The 2025 run is going to surprise a lot of people.

Many are wrongfully comparing it to 2021.

https://x.com/intangiblecoins/status/1858653921020928131

I'm going to need to repeat this often:

2025 is NOTHING like 2021. Targeting a high under $200k when we are trading at $90k+ and 2025 hasn't even started is a silly paper-handed gesture. Best strategy is to not have a price target and just wait 12 months till next November and take gains there.

https://x.com/saylor/status/1858496146026467378

Wow he bought the top again... awesome!

Saylor's Bitcoin Standard playbook is turning out better than anyone's wildest expectations. Just like Blackrock's iBit ETF is outperforming everyone's wildest expectations. Gee wiz, it kind of seems like all the institutions that are embracing Bitcoin right now are getting historically large wins. Microstrategy has beaten everyone to the punch, but this isn't boxing. There's still plenty of spiked punch leftover for the laggards. Time to get crypto drunk.

Saylor has hacked the system.

Dude buys a shitload of Bitcoin using unsecured low interest debt and then gets rewarded with a stock price beyond imagining. This is like the ultimate double spend attack and people are loving it. All the benefit of both BTC and MSTR absolutely skyrocketing.

Many are saying MSTR can't keep up this momentum... and they are right. The problem is the timelines are wrong. MSTR absolutely can keep mooning with all the rest of the shitcoins, because that's what MSTR is. The problem is that many Bitcoiners don't seem to realize this because MSTR is viewed as a proxy to Bitcoin and a friend of Bitcoin. They won't come to the hard realization that MSTR is actually just a shitcoin just like everything else until it crashes 95% or more. Of course that won't happen until the 2026 bear market.

Constantly mistaking the narrative.

The interesting thing about "institutional adoption in crypto" is that we've been guessing it wrong this entire time. First we said 2017 was institutional adoption because they added a futures market. Then we said summer 2019 was institutional adoption because of the BAKKT exchange FOMO. Obviously that went nowhere. Then again we said 2020 was institutional adoption because we had billionaires like Saylor and Musk aping in like degenerates. This was also false.

However I think this time we finally have it.

Blackrock and Fidelity adoption is for sure the institutional run.

The real one.

Or at least "A" real one.

There are still many institutions left to onboard.

The obvious examples are big banks, Apple, Google, Meta, Amazon, etc.

Clearly this is just the beginning and there's no telling how many we'll onboard in 12 months.

The entire point of a currency is a LACK OF TRUST.

Currency allows us to transact with strangers and even people we don't like without having to worry that the value we are receiving is sound. Many grassroots anarchists rightfully point out that we should not be celebrating our centralized enemies coming to sit at our table. While it shouldn't be greedily celebrated it always should have been expected. Disruption and adoption are often the same thing. Deals wif it.

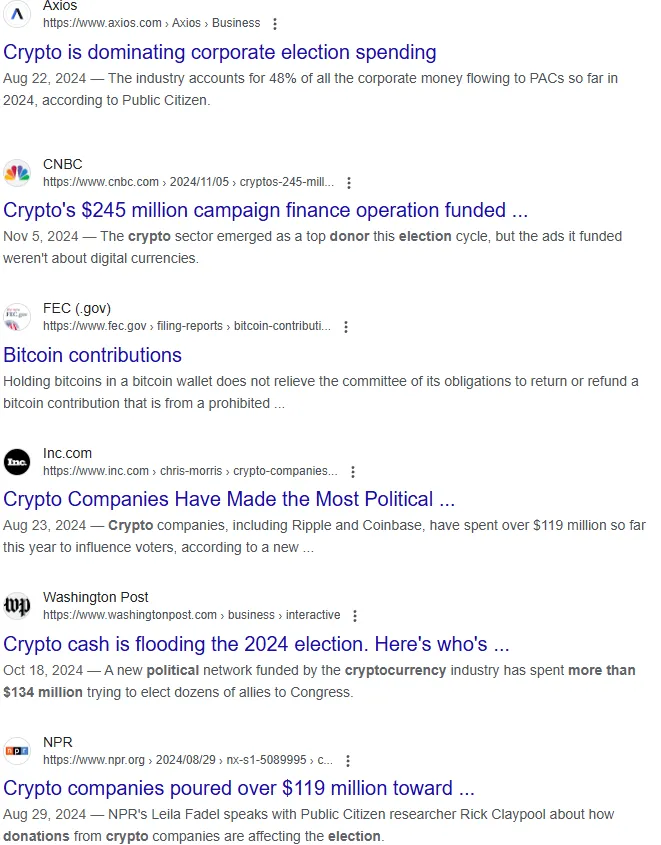

Crypto had the most campaign donations.

Think about how insane that is and how far we've come. We've gone from a regulatory punching bag to doing what all big entities end up doing: buying off the regulators and politicians to get what we want. Imagine what happens when crypto goes another 10x... 100x. At a certain point (likely this upcoming bull market) crypto will be a bulldozing force that no government can withstand. Love to see it even though the way it's being done is a bit on the nose. Nothing subtle about this strategy.

It's also worth repeating that Polymarket was able to predict the Trump victory exponentially faster than traditional polls or media. Expect to see more situations in which uninhibited flows of data trend to beat out the competition. This is only the beginning.

https://x.com/edict3d/status/1856002689877811365

Drawing lines.

I did not find resistance with this line but surprisingly more of a support at this point.

Our last golden cross has come through and Bitcoin is ranging at all time highs.

Surely there will be victory selling at $100k.

I'm ready to go 10x long at $85k if we get a nice flash crash from $100k.

But where did this line come from?

It dates back all the way to February where the 200 daily moving average basically went up linearly until June. That same line intersects the trend we had during the summer hitting several key support and resistance areas. I'm actually shocked I was able to predict that this line would be so relevant... as it was tested four days straight right after I drew it. Definitely interested to see how this turns out in the short term.

But what of the long term 2029 cycle?

Why am I claiming here that institutional adoption today implies mainstream adoption tomorrow? Isn't it obvious? The institutions are going to use their sprawling psychological machine to push it onto the masses. Daddy needs his exit liquidity amirite? This is what institutions do: they get in and usher in the masses behind them at a profit. Typical capitalism.

Conclusion

Crypto has reached critical mass. We've crept over an unstoppable tipping point but many haven't realized it yet because the boulder is still slow-moving. Next year's rally will be nothing short of legendary. Do not be surprised if we outperform the 2017 run. Everyone is making money hand over fist and the music isn't going to stop for another year.

Institutions first, then the world.