More rumbling about the Hive power down period? Well it is certainly one of the important metric of the chain and its overall tokenomics.

I have posted on the topic before Hive Power Down Period. This was back in July 2020. Since then the DeFi boom has started and introduced a whole new layer and ideas about tokenomics. Can we learn and implement some of them into the Hive tokenomics and its power down period? Lets take a look.

For starters just to note the other chains and the DeFi tokens unstaking period for reference. Most of the chains have a few days unstaking period. Somewhere from 3 to 21 days. The DeFi tokens have zero unstaking period. You hit the unstake button and that is, tokens are unstaked immediately. Hive with its 13 weeks power down period (1/13 each week) looks like a dinosaur in the industry. This long unstaking period can deter investors from staking Hive and earing curation rewards.

The long unstaking period on Hive is not just bad things. It has few good things that are very important. First it prevents exchanges staking and interfering into governance (in most of the cases 😊). This is a very important thing, something that @dan has pointed out in his book as well. Most of the tokens with stake governance model suffer from central exchanges gathering a lot of tokens and influence the governance. Other positive thing is that this long term unstaking period creates more loyal user base, or at least is not attractive for speculators only, at least for staking and governance purpose.

Unstaking Period Options?

What are the options for the power down period. One of the most mentioned and popular around here is the four weeks power down period. It is simple and effective. Although it can bring some questions about the exchanges voting. In summary the power down period options would be:

- Simple shorter power down period (four weeks for example)

- Instant power down for a fee

- Internal market for Hive Power to Hive

- Power Down period defined by the user

The first three options have been discussed already in the previous post linked above. In short, the first option (four weeks) seems to be the most preferable. Its simple and something that Hive users are already accustom to. It is the option that most of the tribe tokens are going for as well and we don’t see much discussion there about it.

The second option is something that @theycallmedan mentioned and it gives the ability for Hive to be powered down instantly for a fee. Say you pay somewhere around 5% to 10% fee, that is burned. Instant power down is really investors friendly as in crypto four weeks is still a lot of time, and people usually want their tokens immediately. The con of this is maybe less security, because if an account is hacked it can lose all the tokens. Although there can be a workaround this, adding more security (second account approval?) for the instant power down operation.

The third option is something I proposed as an effort to introduce an open market forces to the power down period. It was mentioned by others as well in the past, I believe @scipio has a post about it a long time ago. The basic idea is to trade Hive Power for liquid Hive on a internal market, just as Hive is traded for HBD.

User Defined Power Down Period

The instant power down period and the option to trade Hive Power to liquid Hive, include a sort of fine in them. If you want your Hive Power immediately you will need to pay a fee or trade it on the market where Hive Power will be cheaper from liquid Hive.

Why not instead of punish the users for shorter power down period, try to reward them for longer power down period?

This concept is stealing from some of the DeFi tokens out there where the longer you stay the higher the rewards. The geyser model for liquidity providers on DEXs. Even better the curve.finance model for yield amplifier. On curve users have options to lock the CRV token up to four years for better return on stable coins, increasing the yield from few percent up to 30% to 40%.

Why not try to implement something like this for Hive. My personal opinion for Hive power down period would be the shortest as possible (a week, a day?) and then give higher APY if the user choose to power up Hive for a longer period of time, years included.

For example when you power up Hive, you have the default option where your Hive will be available to you after a week (day if possible?) after you hit the power down button. In this case you will earn X amount of APY. Just as an example say 8%. You also have an option to lock your Hive for months, say six months for an APY of 12%. If you choose to lock your Hive for up to four years you get an APY of 30%. The numbers are not real, just for the example.

This option will still introduce open market forces to the power down period, but instead of punish users for shorted power downs, it will reward users who will stay longer in power up mode.

What about governance?

If the shortest power down period for Hive is a week (a day if technically possible?), with options to choose a longer period for better rewards what will happen to the governance then?

These short periods will allow exchanges to vote on witnesses and proposals. Will the chain be at risk of centralization then?

I’m not totally familiar with the topic but I know that when a user delegate Hive Power he doesn’t delegate voting rights. This needs to be done with a separate operation on the chain, setting up a proxy for voting.

What this means that even now staking rewards are separate from governance!

Can we separate the staking rewards mechanism, power down period from the governance? With the latest HardFork newly power up tokens are eligible to vote after three day. This prevents overnight attacks as we have seen in the past. Can we make it so, that in order for a user to be eligible to vote on witnesses and proposals he need to stake his Hive for at least 13 weeks (or even more?). This is an option that can enable the chain to introduce more dynamics into the power down period, make it more attractive to investors and at the same time keeps the security and the decentralization of the chain.

This is just some thoughts and ideas about the power down period. There are more options, or some combination from the above. The four weeks power down period looks the easiest and the simplest. But I think more complex tokenomics is coming up overall in the space so why not try to add up a bit to the power down period.

What are your thoughts?

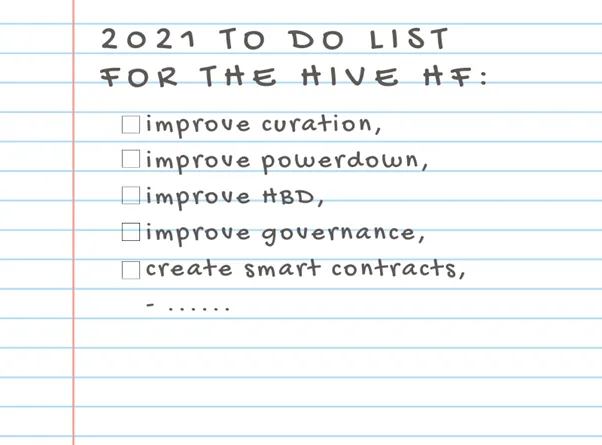

This is a post on the 2021 To Do List For The Hive HardFork:

All the best

@dalz