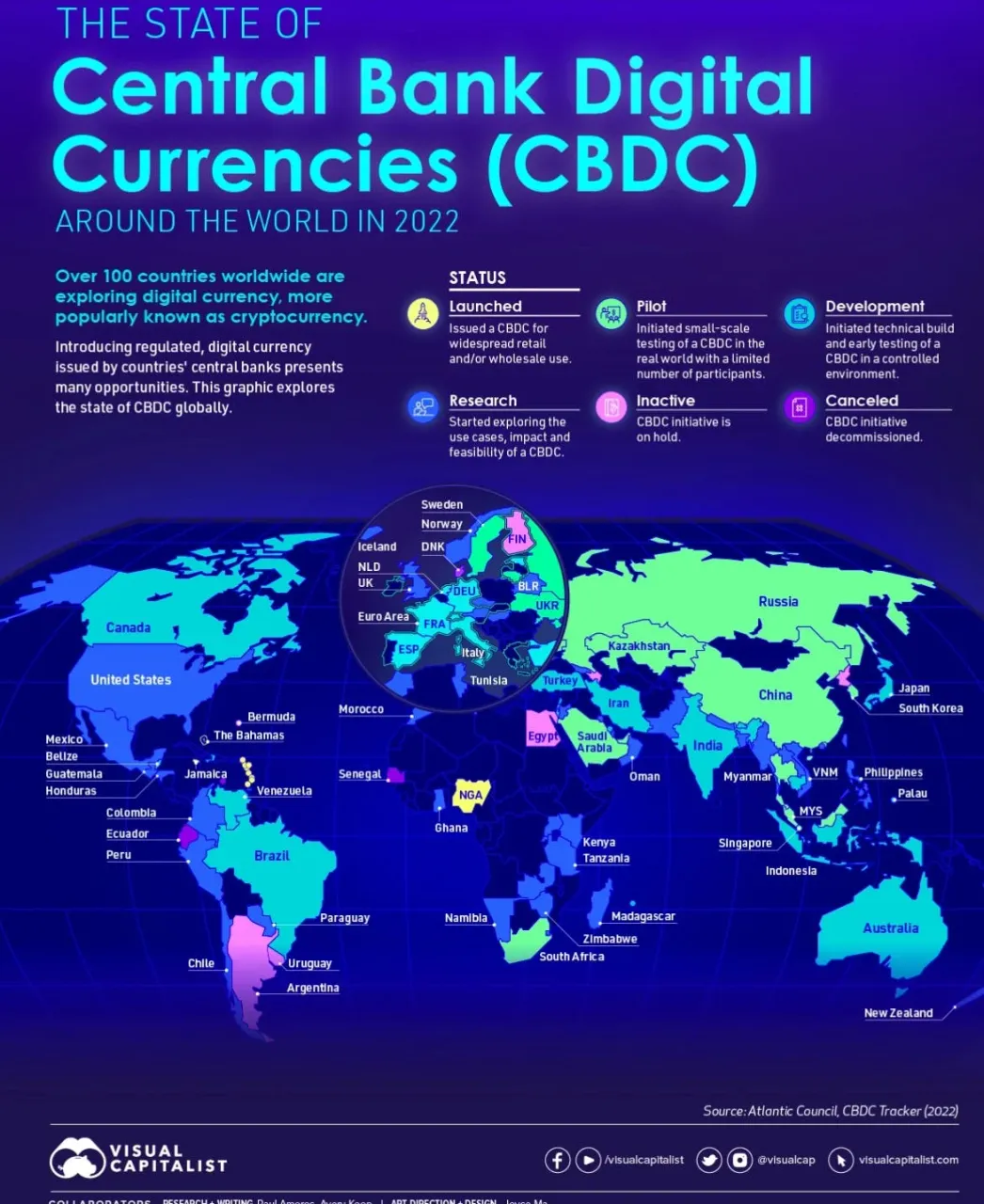

CBDC proposals growing

Even in a troubled year in 2022, when things seemed to be going badly from the beginning, we observed with curiosity and interest the growth of CBCs, Central Banks Digital Currencies. More than 100 countries around the world already have usage models being developed or in operation.

