Prologue

- Presidential Coins

The previous wave of presidential coins wasn't perfectly "missed," and for various reasons, we painfully developed a new set ofAInews and trading information push services. Recently, with new presidential coins - Milei andLIBRAemerging again. On Monday, when a friend asked me about Milei, I was completely clueless and gave a random response (I really knew nothing about it).

- Midnight

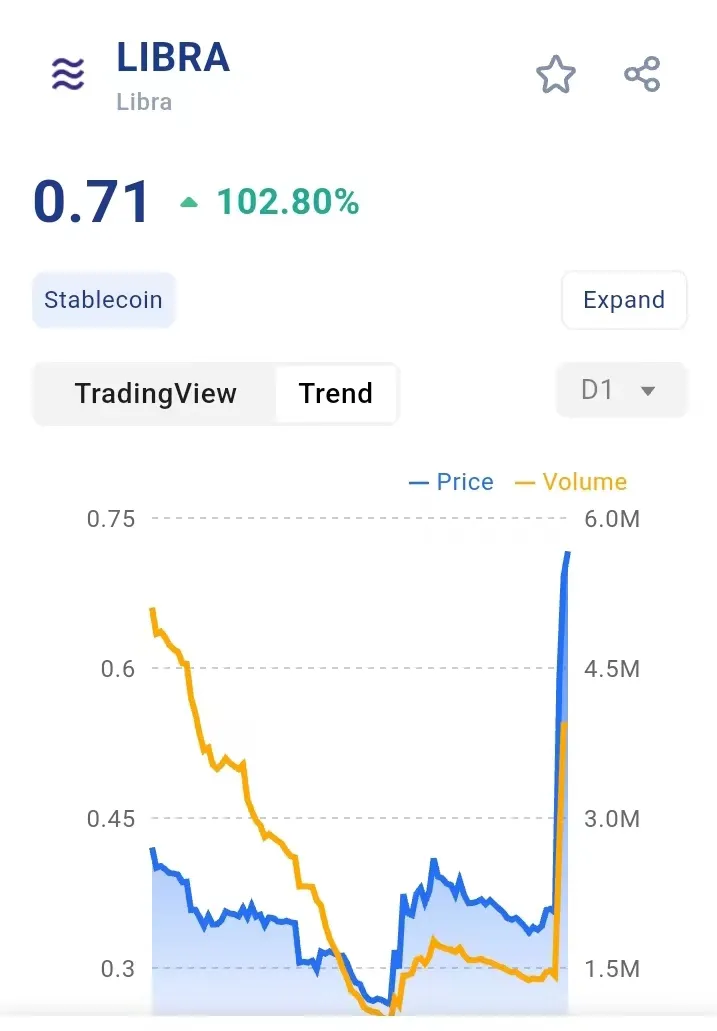

Then at midnight, thatLIBRAthing surged 130% in 10 minutes (actually, the story is quite dramatic - it only reached0.7, and many people haven't even broken even). My small AI pushed a bunch of information to me. That's when I started paying serious attention (Actually, AI sent me lots of info aboutLIBRAand Milei, but because it was Friday and I was busy with other things over the weekend, I technically saw but didn't really focus on any of it). I casually reviewed the messages myAIhad sent me over the past few days. Looking back now, it's almost laughable - another project designed to fleece retail investors mercilessly. Through AI tracking, I followed those whale accounts - their entry price was around 2.12 (7 AM), and exit price around 0.16 (12 PM), losing 96% onLIBRAin 5 hours... Fortunately, it was a Friday/weekend... otherwise, I might have become a victim too.

