Terra has seen a massive growth in 2021 with its stablecoin UST reaching the no.1 spot as a crypto backed, decentralized stablecoin, overthrowing DAI.

Terra Money is a protocol that in theory can create a multiple stablecoins, not just the USD dollar pegged TerraUST or just UST for short. It can create TerraEURO, TerraKRW etc. The way the stablecoins are created is basically by conversion of the native token LUNA to any of the other stablecoins. The dollar pegged stablecoin is dominant in the protocol and we will be looking only at UST here.

To create one new token that is equal to one USD, users need to convert LUNA to UST, burn LUNA in the process and mint UST. If the value of the UST is a bit higher at some exchanges, then users can mint UST from LUNA and make arbitrage on this. Also, if the price of the stablecoin drops below the peg (1 USD) on external exchanges, the protocol offers an exchange rate of one dollar in terms of LUNA tokens, so users can buy the UST on exchanges for lower prices and exchange it on the protocol for one dollar in LUNA and make a profit.

What this means is basically the native token is acting as the collateral for all the stablecoins, providing an option for conversions in both ways. (sounds familiar? 😊).

Here we will be looking at:

- Terra LUNA Supply

- Terra LUNA Price

- Terra LUNA Market Cap

- UST Market Cap

- Debt

The period what we will be looking at is Jan 1, 2021 till Feb 18, 2022.

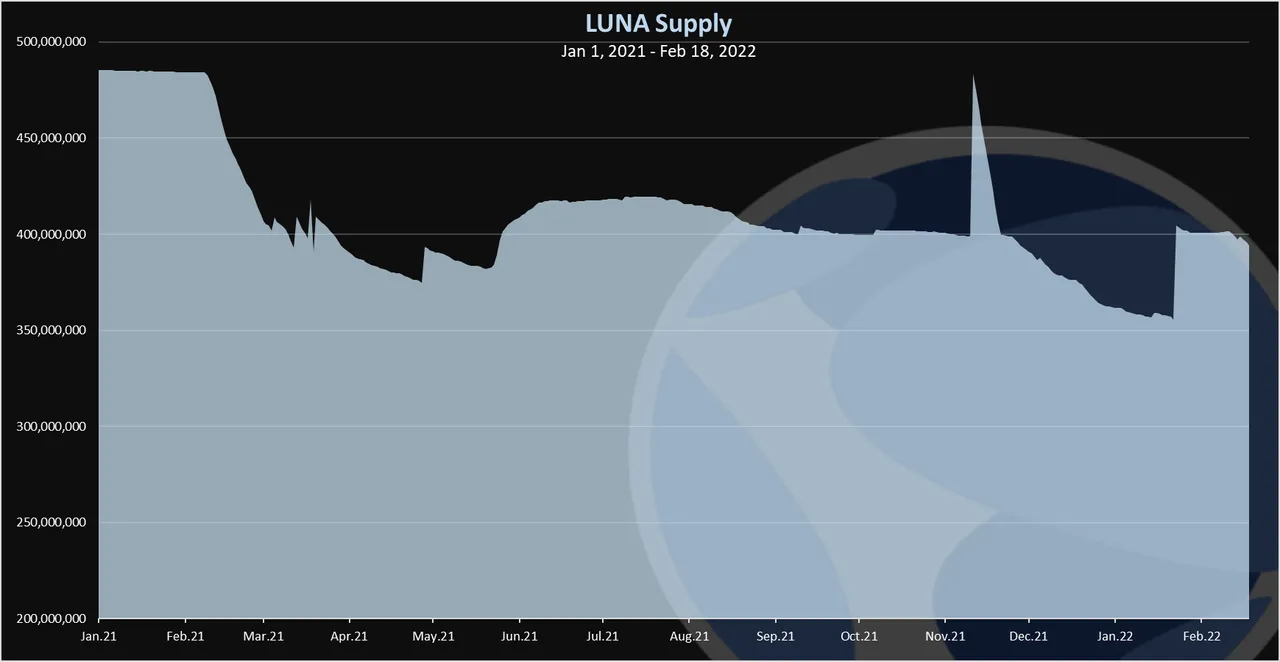

Terra LUNA Supply

The native protocol coin LUNA is used to mint and burn stablecoin UST. Because of this its supply can fluctuate depending on the conversions between the stablecoin token, UST for example and the governance token. The inflation of the token is on top of this.