This type of movement is very interesting, because it confirms what we are already tired of knowing: there is no alternative but the use of digital currencies, paper money is dead. Which is positive, as it encourages a culture of developing use cases for digital assets. But make no mistake, CBDCs are centralized, controlled by governments and do not have the same fundamentals as cryptocurrencies and will probably not even be on blockchain.

The Terra Blockchain Collapse

Bear Market's first major casualty was hit in May. One of the most celebrated networks on the market until then, Terra saw its empire disappear and its LUNA token (today LUNC) lose practically all its value in a very short time. Their algorithmic stablecoin (formerly UST, now USTC) turned out to be a huge failure.

It all happened so fast. The process began when more than 2 billion were withdrawn from the protocol. Whether it was an attack on the Terra network or just investors looking for better positions in the Bear Market is still under discussion.** Hundreds of millions of dollars worth of UST were quickly liquidated and the algorithm was unable to maintain parity** between the LUNA and UST tokens, leading to a ripple effect that doomed the project within hours.

This event had catastrophic consequences, as the Terra network was heavily used in the market and a very significant number of investors, including large companies in the crypto space, were very engaged and had a lot of funds in Luna and UST. The developers tried to bring the project back, a new token was created and even a small pump happened, but the recovery did not last long.

Nomad bridge hack

Bridges are a very high-risk element in the blockchain universe. Most of the representative hacks that have occurred thus far in history have benefited from weaknesses in them. But they are important for mass adoption, improving user experience and market development.

Already in the second half of 2022, when the Bear Market was consolidated and investors were extremely apprehensive after so much turmoil, a Nomad bridge hack made it clear that there was still a lot to happen. More than 190 million dollars were drained from the protocol and sent directly to hundreds of wallets, in a hitherto unprecedented type of attack that would show that the bridges are even more fragile than previously thought.

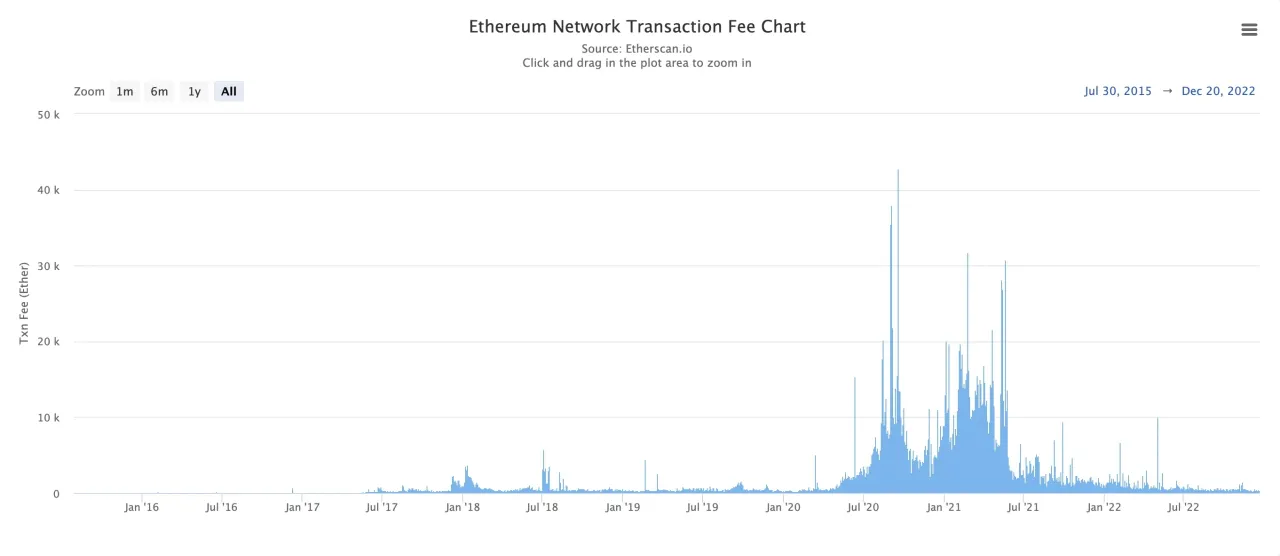

Drop in gas price on Ethereum

When dealing with cryptocurrencies, we have to learn the lesson that there are opportunities at all times in the market, whether it is in an uptrend or a downtrend. And the proof of this was that, when adverse circumstances led to a significant market depreciation, many projects flourished and developed.