Analysis in Retrospect

- Before

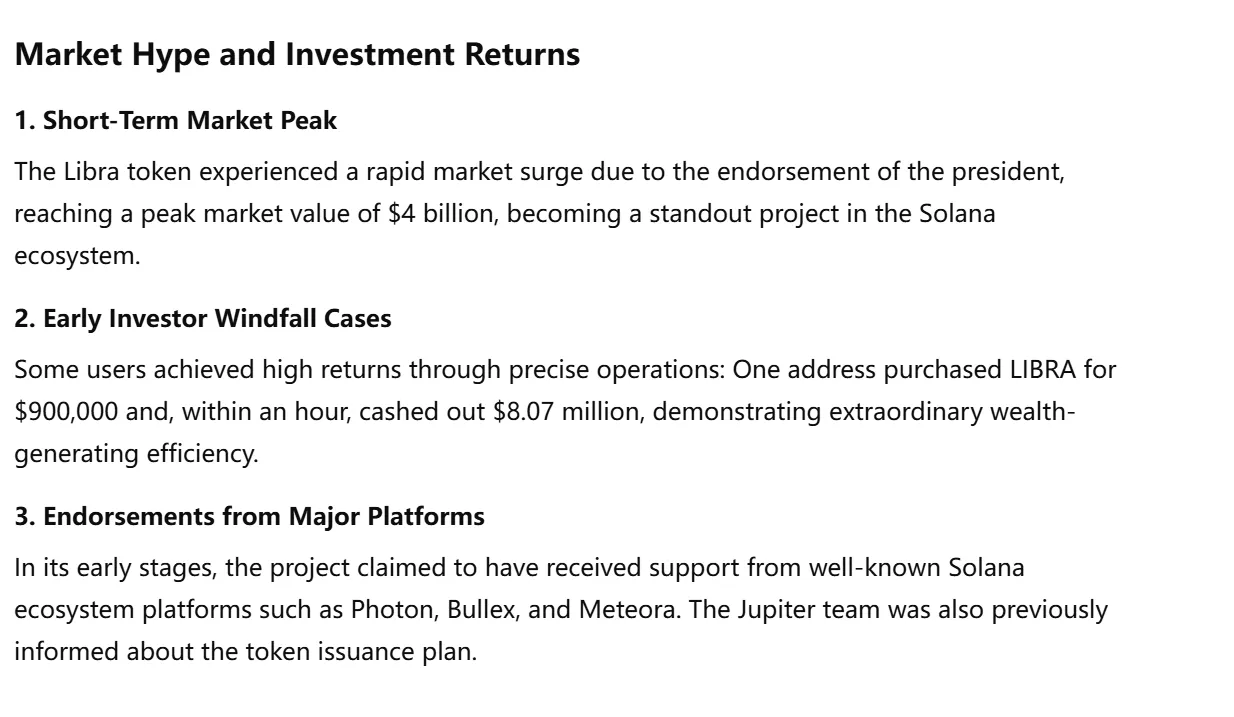

To summarize briefly, before that day,AIpushed information based on real-time news:LIBRAwas a presidential-endorsed project, market enthusiasm was high, whales were making millions hourly, and multiple leading institutions were tracking, supporting, and endorsing it.

