Earlier this month, when Hive was around $0.30, I promised to give away Hive today, as a challenge to motivate myself to lose weight. The higher my weight was this morning, the more I would give away to the people who made the best predictions. And since I didn't reach my goal weight, I needed to come up with 113 Hive on top of the 210 liquid Hive I had in my wallet. I could have powered down, but I didn't want to make it too easy.

Yesterday, I sent the BTC I'd bought at $52k this week to Binance. I saw that Hive was going up by 15%, so I made a low bid at 1120 sats and hoped a market buy would be cheaper the next day. I'm a dip buyer, not a momentum buyer. I don't want to follow the herd, even when it's profitable. This mentality helped me to avoid buying the top when trading random shitcoins, but also made me sell my first bitcoin when it went from $90 to $110.

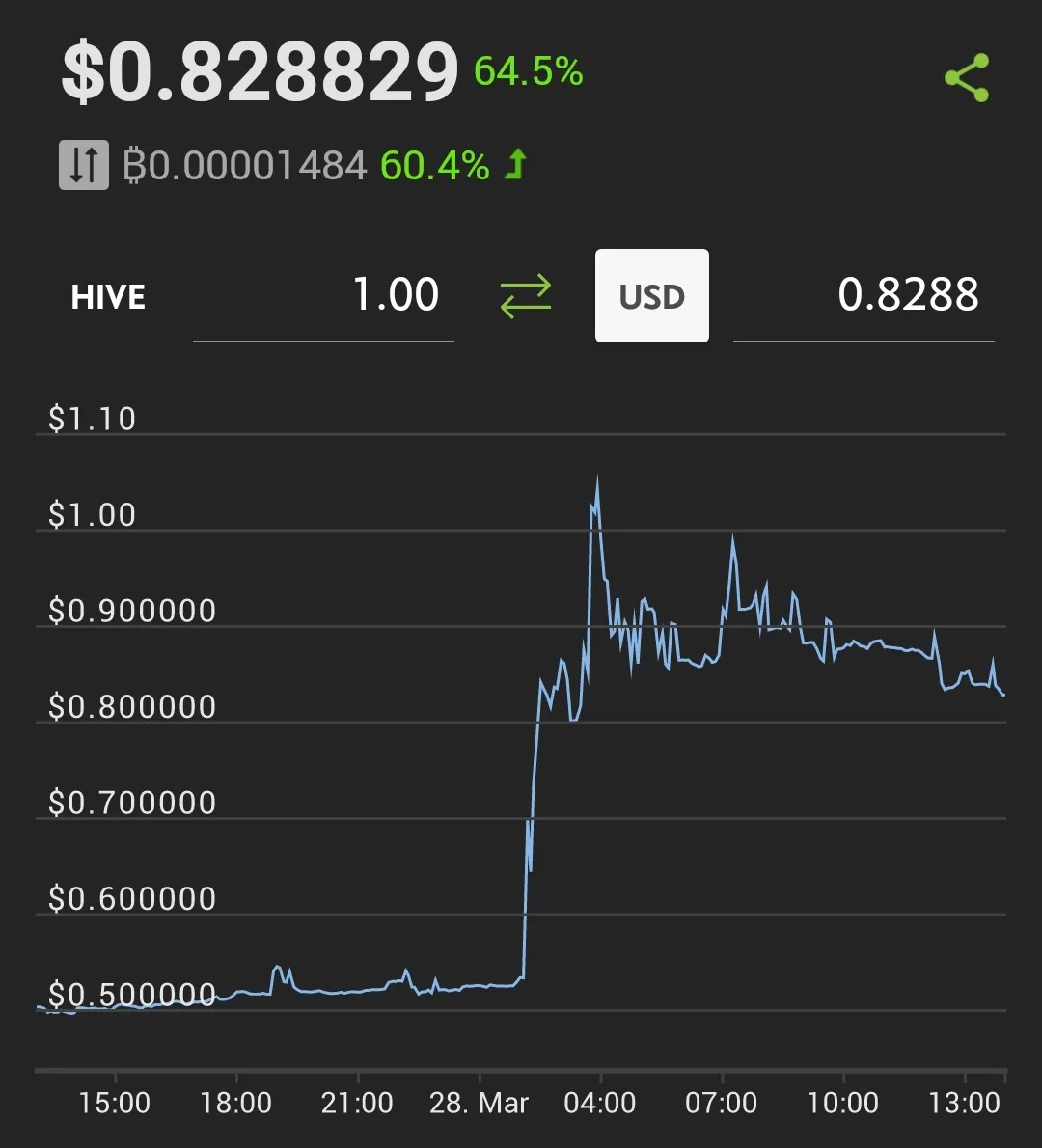

Then I saw this when I woke up this morning:

It was supposed to hurt, but not that much!

OK, I don't really hate that the value of my Hive Power went up by 65%. It's nice that we're above Steem, and it's nice to give votes for more than a cent or two. I'm still not powering down and not selling. As someone said in a comment: it's like your house going up in value: good news, but it doesn't benefit me immediately. Since most of the volume was on Upbit, this must be speculation from our Korean friends again. Maybe people are interested in coins related to publishing content again after Theta Network zoomed into the top 10? I don't know anything about Theta, but it's described as a "decentralized video delivery network". Or maybe Vitalik mentioning the Hive ecosystem in his essay about legitimacy helped us.

