It seems that the chain reaction that many feared would hit the cryptocurrency market negatively took a different turn, taking its worst effects to banking institutions. While, after Silvergate, two other important banks for the crypto market and for companies in the sector close their doors, the crypto market has already accumulated more than 15% appreciation in recent days.

In a super busy weekend we went from a big concern to hope that better days are to come. It seems that this difficult period really serves to separate the wheat from the chaff. In this article we summarize all the important events of the last few days and give an overview of the situation and its effects on the crypto market. So let's go!

The collapse of SVB and Signature

Since the FTX went bankrupt, American regulatory institutions, mainly the SEC (Securities and Exchanges Commission), are going through a fine-tooth comb on all companies linked to the crypto market. And that has put some of them against the wall, as the market contraction has ended up exposing the fragility of their positions.

This has even been one of the positive points of this Bear Market: exposing irresponsible management practices and how some companies earn high money with crypto assets from their investors, exposing them to unacceptable risks. The current moment is one of a lot of learning and can leave a very positive legacy. And that's exactly what the numbers are reflecting!

The domino effect

In a complex monetary system like the one the entire cryptocurrency market is based on, everything is connected. Any relevant event, negative or positive, has potential effects that can affect everyone in the system, whether investors or institutions. And it's been like this for just over a year.

We don't know exactly if the relatively bad moment we are in started with the Wormhole and Ronin bridge hacks, with the breaking of the Terra network, the FTX, or the combination of all of these, or even previous events that were not noticed in your gravity. The fact is that there was a contagion of illiquidity in several important institutions and that this had a big impact on the market.

The last notable episodes in this chain of events were the failures of three essential banks in the segment: Silvergate, Silicon Valley Bank and Signature Bank.

The Silicon Valley Bank

Silicon Valley Bank (SVB) is a commercial bank headquartered in Santa Clara, California, primarily serving innovative technology and science companies. It was founded in 1983 and over the years has risen to prominence in the tech industry, providing finance, banking and strategic advice to some of the biggest names in the industry, including some of the biggest cryptocurrency companies.

SVB was the first bank to offer banking services to cryptocurrency exchange Coinbase in 2013, which helped establish it as one of the largest exchanges in the world. In addition, SVB has offered loans and financing to other cryptocurrency companies such as Bitmain and Ripple. He was a benchmark for crypto companies until last week, when a fulminating crisis unfolded.

Closed by the FDIC

The fall in the cryptocurrency market and the non-payment of loans caused great damage to the bank, which had large companies in the crypto-asset segment as its debtors. The Federal Deposit Insurance Corporation (FDIC) concluded that SVB would not be financially able to maintain its banking operations and protect the interests of its customers, and ordered its closure.

Let's see a timeline of events:

- March 8, 2023: The crisis came to a head when the bank notified its customers that it was experiencing liquidity issues.

- March 9: SVB shares plunged 80% and the bank was forced to halt all new transactions.

- March 10: It was determined that SVB should be closed due to its high debt and risky lending to cryptocurrency companies.

- March 11: The New York State Department of Financial Services (DFS) announced that it was taking control of SVB's operations.

- March 12: The FDIC officially closed the bank.

The SVB crisis brought the market down for a few days and panicked some investors who feared that their funds would be lost as was the case with FTX. And the crisis with the bank ended up leading to the closure of another institution, which was also facing liquidity problems.

The Loss of Parity Between USDC and the Dollar

Anyone who is already used to the crypto market knows that USDC is one of the best known and most used stablecoins.

For those who don't know, stablecoin is a cryptocurrency paired with some other asset, which in the case of USDC is the US dollar, that is, theoretically 1 USDC = 1 dollar.

SVB is one of six banking partners Circle uses to manage the 25% of USDC reserves held in cash.

