Maybe we should start here with a little narration. Let's assume two individuals A and B are into the corn business. Both have five hectares of land to fill with it yet they lack the capital. So what did they do? They both started small with one hectare. The produce was good and it was market demanding. A decided to sell and remain a few seeds to keep planting at only one hectare while B added up another. Keeping this mentality for the Next five years, who do you think will be more profitable? The answer is very obvious.

I once said if you are not financially free in the next five to a decade, you have yourself to blame. Don't get tired of this preaching, if we can get more millionaires in the next decade, it will really boost global businessing. The world into a phase of ‘abundant of abundance’. Many are in doubt anyway; the idea of if artificial intelligence takes over the job industry, what is then left for us? It is ALL about what you know or perhaps more professionally put, you are still clinging to the old ways. I have said it several times, ‘the future needs investors not workers’.

source

The earlier one evolves, the better. The 90/10 rules is about to take a big shift courtesy of AI, web3 and blockchain tech. The current flaws of this era is that people have become so used to and very devoted to the area of specification and are on the other end very poor when it comes to investing. So they were taught; it is the job that puts food on the table. Many live from paycheck to paycheck. The best they can do is save for retirement and they fan themselves so very well. Little do they know, fiat depreciates.

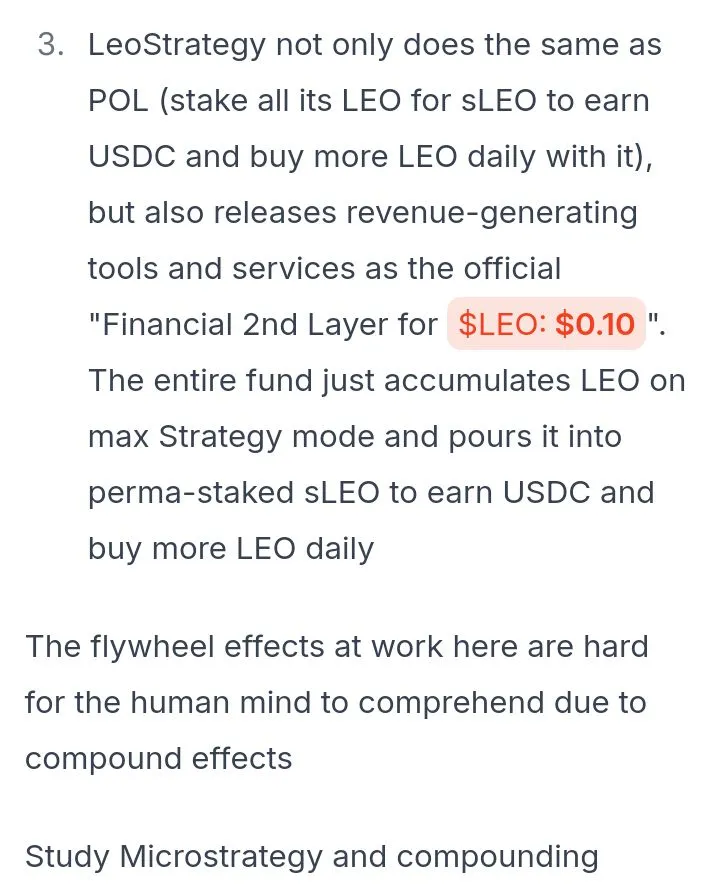

Get this quick tip, Fiat savings is not really an investment (especially when it is your country’s currency), it carries long term loss. have covered many related articles about this, even the US Dollar is not safe. A US citizen will sure tell your their dollar has indeed lost value over the last five years. So is it also in Nigeria and other parts of the world. So what brought about this article? I was look at the current growth of LEO tokens and beyond that, I was looking at these three strategic compounding activities surrounding it. Take a good look at the ok image below.

Screenshots for Threads page.

You can check full thread details here, in case you wish to comment. I guess the images above make a clear definition of what compounding is. Another thing you have to note here is there; a compounding investor cannot be classified ordinary. What do I mean here? Yes, the future belongs to investors yet those who will reap the best of rewards are those who learn the compounding trick. The best market results are not NOW but later. The advantages of compounding are very numerous. It helps tackle loss due to a dying market, your rewards are flowing in heavy to salvage the Red candle days.

The mentioned three as you can see are buyers. Very impressive, don't you feel you could be the one owning one of those accounts? I am seeing one of the favorite words of @taskmaster4450le here; ‘flywheels’. He did talk severally about this, especially last year. The flywheel effect is in action. My take home here is that many should learn from here. Individual investors can set their flywheel into action only if they understand the hedge of compounding.

To conclude, let me add, this goes beyond Hive or InLeo frontend and even the online space. Even in the offline space, a good investor will have to learn how to continually reinvest. I have seen many businesses shutting down because they took lightly the need for compounding. When the market shifted and interest slipped they had to face bankruptcy.

As we speak, when the future economy is awaiting compounders, some are even yet to take a lucrative investment step. Financial intelligence needs to be taught vastly. Many will feel robbed when the entire table turns. Of course it will be ignorance. AI will take over the working industry, be sure of this, web3 will become a more rewarding base platform and blockchain tech will help in this fair distribution. The world will shift grounds from the ‘human workers base’. The only question to ask yourself is, what am I investing in the next broader one is thinking of its compounding effects.