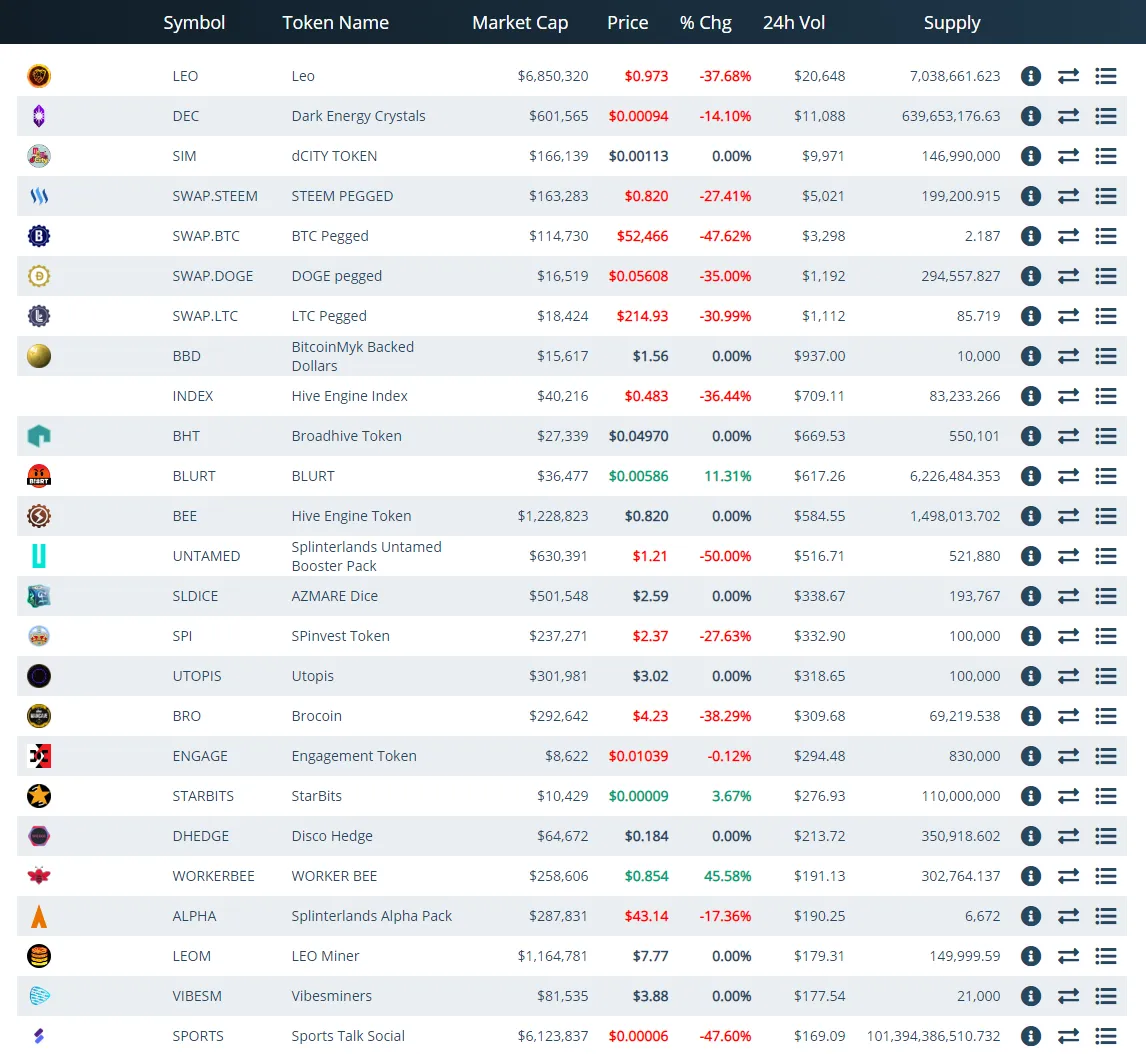

The pain went away when I realized I could fund the shortfall by selling Hive-Engine tokens. I sold 60 BEE and the 7 LEO I hadn't powered up yet (sorry). The price of BEE hadn't moved an inch. Maybe it makes sense that it tracks Hive closely? I don't know. Now that there's a whole ecosystem of tokens around Hive, I guess you can make money from arbitrage when you have time to figure out which token prices are lower or higher than expected, or deviating from other markets. Some token prices went down this morning, but not by 65%:

There's more green now. In the end, I regretted selling all my liquid Hive-Engine tokens that had any value. I bought 30 HIVE on Binance, and bought back 20 BEE and 5 LEO.