One of the reasons for this was a historic low in the price of gas for using the Ethereum network. After insane values mainly driven by the explosion of NFTs in 2021, the network fee reached its lowest level of the last two years at the end of 2022, due to the drop in the number of transactions. This allows projects to move better and initiatives to be put into practice at a lower cost, encouraging market development.

Celsius case

And there's more evidence that you can speculate on Bear.

The cryptocurrency lending platform Celsius (CEL) token made money for those who anticipated its potential and knew how to exit at the right time.

It was not easy at all, considering that the company's balance sheet showed a deficit of more than one billion, and it was even seeking legal measures to protect itself from bankruptcy.

Even so, with an absolutely adverse scenario, the CEL, the platform's utility token, went from 0.093 cents in July to an incredible 3.93 dollars in August. That means an appreciation of more than four thousand percent in less than two months. The rise was attributed to a short-squeeze by investors and rumors of buying the company, although nothing solid was revealed about it.

The pump in the token price was not enough to keep the exchange well. She is currently under heavy pressure from creditors in a bankruptcy court case. CEO Alex Mashinsky stormily resigned during the bankruptcy, and it was discovered that he had withdrawn $10 million from the company shortly before withdrawals were blocked from other clients.

MicroStrategy and El-Salvador

And those who know how to take advantage of market moments can really do very well. Connected to this, the president of El-Salvador and the executive president of Microstrategy made a curious double that generated memes in 2022. Both the country and the company made purchases with excellent prices in Bitcoin, the most valued crypto asset in the world.

In September 2021, during an all-time low, both had already acquired significant amounts of BTC at a discount. And the same thing happened again in July 2022. This time the country bought 80 Bitcoins for 19 thousand dollars each, and Microstrategy continued to acquire Bitcoins to guarantee a better average price. The internet has not forgiven the fact that, although they have made good purchases, both are losing money at the current exchange rate.

It is important to point out that those who only look at the price do not see the possibility of future asymmetry, nor that the fundamentals remain intact.

Ethereum Merge

That was certainly the darling of the year, even though it didn't have as much of an effect on the ETH price as some of the most hopeful investors anticipated. On September 15th, many of us spent hours following this historical moment of cryptocurrencies, where Ethereum migrated from the Proof of Work system to the Proof of Stake, in a very satisfactory way, by the way.

In practice, the change makes it possible for there to be a lower environmental impact on the exploration of Ethereum, as mining as we know it becomes obsolete, and also for better network scalability. The expectation is that there will be a gradual reduction in the price of gas and that in the next Bull Market we will have more movement with a lower cost for users.

Vasil Fork at Cardano

One of the highlights of the year was the Hard Fork on the Cardano network. It means that a new version of the network is running on top of the old one, similar to what happened with Ethereum and Ethereum Classic. After many delays, Cardano investors were finally able to celebrate the most awaited delivery for them, which has the potential to change a lot in the network and in the crypto universe.

According to the blockchain development team itself and other people heard by numerous press vehicles, the implementation of Cardano Vasil will generate more and better possibilities for using smart contacts on the network. This creates a whole universe of opportunities for developers and investors.

