It is easy to get agitated when crypto goes down. But I realise that is rather delusional. It needs to be viewed from the grand scheme of work.

In this case, by doing a review of net worth in one's portfolio, things will get a bit clearer.

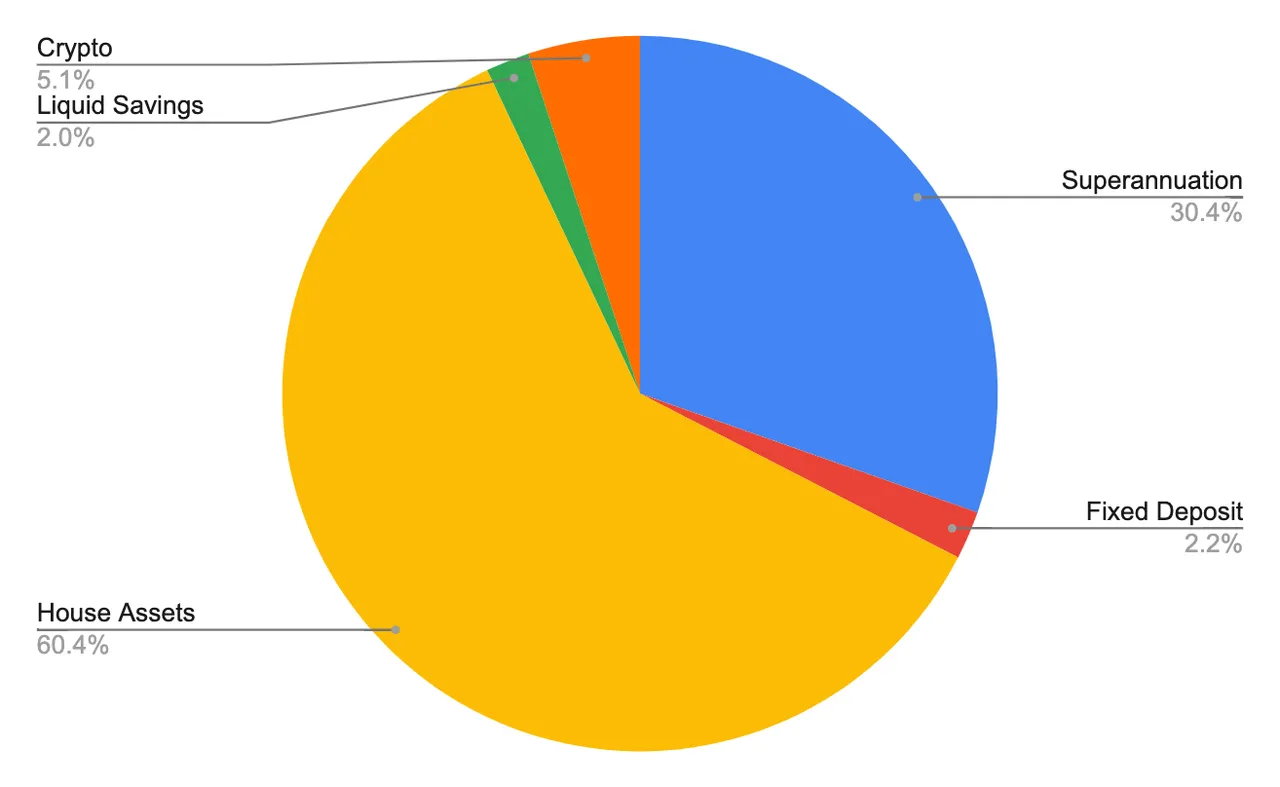

This is how my current portfolio assets looks like...

First, calculate the worth of every assets one holds. House assets, liquid savings, etc.. And chart it.

From the pie chart above, it can be seen that crypto occupies 5.1% of overall portfolio. The rest of the assets are less risky, and only crypto is the most risky.

5.1% in crypto, is it too much? No, I don't think so given that I have other assets to fall back on.

By keeping it low, it helps keep the mind sane when crypto tanks.

It is also clearer for one to see how one can limit risk when the crypto percentage goes higher in the bull market. In such cases, sell some crypto, take some profits and put into liquid saving for expenditure or fixed deposit.

This is a good exercise. I think all investor should create one for themselves.