Here is the chart.

The data for the supply has been extracted from messari

At the beginning of 2021 there was a 485M LUNA in circulation, and at the moment there is 394M LUNA in circulation. The LUNA supply has went down in the period. This is mostly because of the LUNA conversion to UST. A lot of LUNA has been used to mint UST.

The sharp increase and then decrease in November 2021, to my understanding was a release of some protocol owned LUNA and then convert that immediately into UST. At the end of January there is another spike in the supply. Not sure where these tokens come from, maybe some of the protocol or dev funds.

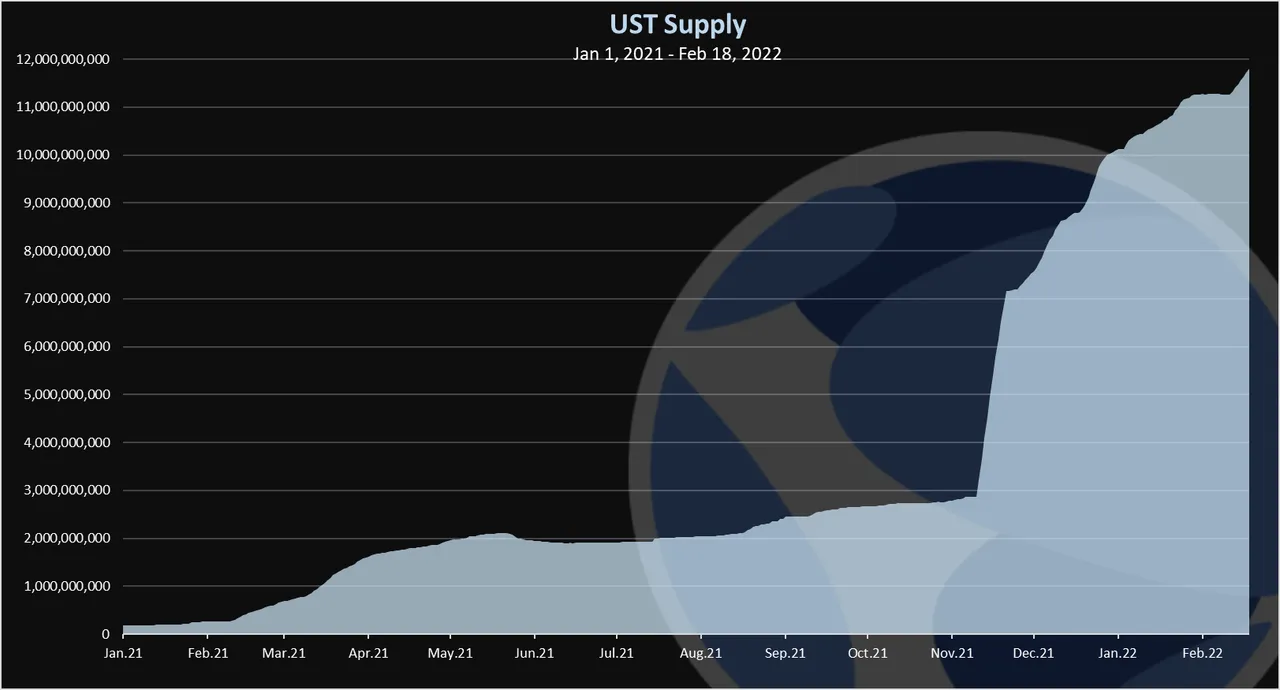

UST Supply

As mentioned, UST is created from LUNA, in a process of converting LUNA to UST, burning LUNA and minting UST.