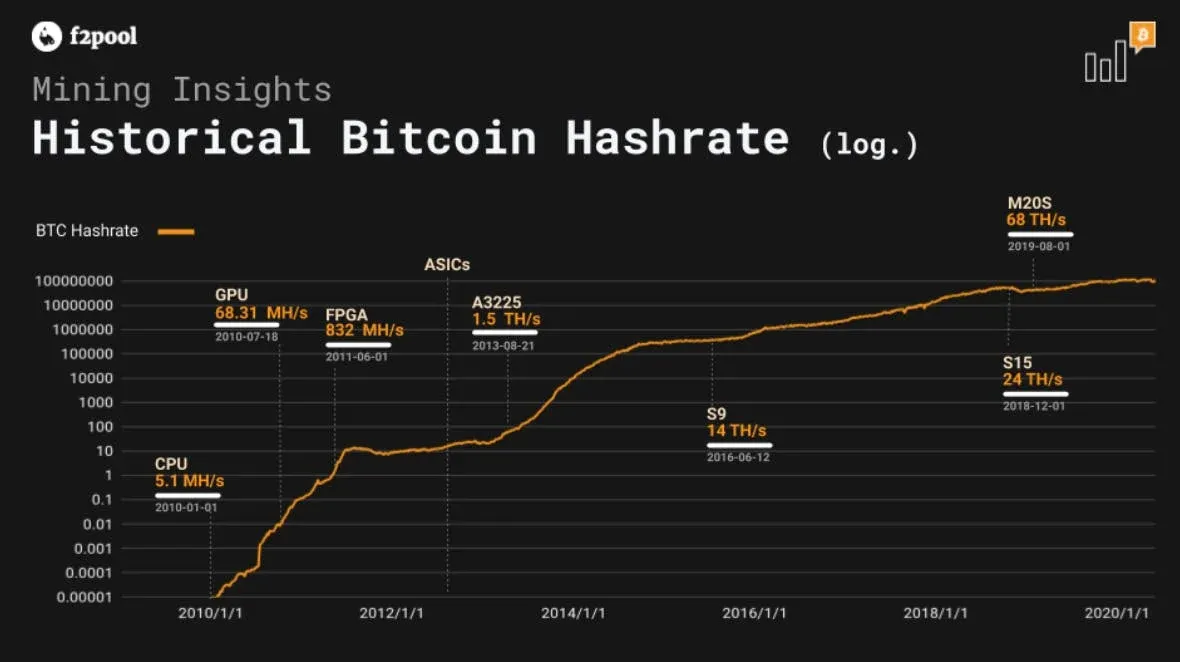

All-time high in BTC hashrate

Of course, we couldn't mention the all-time high in the BTC hashrate in our hindsight. It's important to consider the whole context and what it represents. The hashrate represents the speed and processing potential of a network. The higher its value, the more processing power is being offered to the network by miners.

For the first time in history, it is estimated that between August 1st and 2nd it reached 300 Ehash/s. This means miners are active and competing aggressively. It may be a negative data if we consider that their profitability may decrease with this. But not necessarily, as a higher hashrate can also mean a higher reward.

The FTX collapse

Whether by implicating several powerful Americans, including celebrities, by the brazen way in which SBF, CEO of FTX, handled the crisis, or by the accumulation of so many disappointments for investors in this Bear Market, this event will be marked in the history of cryptoassets as the worst moment from 2022.

What brings some relief to investors is the arrest and extradition of SBF as a result of its responsibility for possible fraud. In a negotiation in which it is not known what he may have as a bargaining chip, his lawyers are trying to reach an agreement for him to respond in the United States, but not to be arrested before conviction.

Voyager and its acquisition

Voyager was already going through a difficult financial situation in 2022 and had even filed for bankruptcy. And things got even worse with the default of Three Arrows Capital, a huge and up-and-coming investment group that went bankrupt after being hit very hard in the Ronin bridge hack of the Axie Infinity game and the crash of the Terra network.

According to Voyager, he would have defaulted on his loans of more than 15 thousand Bitcoins and 350 million dollars in USDC. As a result, the brokerage, which until then had a good reputation, stopped customer withdrawals and became another victim of this Bear Market. About a month ago, CoinDesk broke the news that Binance would be interested in acquiring Voyager.

FTX was one of Binance's competitors in the business, but with its downfall, no other company was able to outbid the world's largest. The American regulatory agency agreed to the deal and Binance will pay the total value of the tokens held by Voyager (1 billion) plus 22 million dollars.

The year is not over yet

A year of Bear Market, but also a year in which important things happened and in which there was opportunity for great learning. Those who remained firm were able to take advantage of some opportunities to increase their portfolios and make money even in this difficult year, but, above all, to choose and study good projects to reap good results in the future. It was a little scary, yes, but it also brought a lot of hope.