- After

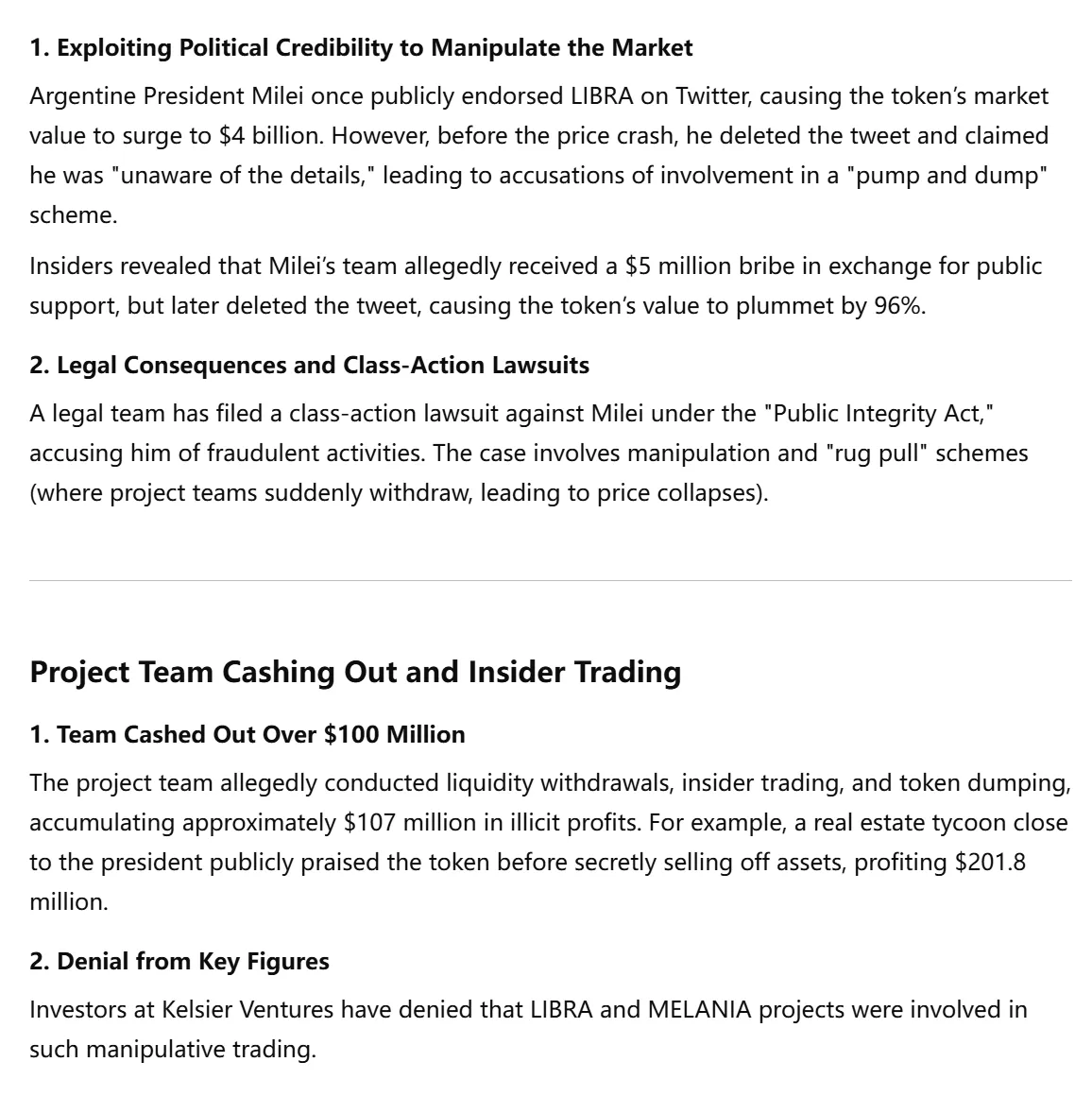

After February 15th, whenAIpushed real-time news updates,LIBRAbecame a presidential "scam," with deleted tweets and finger-pointing. It was embroiled in commercial bribery scandals, the project team cashed out $100 million, multiple leading users lost millions, and were preparing legal proceedings.

- Reflection

Looking back at this information now, it's quite amusing! From presidential credibility endorsement, star headline project, to presidential "scam" and a retail-fleecing garbage project - the entire transformation took less than a day (just a few hours). Fortunately, I couldn't get out of bed early and didn't seriously analyze it. The market movement just passed by. Even theAI'ssummary analysis changed its tone so dramatically!

Brief Overview of AI Financial Analysis Logic

Principle

Current mainstream LLM models, including others in the market, basically use the Q (Query), K (Key), and V (Value) matrix mechanism from the Transformer model. This thing's overall original logic is essentially table lookup. In fancy terms, it's dynamic table lookup. Simply put, it first takes the question (Q), then dynamically indexes keys (K) and weights, associates specific data (V), and finally outputs content after multiple such back-and-forth queries (matrix calculations) within the model.Example

For instance, asking "Find tech stocks with high growth potential in the next 3 years?" First, the AI model converts the question "characteristics of tech stocks with high growth in next 3 years" into a vector (Q), then builds related feature sets (K) like company R&D investment, industry growth rate, etc., and collects specific data for these features (V). Next, the AI model calculates the correlation between question vector Q and each feature vector K to evaluate which features are most relevant to the goal. For example, if the question focuses on "technological innovation," the "R&D investment ratio" feature would score high correlation. Then, the AI model normalizes these correlation scores to get weights for each feature. Finally, the AI model performs weighted summation of the specific data (V) based on these weights to generate a comprehensive signal. For instance, if a company's R&D investment data has high weight, this data will significantly influence the final decision. Through this process, the AI model produces a scored list of tech stocks, each with detailed recommendations. For example, Company A scores 92% due to high R&D investment ratio and rapid expansion in emerging markets. The AI model also generates investment advice like "focus on semiconductor and AI sectors, especially companies with core technologies expanding into overseas markets."Conclusion

Actually,AI'sfinal output mainly relies on the V (Value specific data) of Q,K,V matrices, but the result content isn't simply raw data, rather it's the result after deep processing by the model, demonstrating intelligent screening, aggregation, and reasoning capabilities for V. The Q,K,V matrices in non-fine-tuned large models don't change internally. Current mainstream AI models are from several months or a year ago (Deepseek is from July 2024, ChatGPT is from 2023). New information mainly relies on user input context (there's actually a lot of subjectivity here - from the very beginning, it's already examining user thinking and viewpoints).

END

- Drama

Investment ultimately depends on the individual - investment requires caution, and tools and authorities actually can't determine human nature in final decision-making.