So the money's in the bag, but the official giveaway result post will take a while.

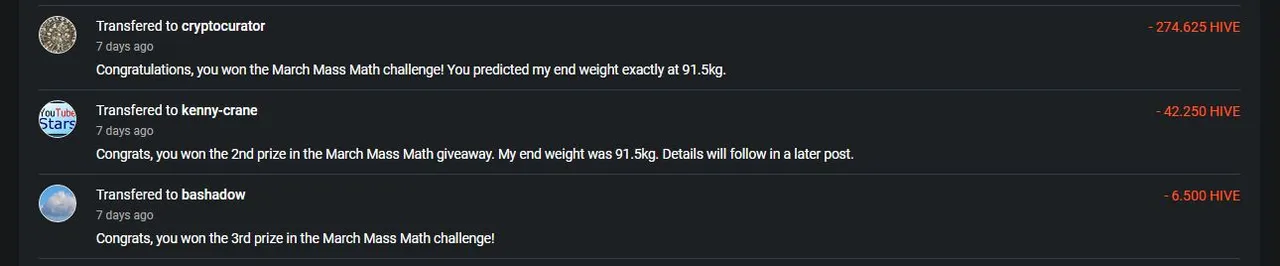

Update: In the meantime, I should at least post an overview of the payments. It was easy to distribute the prizes, since the highest prediction of 91.5kg was exactly correct.

Meanwhile, next month's challenge will be a chance to win 20 Hive SBI for 20 participants, and you'll have to work for it. Rewards will go to whoever has more days in April with 10,000 activity points on Actifit or 5km of running/25km of cycling on Exhaust. Let me know in the comments if you're interested in a bonus for tracking your exercise.