Nobody needs that!

Driving can be stressful enough without the law on your tail. Everyone knows that if there's an officer present they really don't need a reason to pull you over. If they want to: they find a reason, and it's not even difficult to do. I was once pulled over in Portland Oregon under the false pretense that I didn't "signal 100 feet before a stop sign". Spoiler alert: there wasn't 100 feet to begin with because I originally turned out of a parking lot that was next to the stop sign. I won that one in court, easily. But that doesn't make it any less annoying or a violation of my rights as a citizen.

Of course the reason I was actually pulled over had nothing to do with a stop sign. At that time I was living across the street from a bar and a strip club (highest per capita anywhere in America apparently). This novice was clearly fishing for drunk drivers but when I pulled into my apartment complex he discontinued pursuit. The problem was that the lot was full (due to people parking there without a permit). So when I turned around to park on the street the cop thought that I had just pulled into the lot to evade him and made up a bullshit excuse to pull me over right there.

The point here is that law enforcement doesn't need a reason to enforce their power and very few of them get in trouble even when proven to be blatantly corrupt. This applies to finance as well. Just the other day I was watching this super random documentary on Martha Stewart. Remember how she "insider traded"? turns out she never broke any law whatsoever and the court simply decided that she "lied" without any real evidence to back it up.

https://x.com/AEJ58/status/1857239484279972206

You the the right to remain silent!

Basically the FBI director at the time (Comey) would just accuse people of "lying" to FBI agents when he was in charge in order to get a bullshit conviction. So what was Martha Stewart "lying" about? She said she didn't remember something when asked a question. This is why you don't answer questions.

I do not recall...

You see normally this strategy works every single time it's employed because you can never prove if someone remembered something or not. It's a way to answer questions without actually answering. But as we can see with the FBI it's not a foolproof way of doing it because they can just trump up some "evidence" that might suggest you actually did remember at the time. Which is of course ridiculous but that didn't stop these guilty verdicts.

What's the point of this discussion?

Within the context of crypto, you never ever want a cop driving behind you. In this case said cop would likely take the form of the IRS. It doesn't matter if everything you're doing is perfectly legal. The tax code is a mountain of ridiculous loopholes that could never be followed perfectly. If the cop wants to pull you over for any reason they're going to find one. Best not to find oneself in that position to begin with!

Example: cashing out debt to a bank account.

Let's say crypto moons next year and you want to take out a loan to avoid a tax event. So you lock up your crypto and pull out a USD loan that you owe back at a later date. All perfectly legal. Except none of that matters depending on how much we're talking about. If for example it was a huge amount like a million dollars red flags would go up all over the place and you'd have to explain yourself and potentially even be audited. Even if they found nothing wrong with that transaction they'd find something if they wanted to.

Coinbase reports you to IRS if you make more than $600 in a year.

It used to be this number was in the tens of thousands but changed a few years back during the Biden admin's illegal backdoor war on crypto. Funny enough Coinbase has still never reported me or my buddy because we always make sure to earn zero dollars on the exchange that is also a fiat ramp. I'm realizing this is actually quite easy to do.

For example if you were to buy Bitcoin from a bank account, this is not a tax event, as USD is legally treated as a currency which allows it to be spent without penalties like capital gains. However, if Bitcoin then goes x2 and you sell back into your bank account Coinbase would report you to the IRS, which is obviously not great.

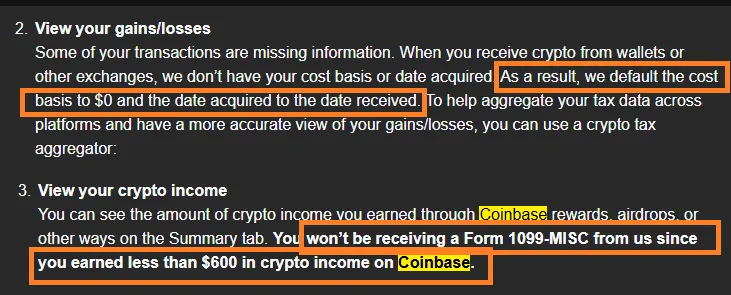

An easy way to avoid this type of regulatory overreach (which Coinbase publicly opposes while also begrudgingly complying) is to move the crypto off of the exchange and then move it back again (or sell it somewhere else). By moving the crypto off the exchange and then moving it back Coinbase no longer knows if the sales are gains or losses and they have to assume net zero by default.

Again this is not a strategy for doing something shady or illegal, but rather making sure we don't pull out in front of a cop that might want to mess with us for whatever reason. It's no secret that governments all over the world have been very unfriendly within this industry. This should make sense because crypto is in itself an anti-establishment technology.

There's absolutely no reason a crypto exchange should ever reporting us to the IRS even with a crazy low threshold like $600. We should not be doing our business there except to onramp, buy, and exit to self-custody. Best way to cash in & out is to deposit USDC and get the free conversion 1:1 to USD. That way there are no questions that need to be answered.

Centralized dev teams and exchanges understand these rules all too well. The companies who have been the most compliant and transparent are the same ones that the SEC has brought bogus charges against while refusing to clarify the issue.

Conclusion

The fiscal year is coming to an end soon.

Try not to create any tax events.

And if you do make sure they don't look suspicious.

Intent is irrelevant.

Protect yourself from the man.

Big Brother is not your friend.

You absolutely do have something to hide.

It's called basic privacy and decency within civilized society.