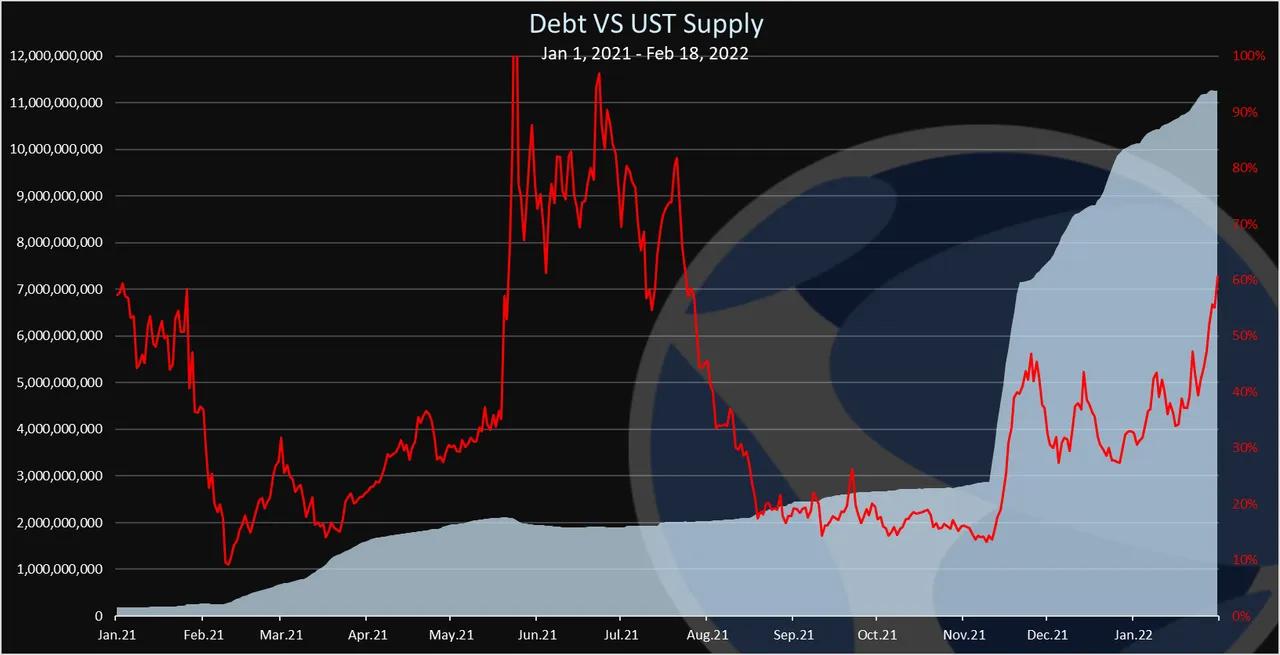

We can notice the sharp increase in the UST supply in November when a large amount of LUNA has been converted to UST. The UST supply now stand at 11.8 billions. Almost all of it was created in a single year.

This amount of UST, in theory can be converted back to LUNA, increasing the supply of UST