About these reservations, we will explain better:

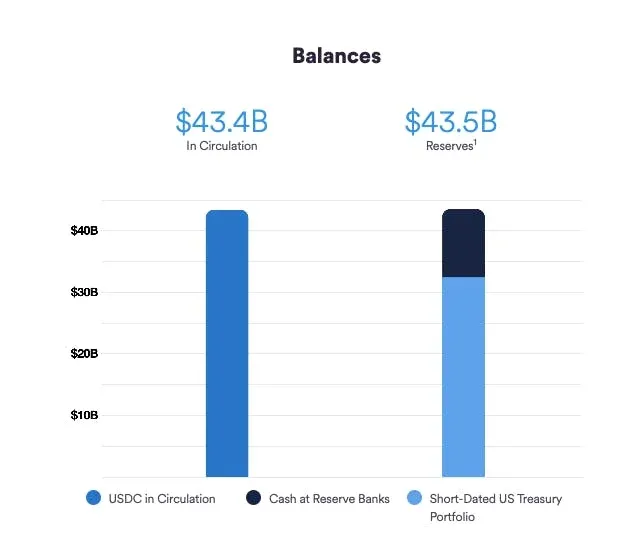

On the left side of the image, we have the total USDC in circulation and on the right side the amounts in reserves.

Note that in light blue it is shown that 75% of the reserves are in a short-term fixed income portfolio in US Treasuries, while 25% is in cash reserve deposited in banks, of which US$3.3 Billion is deposited in the SBV, totaling around 8% of the total reserves backing the USDC.

With the news of the possible insolvency and bankruptcy of the bank on Friday and a general scare in the market, many people sold their USDC, afraid of the same thing that happened in the Terra/LUNA crash with its stablecoin UST last year, causing the USDC to lose the peg, that is, the parity with the dollar.

It is still too early for us to know the developments and make a long-term impact on the USDC, but the crypto market calmed down with the news that the banks would be rescued by the US government, in a plan to help customers.

The Signature Bank

Signature Bank was founded in 2001. Since 2018, the institution has been involved in the cryptocurrency market with the launch of the Signet digital payments platform. Signet enabled real-time payments using blockchain technology and was being widely adopted by exchanges and other companies operating in the sector.

Signature Bank's focus on digital innovation and success at Signet has made it a significant player in the cryptocurrency market. But the fall in the market and the consequences of the problems faced by other important companies in the segment ended up having a negative and decisive impact, leading to its closure along with SBV.

Another bank closed

The closure of SVB led to a liquidity crisis in the financial market that affected several banks, including Signature Bank. He was forced to liquidate his cryptocurrency holdings to face the liquidity crisis. However, these sales led to a drop in the prices of cryptocurrencies, including Bitcoin and Ethereum, which in turn increased the bank's losses.

Furthermore, Signature Bank had exposed itself to significant risks in the crypto market by offering loans to companies in the sector. The New York State Department of Financial Services (DFS) had already instructed the bank to reduce its cryptocurrency lending and increase its liquidity, but this was not done in time to prevent its closure.

Intervention by financial institutions

The banking crisis involving SVB and Signature Bank resulted in major instability in the cryptocurrency market. The SEC and FED intervened to protect affected investors and to prevent the situation from escalating further. On March 12, the New York State Department of Financial Services ordered the closure of Signature Bank after it became apparent that the institution was experiencing problems similar to the SVB.

On the same day, American entities intervened to guarantee market stability and that investors from both banks could withdraw their funds in full.

Since then, the US government has continued to monitor the situation to ensure that investors are safe and that the market can recover. The intervention of the regulatory authorities was crucial to avoid an even bigger crisis and to protect the affected investors. And the market responded very positively!

Asset conversion by Binance

Another measure that may have helped the market to recover and continue to appreciate came from Binance.

It converted $1 billion into its stablecoin Binance USD (BUSD), Bitcoin, Ethereum and Binance Coin (BNB), according to a press release. The conversion took place due to an overhaul of the exchange's balance sheet. The objective was to ensure that BUSD maintained 1:1 convertibility with the US dollar. Converted funds account for about 40% of the total BUSD supply. The conversion to cryptocurrencies helped boost the market, with the price of bitcoin rising by almost 12% on Sunday, March 12th. The price of Ethereum also rose by around 10%. The market cap of Binance Coin, Binance's native cryptocurrency, increased by around 14%.

Turning around

The quick reaction of US regulators gave an extra boost to the market which encouraged investors. It is still too early to talk about an uptrend, but the rapid recovery has already taken place and prices continue to rise.

Some investors took the actions of US financial institutions as an indication that the crypto market has returned to being a relatively safe environment. We don't know when the next Bull Market will start, but it is increasingly clear that the Bear Market is losing its strength and the worst seems to be behind us.