The media is still using the words "organised" and "coordinated" in regards to the WSB short squeeze, and while that was true two days ago I don't believe it to be the case now.

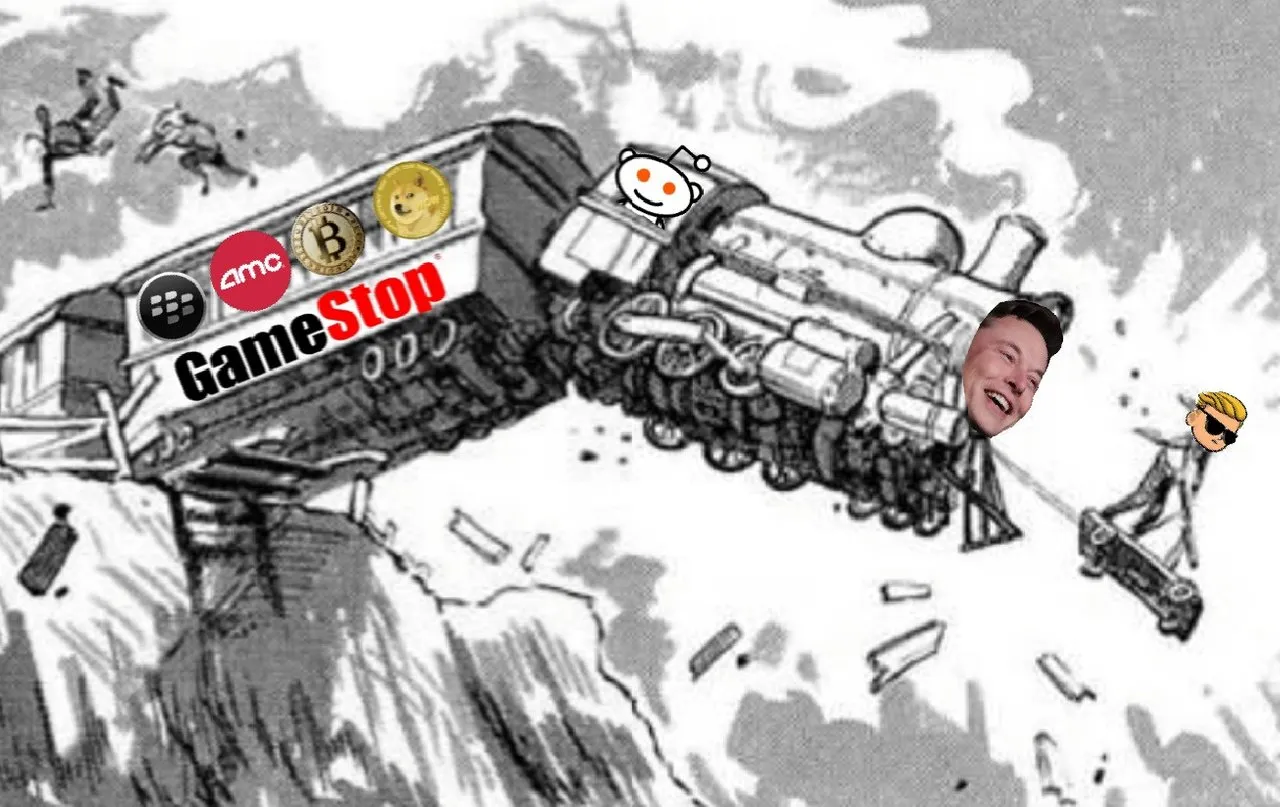

The WallStreetBets discord was taken down and the subreddit itself is hitting people with bans for trying to steer the movement in an actionable direction. Simply put, the "organised" movement is now nothing but noise. Chaos.

This is dangerous because amateur investors are still flooding in, late to the party but wanting to join in. Encouraged by screenshots of 800% gains in portfolios, the promise of millions of dollars. Or for the chance to "stick it to the man", many people would happily lose $500 if it meant a hedgefund investor lost 1000 times that.

The original "targets" all had similar traits. They were failing businesses (with the exception of AMC, they were hit by the pandemic mostly) that had billions of dollars of shorts against them. The short squeeze worked because of the sheer numbers of people concentrating their investments in such a small number of stocks.

Once the censoring began so did the increase in noise, and as more "targets" were called, the less concentrated the investments became. The short squeeze has turned into totally random pump and dumps.

For example, dogecoin fit none of the criteria for a short squeeze. People just made enough noise to attract the mobs attention.

In summary

Be careful Lions. Trading is volatile at the best of times. That isn't the case this week. This week is mayhem.