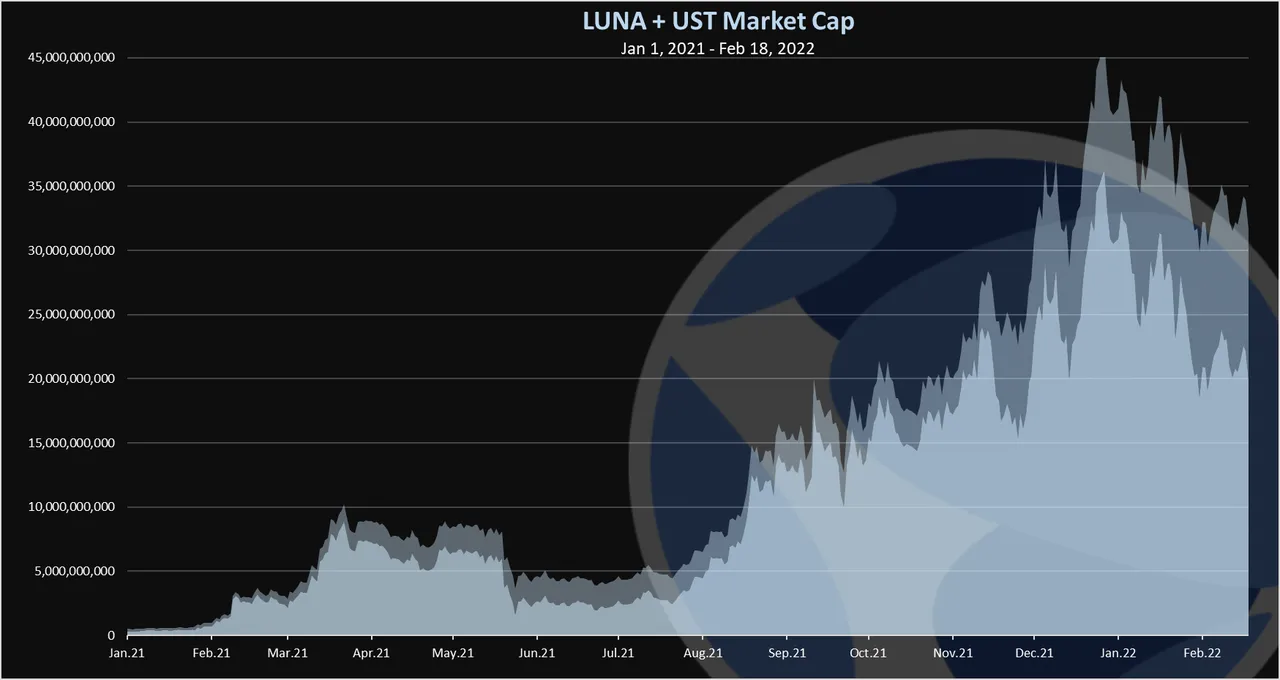

LUNA and UST Combined Supply

Since in theory all the UST can be converted back to LUNA we can add this virtual LUNA supply to the current one. When we do this, we get the following chart.

In periods when the price of LUNA drops, the virtual supply increases. This was the case back in the summer 2021 when we had a drop in prices for crypto, that caused at one point the virtual supply to double the amount of circulating LUNA, from around 400M to 800M.

In the last month, again we have this increase in the virtual supply because of the drop in the prices.

Terra LUNA Price

To get the LUNA market cap first we need the price. Here is the chart.

The price of LUNA has experienced a massive growth, starting from $1 at the begging of 2021 up to $100 at the end of 2021. In the last months it has been in a downtrend and at the moment is around $50.

Terra LUNA Market Cap

The chart for the Terra LUNA market cap looks like this.

Notice the light color on the top, that is the added market cap from UST.

The LUNA market cap at the moment is around 20B and with the UST market cap it reached more then 30B. At the peak the combined market cap of LUNA and UST was 45B.

Terra LUNA Debt

Note on the wording: I haven’t found any official papers from the LUNA protocol that are naming this as a debt. I’m naming this myself since from my understanding this additional stablecoins minted from the underling assets act as a debt.

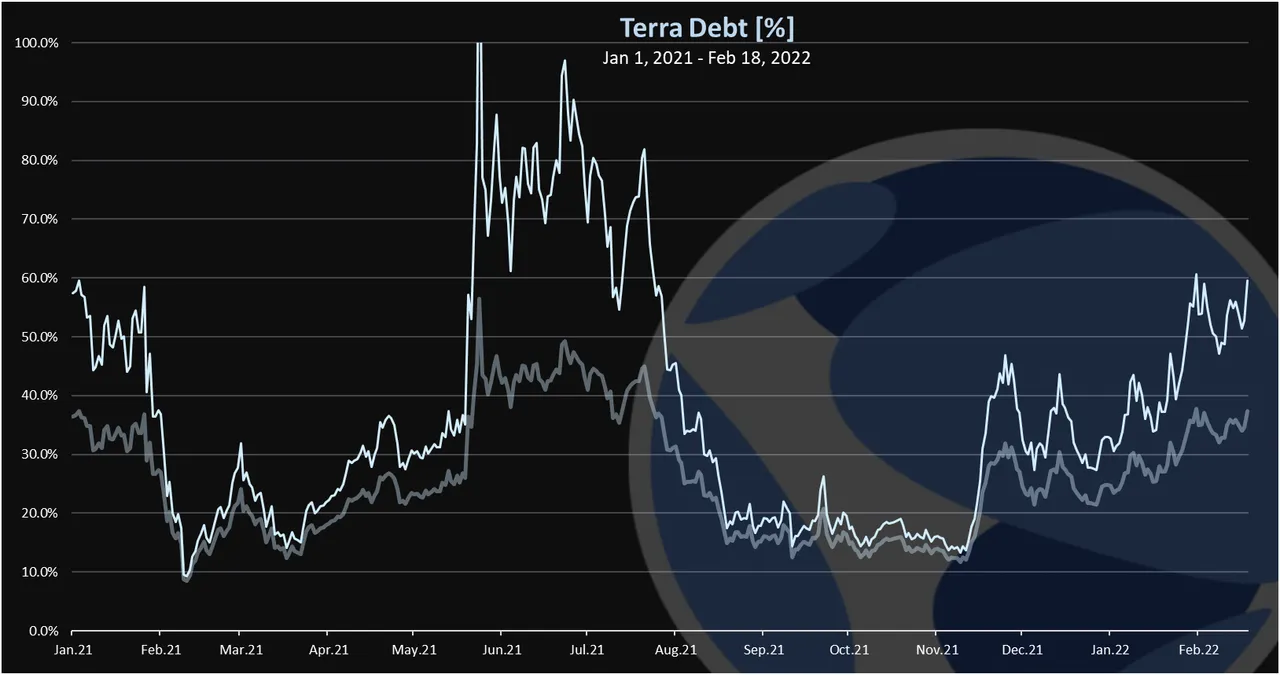

To get the debt we calculate the ratio between the UST market cap and the LUNA market cap. The thing is the LUNA market cap can include the combined market cap from the LUNA token and the stablecoins, so we have a scenarios when the stablecoins market cap is added or not.

Here is the chart.

The light line is with the UST market cap added to the LUNA market cap.

The debt has been swinging in a wide range from 10% up to 100%. At the moment the debt is at 60% and if we add UST to the overall LUNA market cap it is around 40%.

Unlike the Haircut rule on the Hive blockchain that puts limit on the debt, the Terra blockchain uses a tax system to control its debt.

The tax system depends on the current economic situation but basically works like this.

- Demand for stablecoins goes up lower the tax

- Demand goes down increase the tax

When the demand is up and more stablecoins are needed, the tax is set lower, meaning less LUNA burned in the process of conversions, resulting in more LUNA supply and when the demand is down, a higher tax is set resulting in more LUNA burned in the process.

The end result of high taxes is LUNA being priced less then what it is on the open market when making the conversions, ergo you will get less then $1 for 1 UST.

UST is still in early stages and in its existence, it has faced two major downtrends. The first one in the summer of 2021 and the last one just now. In both of those periods the price of UST has maintained its peg amazingly well, with a tiny deviations from the peg in decimals. It will take some time and beating from the markets for the token to prove itself, but for now it seems to works well. The 12B UST market cap is a statement by itself.

All the best

@dalz